Last updated on

Jan 19, 2026

Customize and complete your essential Consumer Credit Application template

Prepare to streamline document creation using our fillable Consumer Credit Application template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

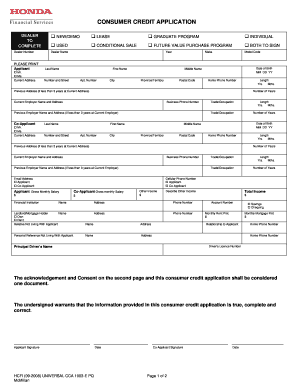

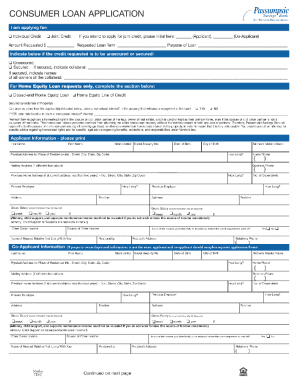

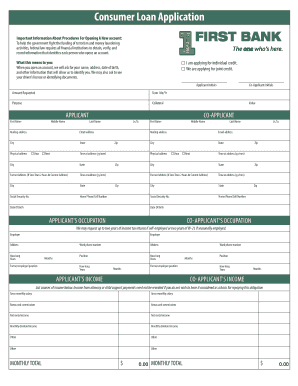

Customize Your Essential Consumer Credit Application

Streamline your credit application process with our customizable Consumer Credit Application template. This feature allows you to tailor your application to meet specific needs, ensuring a smooth experience for both you and your clients.

Key Features

Fully customizable fields to capture essential client information

User-friendly interface designed for easy navigation

Secure data storage and management to protect sensitive information

Compatibility with various devices for on-the-go access

Instant feedback and approval processes to enhance user satisfaction

Potential Use Cases and Benefits

Perfect for financial institutions looking to streamline their credit application process

Useful for small businesses that require quick and efficient client onboarding

Great for consultants and advisors who assist clients with credit applications

Helps in tracking application progress and managing client communication

Empowers applicants to submit information quickly and get results faster

This customizable Consumer Credit Application template solves common issues like lengthy application processes and data inaccuracies. By tailoring your application, you promote clearer communication, reduce errors, and enhance overall efficiency. Say goodbye to rigid templates and hello to a solution that adapts to your unique needs.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Consumer Credit Application

Creating a Consumer Credit Application has never been so easy with pdfFiller. Whether you need a professional document for business or personal use, pdfFiller offers an intuitive platform to make, edit, and handle your paperwork effectively. Use our versatile and fillable templates that align with your precise demands.

Bid farewell to the hassle of formatting and manual editing. Utilize pdfFiller to easily craft accurate documents with a simple click. your journey by using our comprehensive instructions.

How to create and complete your Consumer Credit Application:

01

Sign in to your account. Access pdfFiller by logging in to your account.

02

Find your template. Browse our extensive collection of document templates.

03

Open the PDF editor. When you have the form you need, open it up in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can choose from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Include text, highlight areas, add images, and make any required changes. The intuitive interface ensures the procedure remains easy.

06

Save your edits. Once you are satisfied with your edits, click the “Done” button to save them.

07

Submit or store your document. You can deliver it to others to eSign, download, or securely store it in the cloud.

To conclude, creating your documents with pdfFiller templates is a smooth process that saves you time and guarantees accuracy. Start using pdfFiller right now to benefit from its powerful features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

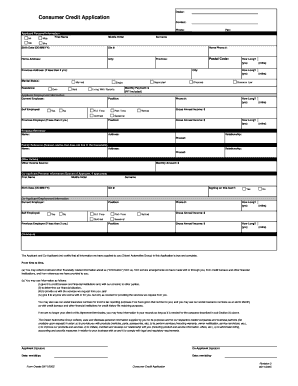

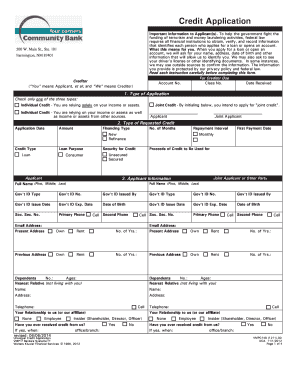

How to fill a credit application?

Here's what is typically included on a business credit application form: Business name, address, phone, and email numbers. Identifying details of principals or owners. Business structure. Industry type. Number of employees. Bank and trade payment references. Credit history.

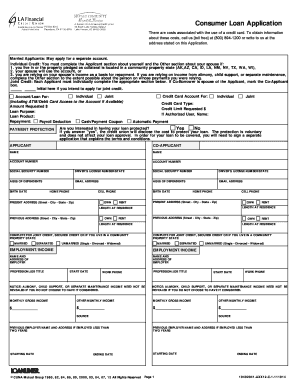

How to fill out a credit card application?

You'll need to provide your personal information and copies of certain documents to apply for a credit card, including your: Legal name. Social Security number (SSN) or Individual Tax Identification Number (ITIN) Mailing address. Birthdate. Employment status. Income information. Debt information.

How to fill a credit application form?

The application will ask for the: Name of your employer. Your position. Length of employment - Start date and end date. The type of business - Education, financial, food service, etc. Address and phone number of business. You may have to provide information for your last few employers.

How do I create a credit application form?

A customer credit application form should typically include fields for personal information, financial information, employment details, references, and authorization for credit checks. Additionally, you can customize the form to include specific fields that are relevant to your credit application process.

How do I ask my customer to fill out a credit application?

“Hi Joe, I am very happy to know that you will be sending us business and I want to make sure we can accommodate your future needs in regards to credit. My bank line of credit requires that we have a credit application on file to insure we are following their guidelines in establishing credit with our customers.

How to fill a letter of credit application form?

Fill in your personal details accurately, including your full name, contact information, and any required identification numbers. Provide the necessary information about the purpose of your lc application, such as the type of lc you are applying for and the desired duration.

What is a credit account application form?

A Credit Application Form serves to expedite the process of choosing whether to give credit and setting the credit limit. The credit application collects vital information for evaluation and can also be used in court as proof of the conditions of the sale and credit I loan application.

How to fill in a credit account application form?

Your credit application form should ask for the registered name, company number and registered address of the legal entity behind the order, and ideally the names of at least a couple of the directors. Also ask for the invoicing address as this can often be different from the registered office in larger companies.

How do you process a credit application?

Application submission: The borrower submits the credit application to the lender, either online, by mail, or in person. Therefore, the application will typically include the borrower's personal and financial information and other required documentation, such as proof of income and identification.