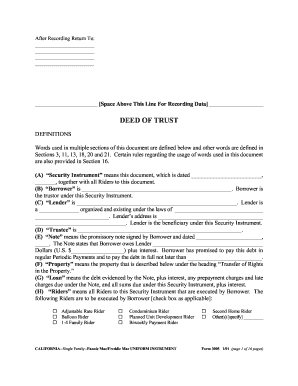

Deed Of Trust Form California

What is deed of trust form California?

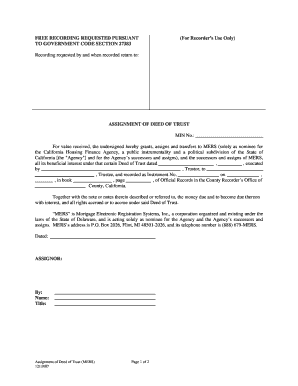

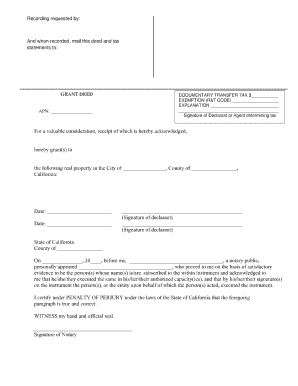

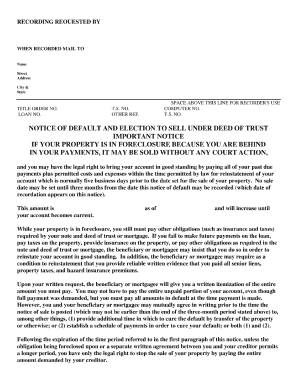

A deed of trust form in California is a legal document that establishes a lien on a property as security for a loan. It is commonly used in real estate transactions where a borrower is obtaining financing from a lender. The deed of trust serves as evidence of the lender's interest in the property until the loan is fully repaid.

What are the types of deed of trust form California?

In California, there are mainly two types of deed of trust forms: 1. Owner-Occupied Deed of Trust: This type of deed of trust is used when the borrower intends to occupy the property as their primary residence. 2. Investment Property Deed of Trust: This type of deed of trust is used when the borrower does not intend to occupy the property as their primary residence and instead plans to use it as an investment or rental property.

How to complete deed of trust form California

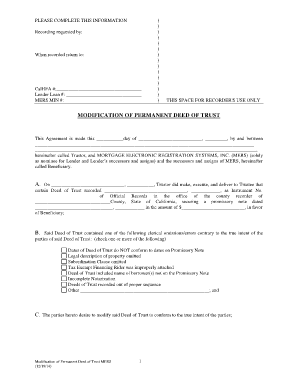

Completing a deed of trust form in California involves the following steps: 1. Identify the parties involved: You need to provide the names and contact information of the borrower, lender, and trustee. 2. Describe the property: You must accurately describe the property that will be subject to the deed of trust. 3. Specify the loan details: You need to include the loan amount, interest rate, and repayment terms. 4. Sign and notarize the document: The borrower, lender, and trustee must sign the deed of trust in the presence of a notary public. 5. Record the deed of trust: The document should be recorded with the county recorder's office where the property is located.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.