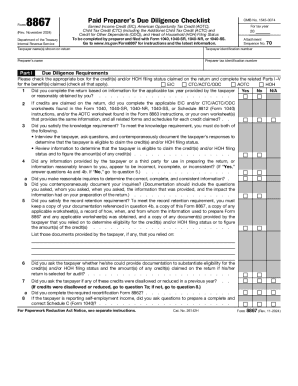

Who Needs IRS Form 8867?

This document is the IRS form fully called Paid Preparer's Earned Income Credit Checklist. It is to be filled out by paid tax return preparers for exercising due diligence at the moment of completing their client’s federal return or claiming a refund.

What is the Purpose of Form 8867?

The completion of the form lets the paid preparer make sure that they have exercised due diligence by interviewing their client, asking adequate questions and obtaining appropriate and sufficient information to determine the correct reporting of income, claiming tax benefits (like credits and deductions) and being compliant with the tax laws.

Is Form 8867 Accompanied by any Other Documents?

The form serves as an accompaniment to a tax return that is not filled out by a paid preparer hired by the taxpayer. Therefore, the tax preparer must fill out the Paid Preparer's Earned Income Credit Checklist and attach it to Form 1040 or its applicable version: 1040A, 1040EZ, 1040NR, 1040SS, 1040PR.

When is Form 8867 Due?

The form does not have its own due date, it must be filed with the tax return due by April 15th (if it does not fall on a federal holiday or a weekend) as one package.

How do I Fill out Form 8867?

The form is not difficult to complete. The top two lines require indicating the name of the taxpayer and the preparer’s name and PAIN (Preparer Tax Identification Number).

Otherwise, the document is a two-page form containing a list of yes/no questions about different types of credit claimed, they can be: an earned income tax credit (ETC), a child tax credit (CTC), an additional child tax credit (ACT), or an American opportunity tax credit ATC).

To help you with proper filing, the IRS has an instruction to describe the procedure step-by-step.

Where do I Send Form 8867?

The completed document must be delivered to the IRS office together with the federal return and other applicable forms.