Note Secured By Deed Of Trust Form

What is note secured by deed of trust form?

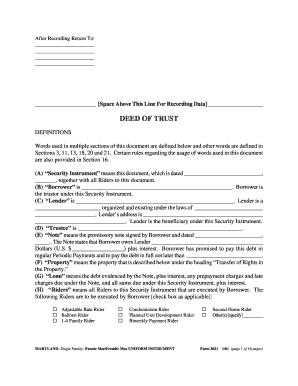

A note secured by deed of trust form is a legal document used in real estate transactions. It serves as evidence of a debt owed by a borrower to a lender, and it is secured by a deed of trust, which is a legal instrument that grants the lender a security interest in the borrower's property as collateral for the loan. In other words, it ensures that the lender has the right to foreclose on the property and sell it to recover the debt if the borrower fails to repay the loan.

What are the types of note secured by deed of trust form?

There are two main types of note secured by deed of trust forms: 1. Fixed-Rate Note: This type of note has a fixed interest rate throughout the term of the loan. The monthly payments remain the same, providing stability for the borrower. 2. Adjustable-Rate Note: This type of note has an interest rate that can change over time as specified in the loan agreement. The monthly payments may increase or decrease based on market conditions, offering potential savings or risks to the borrower.

How to complete note secured by deed of trust form

Completing a note secured by deed of trust form is a crucial step in a real estate transaction. Here is a step-by-step guide to help you: 1. Obtain the form: You can find note secured by deed of trust forms online or get them from a real estate attorney or lender. 2. Fill in the borrower and lender information: Provide accurate details about the borrower and lender, including their names, addresses, contact information, and the loan amount. 3. Specify the terms of the loan: Clearly state the interest rate, repayment schedule, and any additional terms or conditions. 4. Describe the property: Provide a detailed description of the property being used as collateral, including its address and legal description. 5. Sign and notarize the form: Make sure both the borrower and lender sign the form in the presence of a notary public. Remember to review the completed form carefully before signing and submitting it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and securely.