Last updated on

Jan 19, 2026

Customize and complete your essential Forbearance Agreement template

Prepare to streamline document creation using our fillable Forbearance Agreement template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

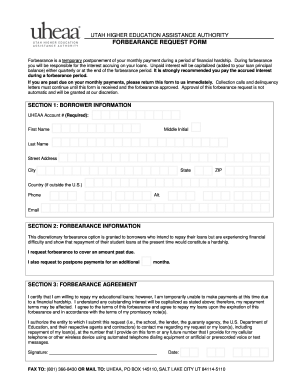

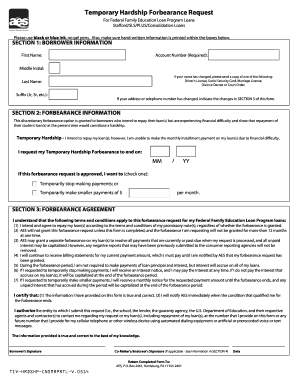

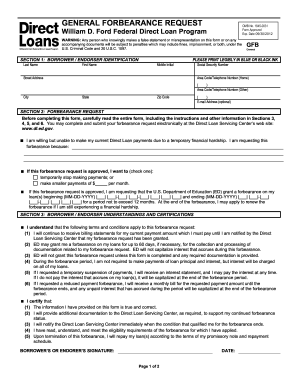

Customize Your Forbearance Agreement Template

Easily create and customize your Forbearance Agreement with our user-friendly template feature. This tool helps you tailor the terms to fit your specific situation, ensuring you meet all necessary requirements.

Key Features

User-friendly interface for easy customization

Template options for various situations

Guided prompts to ensure completeness

Downloadable and printable documents

Secure storage for your agreements

Potential Use Cases and Benefits

Individuals seeking to defer loan payments

Businesses needing temporary relief from creditors

Property owners managing rental agreements

Financial advisors assisting clients with payment plans

Lawyers preparing forbearance documents for clients

This customized Forbearance Agreement template solves your challenges by offering a straightforward solution to manage financial obligations. By personalizing your agreement, you can address your unique needs, avoid confusion, and ensure legal compliance. Take control of your financial situation with confidence.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Forbearance Agreement

Crafting a Forbearance Agreement has never been so easy with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller provides an intuitive platform to make, customize, and manage your paperwork effectively. Use our versatile and editable web templates that align with your precise demands.

Bid farewell to the hassle of formatting and manual editing. Employ pdfFiller to smoothly craft polished documents with a simple click. Begin your journey by following our comprehensive instructions.

How to create and complete your Forbearance Agreement:

01

Sign in to your account. Access pdfFiller by logging in to your account.

02

Search for your template. Browse our extensive collection of document templates.

03

Open the PDF editor. Once you have the form you need, open it up in the editor and use the editing instruments at the top of the screen or on the left-hand sidebar.

04

Add fillable fields. You can pick from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Add text, highlight areas, insert images, and make any necessary changes. The user-friendly interface ensures the procedure remains easy.

06

Save your edits. Once you are satisfied with your edits, click the “Done” button to save them.

07

Send or store your document. You can send out it to others to eSign, download, or securely store it in the cloud.

In conclusion, creating your documents with pdfFiller templates is a straightforward process that saves you time and guarantees accuracy. Start using pdfFiller right now to make the most of its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a forbearance letter?

A forbearance letter is part of a restructured agreement that acknowledges the lender's right to enforce upon its security but will hold off for a period from doing so if the lender agrees to meet new terms and conditions. The purpose of a forbearance agreement is to allow the borrower an opportunity to restructure. Forbearance Letter - What Does It Mean And What Should You Do eCapital blog you-just-received-a-forbear eCapital blog you-just-received-a-forbear

What are the two main types of forbearance?

There are two main categories of forbearance: general and mandatory.

What does it mean to apply for forbearance?

Forbearance is a process that can help if you're struggling to pay your mortgage. Your servicer or lender arranges for you to temporarily pause mortgage payments or make smaller payments. You still owe the full amount, and you pay back the difference later. Forbearance can help you deal with a financial hardship.

How does a forbearance work?

Forbearance is a temporary reduction or suspension of your monthly payment to help you through a difficult period. You will need to repay any missed or reduced payments in the future through one of numerous options. Mortgage Payment Forbearance and Foreclosure Protection Senator Steven Bradford sites files e_alert 20200 Senator Steven Bradford sites files e_alert 20200

What is a forbearance document?

Forbearance is a financial arrangement that provides individuals facing economic hardships with temporary relief from meeting their loan payment obligations.

What is the meaning of forbearance agreement?

Key Takeaways. Forbearance is a temporary postponement of loan payments granted by a lender instead of forcing the borrower into foreclosure or default. The terms of a forbearance agreement are negotiated between the borrower and the lender. Forbearance: Meaning, Who Qualifies, and Examples Investopedia Mortgage Investopedia Mortgage

What does a forbearance agreement mean?

A mortgage forbearance agreement is an arrangement between you and your lender to provide temporary relief from paying your mortgage, either by lowering or pausing the payments.

What does it mean when a loan says forbearance?

a temporary postponement of Forbearance is a temporary postponement of principal loan payments. Interest continues to accrue, but when you complete your term of service, the National Service Trust will pay the accrued interest on your behalf if you received an Education Award. What is the difference between ”forbearance” and ”deferment”? My AmeriCorps trust help member_portal My AmeriCorps trust help member_portal

Is forbearance good or bad?

Mortgage forbearance can help you avoid foreclosure, but it can also have negative consequences for your loan, home and credit score.

What does forbearance mean in contract?

forbearance. n. an intentional delay in collecting a debt or demanding performance on a contract, usually for a specific period of time. Forbearance is often consideration for a promise by the debtor to pay an added amount.

What is an example of a forbearance?

Forbearance is the intentional action of abstaining from doing something. In the context of the law, it refers to the act of delaying from enforcing a right, obligation, or debt. For example, a creditor may forbear legal action against the debtor if they settle the debt payment with new payment conditions.

What happens in a forbearance agreement?

As part of a standard mortgage forbearance agreement, the lender agrees not to foreclose on your home for missed payments. After the forbearance period ends, you'll still need to make up the payments you missed, but there are a couple of ways to do this, including making a lump sum payment.

What does it mean to request forbearance?

If you're having trouble repaying your loans, you may consider requesting a loan deferment or forbearance: With a loan deferment, you can temporarily stop making payments. With a loan forbearance, you can stop making payments or reduce your monthly payments for up to 12 months. What are loan deferment and forbearance? Federal Student Aid (.gov) help-center answers article Federal Student Aid (.gov) help-center answers article

What happens when a loan is in forbearance?

With forbearance, you won't have to make a payment, or you can temporarily make a smaller payment. However, you probably won't be making any progress toward forgiveness or paying back your loan. As an alternative, consider income-driven repayment. Student Loan Forbearance | Federal Student Aid Federal Student Aid (.gov) get-temporary-relief forbeara Federal Student Aid (.gov) get-temporary-relief forbeara