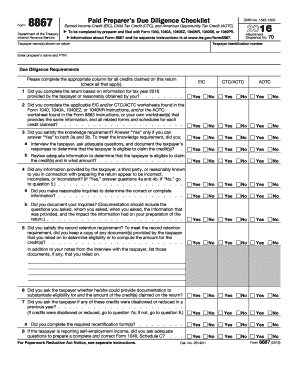

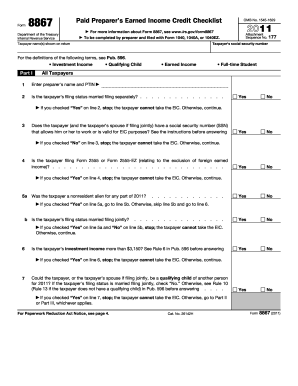

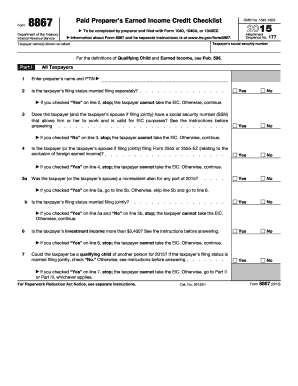

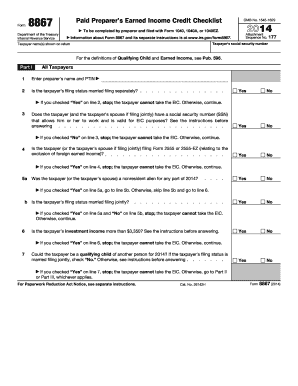

8867 Form

What is 8867 Form?

The 8867 Form, also known as the Paid Preparer's Due Diligence Checklist, is a document used by tax preparers to ensure that clients claiming the Earned Income Credit (EIC), the Child Tax Credit (CTC), or the Additional Child Tax Credit (ACTC) meet all the necessary requirements. It helps to prevent fraud and ensure accurate reporting of these credits to the Internal Revenue Service (IRS). By completing the 8867 Form, tax professionals can demonstrate their due diligence and avoid penalties.

What are the types of 8867 Form?

There is only one type of 8867 Form, which is the Paid Preparer's Due Diligence Checklist. However, this form may vary slightly depending on the tax year it is used for. It is important to use the correct version of the form for the specific tax year to ensure compliance with IRS guidelines.

How to complete 8867 Form

Completing the 8867 Form is a crucial step for tax preparers. Here is a step-by-step guide to help you complete the form accurately:

pdfFiller simplifies the process of completing and managing the 8867 Form. With pdfFiller's user-friendly interface, you can easily create, edit, and share documents online. Access a vast collection of fillable templates, including the 8867 Form, and utilize powerful editing tools to streamline your workflow. Save time and effort with pdfFiller, the all-in-one PDF editor trusted by professionals.