What is Short Form Deed Of Trust?

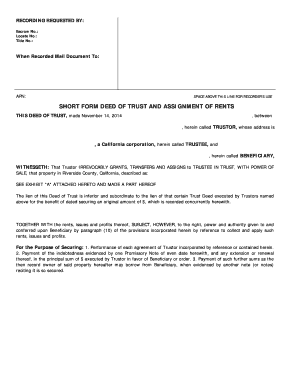

A Short Form Deed Of Trust is a legal document that allows a borrower to secure a loan by using their real estate property as collateral. It is commonly used in real estate transactions to protect the lender's interest in the property. The borrower transfers the legal title of the property to a trustee, who holds it on behalf of the lender until the loan is repaid in full. This document serves as a record of the mortgage and provides the lender with the right to foreclose on the property if the borrower defaults on the loan.

What are the types of Short Form Deed Of Trust?

There are several types of Short Form Deed Of Trust, including:

First Trust Deed: This is the most common type of Short Form Deed Of Trust and is used when a loan is secured by the property for the first time.

Second Trust Deed: This type of deed is used when a property already has an existing first trust deed and the borrower needs an additional loan secured by the property.

Wraparound Trust Deed: In this type of deed, a new loan is created that includes the balance of an existing loan. The borrower makes payments on the new loan, which includes the payments on the existing loan.

Open-End Trust Deed: This type of deed allows the borrower to take out multiple loans on the same property, up to a specified limit.

Closed-End Trust Deed: This type of deed provides for only one loan on the property and does not allow for additional loans to be taken out.

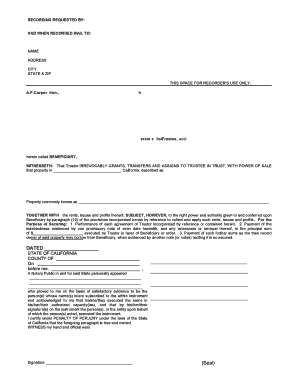

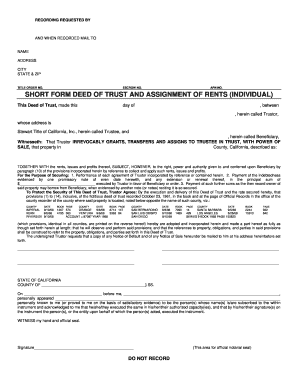

How to complete Short Form Deed Of Trust

Completing a Short Form Deed Of Trust involves several steps:

01

Identify the parties involved - the borrower, lender, and trustee.

02

Provide details of the real estate property being used as collateral, such as its legal description and address.

03

Specify the loan amount, interest rate, and repayment terms.

04

Include any additional clauses or provisions, such as insurance requirements or the borrower's right to prepay the loan.

05

Sign and date the document, making sure all parties involved also sign and date in the appropriate places.

06

Record the document with the appropriate government agency to make it a matter of public record.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.