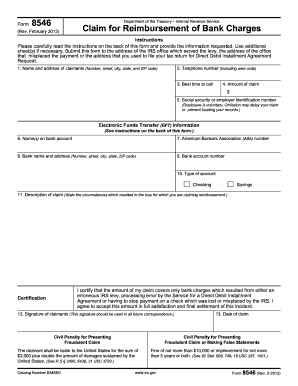

8546 Form

What is 8546 Form?

The 8546 Form is a document used for ___________. It allows individuals to ___________. By completing this form, users can ___________. It is an important tool for ___________ and is required by ___________.

What are the types of 8546 Form?

There are several types of 8546 Form, including: 1. Type 1: ___________ 2. Type 2: ___________ 3. Type 3: ___________ Each type is used for different purposes, and it is important to select the correct type when completing the form.

How to complete 8546 Form

Completing the 8546 Form is a simple process that can be done in a few steps. Follow the instructions below to complete the form accurately and efficiently:

With pdfFiller, completing the 8546 Form has never been easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.