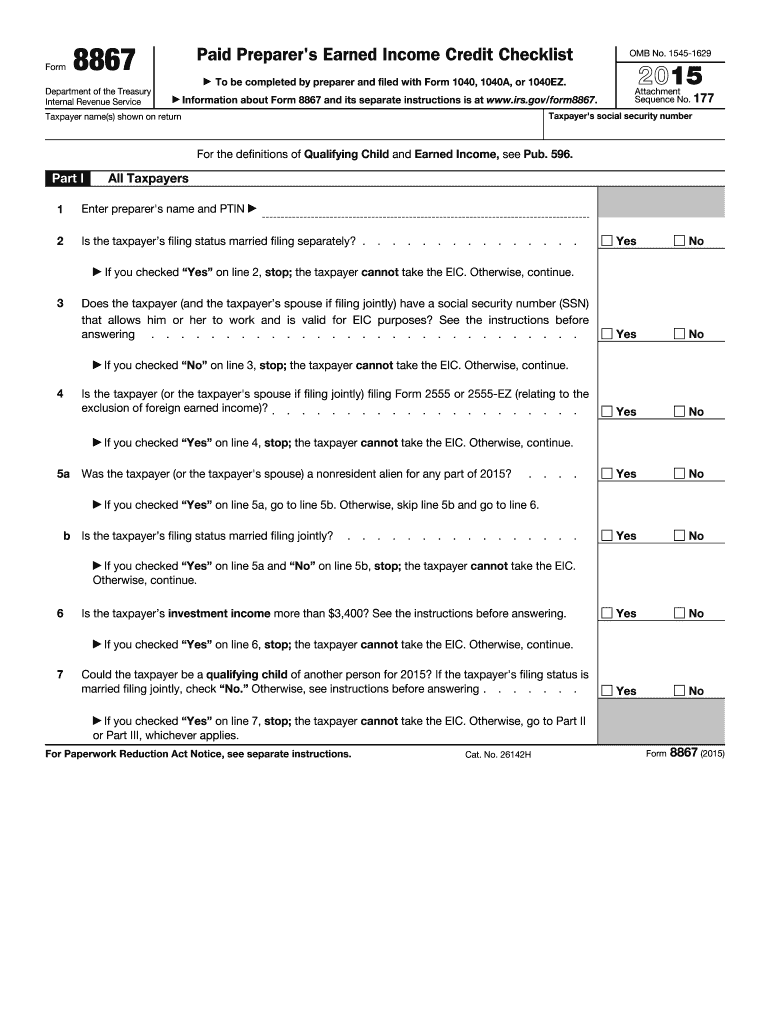

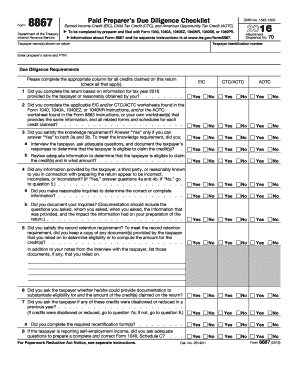

What is Form 8867?

Form 8867 (Paid Preparer's Earned Income Credit Checklist) confirms preparers considered all applicable criteria for tax credits when preparing tax returns. They show due diligence by interviewing their client, asking good questions, and obtaining appropriate and sufficient information to determine the correct income reporting, claiming tax benefits (like credits and deductions), and being compliant with the tax laws.

Who should file IRS Form 8867?

Paid tax return preparers must fill it out for exercising due diligence when completing their client's federal return or claiming a refund.

How do I fill out Form 8867?

The template is not difficult to complete. Follow the guidelines below to fill it out online with pdfFiller:

- Select Get Form and wait for a few seconds while filler establishes a secure connection to protect your data.

- Provide a taxpayer's name and identification number in the first line.

- Enter your name and PTIN (Preparer Tax Identification Number) in the second line.

- Complete a two-page survey with yes, no, or N/A options by clicking checkboxes.

- If required, check the official Form 8867 instructions for more information.

- In Part I, point 5, indicate the taxpayer documents you relied on for information.

- Click Done to close the filler and export the filled-out document in your preferred way.

Is Form 8867 Accompanied by any Other Documents?

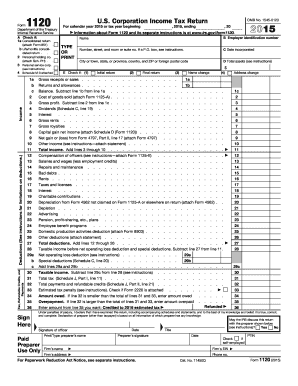

The document should accompany returns that the taxpayer does not fill out. Therefore, the preparer must fill out the Paid Preparer's Earned Income Credit Checklist and attach it to 1040 or its applicable versions: 1040A, 1040EZ, 1040NR, 1040SS, 1040PR.

When is Form 8867 Due?

The record does not have its own due date; it must be filed with the tax return due by April 15th (if it does not fall on a federal holiday or a weekend) as one package.

Where do I Send Form 8867?

Send the completed document to the IRS office with the federal return and other applicable forms.