Arrange Payment Transcript Grátis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

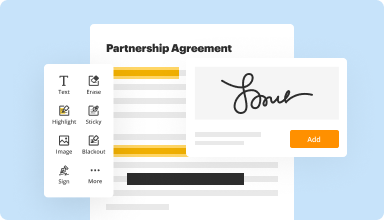

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

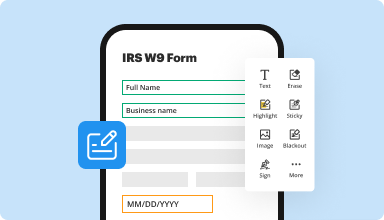

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

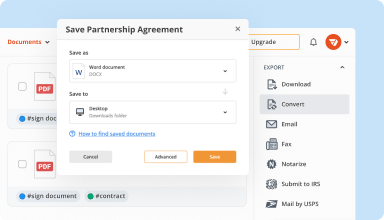

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

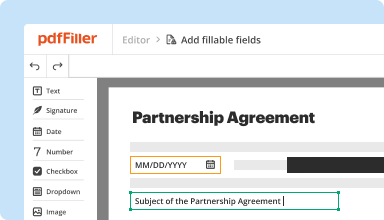

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

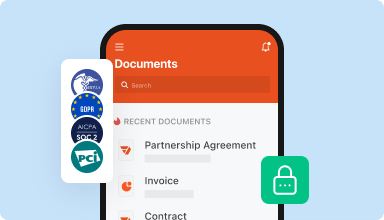

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I am older and my hand shakes so badly I cannot fill in forms -- it is a real life-saver, not to mention time-saver. I don't have to call someone in to fill the forms out for me, I've already recommended PDFfiller to a dozen friends!

2014-08-04

originally i was dissatisfied with paying $20 to learn how to use the system and still did not get any benefit. Then customer service reached out to me to provide assistance and work on a solution. I am still learning how to effectively use it but am happy for their willingness to help.

2017-10-05

It is very user friendly. I do not like that you have to use the eraser to delete text but otherwise it is way better than other programs I tried. I am also having problems opening pdf filler links on my business account because it goes to my personal account every time because it's on the same computer. I will call customer to fix the problem. Otherwise we are very happy with it!

2019-03-10

PDF Filler has wonderful customers…

PDF Filler has wonderful customers service. They provide a very extensive service and if I ever need such a comprehensive program again they will be whom I will sign up with. They took care of my needs and quickly helped me when I needed some extra help.

2019-07-05

I like the flexibility of this program

I like the flexibility of this program.

But there is a glitch when trying to edit some of the text lines. The original text area shrinks so small you cannot see it, I figured out that using the "T" text increase option helps fix the issue, it took me a bit to figure it out.

2024-07-10

PSFfiller is a very accommodating…

PSFfiller is a very accommodating company. Their customer service is really fast and helpful. All questions and concerns are dealt with immediately. They go the extra mile for their customers.

2024-04-15

Ny experience was good but I only have a need for the form I used maybe once a year. So I will probably be canceling my month to month once I am sure the form I needed has been accepted. It would be nice if you had an option for a subscription that was based on usage rather than on time. I might then sign up for a longer term commitment if I wasn't being charged every month but rather on my usage.

My experience with your product was that actually filling out the form was user friendly but it was a form that had a continuation sheet and figuring out how to use several continuation sheets was not intuitive and I ended up filling out several different form continuation sheet pages and then had to combine all those multiple forms into one document in order to get what I needed for submission to the court.

2020-08-24

Honestly has saved me so much time with…

Honestly has saved me so much time with PDF's that are hard to fill out. I am in nursing school and it is a must for me now.

2020-05-20

Simple and easy document solutions

Its been less than 2 weeks and I have used this service quite a few times to fill in documents or customize documents. Its been extremely user friendly and I really like the verified signature feature. Its has simplified my document process so much. I'm looking forward to using these for Insurance accord documents which I see they have in the database for use.

2020-04-28

Arrange Payment Transcript Feature

The Arrange Payment Transcript feature simplifies the way you manage your payment records. It allows you to easily organize and access transcripts related to your payments.

Key Features

Easy-to-use interface for arranging payment transcripts

Secure storage for all your payment records

Quick access to transcripts with simple search options

Customizable options for organizing payment details

Automatic updates for any changes in payment status

Potential Use Cases and Benefits

Individuals managing personal finances can keep track of payments efficiently

Small businesses can streamline their accounting processes with organized payment records

Accountants can provide improved services by accessing transcripts quickly

Auditors can ensure compliance and accuracy with well-organized payment history

Companies can enhance transparency in financial transactions

This feature solves your problem of disorganization and lost records. By using the Arrange Payment Transcript option, you gain confidence in managing your payments. You will no longer waste time searching for information or worry about misplaced documents. Enjoy the ease of having everything at your fingertips, allowing you to focus on what matters most.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I set up a payment plan with the IRS?

Setting up a Payment Plan First, determine how much you owe in unpaid taxes. Contact the IRS or check your copies of your tax returns to verify the amount. The total will include your original tax due plus penalties and interest. Now fill out Form 9465, the Installment Agreement Request.

How do I set up a payment plan with the IRS online?

Apply online: $0 setup fee.

Apply by phone, mail, or in-person: $0 setup fee.

No future penalties or interest.

Can you get a payment plan with the IRS?

You can apply for an installment agreement online, over the phone, or via various IRS forms. To some degree, you get to choose how much you want to pay every month. The IRS will ask you what you can afford to pay per month, encouraging you to pay as much as possible to reduce your interest and penalties.

How do I contact IRS installment agreement?

More In News You have several options available if your ability to pay has changed, and you are unable to make payments on your installment agreement or your offer in compromise agreement with the IRS. Call the IRS immediately at 1-800-829-1040.

Can you pay taxes in installments?

File Form 9465, Installment Agreement Request, to set up installment payments with the IRS. ... Completing the form online can reduce your installment payment user fee, which is the fee the IRS charges to set up a payment plan. The IRS must allow you to make payments on your overdue taxes if: you owe $10,000 or less, or.

How do I contact IRS about payment plan?

You also may submit Form 9465 (PDF) or attach a written request for a payment plan to the front of your bill. You may also request a payment plan by calling the toll-free number on your bill, or if you don't have a bill, call us at 800-829-1040 (individuals) or 800-829-4933 (businesses).

How do I contact the IRS to set up a payment plan?

Individuals can complete Form 9465, Installment Agreement Request. ...

If you prefer to apply by phone, call 800-829-1040 (individual) or 800-829-4933 (business), or the phone number on your bill or notice.

How long can I make a payment plan with the IRS?

When you file your tax return, fill out IRS Form 9465, Installment Agreement Request (PDF). The IRS will then set up a payment plan for you, which can last as long as six years.

Can you pay IRS in installments?

File Form 9465, Installment Agreement Request, to set up installment payments with the IRS. ... The IRS must allow you to make payments on your overdue taxes if: you owe $10,000 or less, or. you prove you can't pay the amount you owe now, or.

How do I cancel a payment plan with the IRS?

Cancellations, Errors and Questions: If changes are needed, the only option is to cancel the payment and choose another payment method. Call IRS e-file Payment Services 24/7 at 1-888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

#1 usability according to G2

Try the PDF solution that respects your time.