Blend Currency Settlement Grátis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

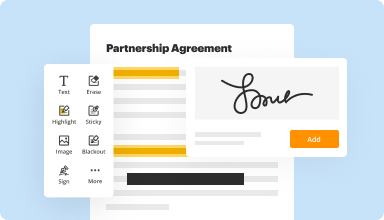

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

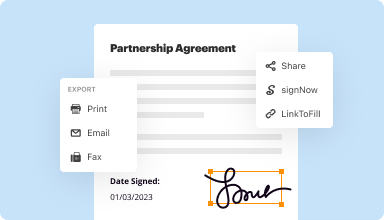

Fill out & sign PDF forms

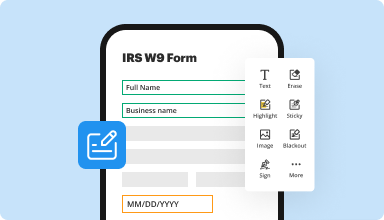

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

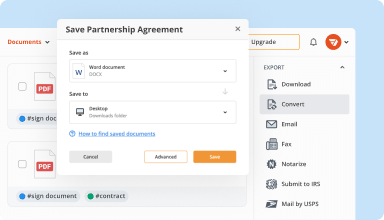

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

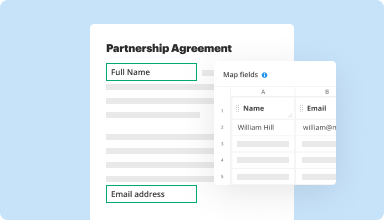

Collect data and approvals

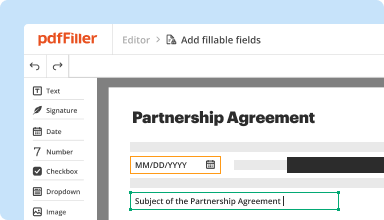

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

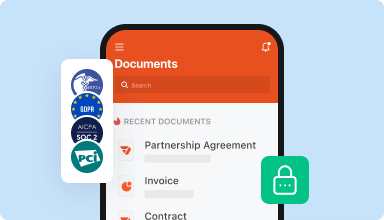

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Unclear as to whether or not I can save multiple versions of the fillable form for future editing, which I assume, but it's not intuitive, otherwise I would have rated 5.

2015-05-05

PDFfiller is an awesome tool to have. It saved me a lot of time of writing information on forms. I like my forms to be neat and typed instead of handwriting.

2015-09-06

I haD an outstanding issue with CONCERNS AND CHAT SPECIALIST your order and HAS been able to resolve it with PDFfiller directly, Customer Care Resolution service, . RYAN S. WAS GREAT IN RESOLVING MY CONCERNS. THANK YOU,JACQUELINE NESBITT

2017-03-31

What do you like best?

I have been using PDFiller for 2 years now, and it doesn't disappoint! It is easy to navigate around, and just as easy to save on to your computer, send as email or just print right away. I also like the new function of saving repeated work as a template. Thanks so much for a great product!

What do you dislike?

There's nothing that I would say is wrong with this program! I have never had an issue!!

Recommendations to others considering the product:

Use it! Super simple to naviagte!!

What problems are you solving with the product? What benefits have you realized?

I am able to work quickly on documents that I need for my foodservice operation. PDFiller makes it easy to taper any document to my specific customers needs.

I have been using PDFiller for 2 years now, and it doesn't disappoint! It is easy to navigate around, and just as easy to save on to your computer, send as email or just print right away. I also like the new function of saving repeated work as a template. Thanks so much for a great product!

What do you dislike?

There's nothing that I would say is wrong with this program! I have never had an issue!!

Recommendations to others considering the product:

Use it! Super simple to naviagte!!

What problems are you solving with the product? What benefits have you realized?

I am able to work quickly on documents that I need for my foodservice operation. PDFiller makes it easy to taper any document to my specific customers needs.

2018-12-20

What do you like best?

the customer support is excellent . The ease of using PDF filler is commendable.

What do you dislike?

very rarely the website crashes & have to re do everything

Recommendations to others considering the product:

yes ! definitely!!

What problems are you solving with the product? What benefits have you realized?

my work requires signatures on the applications & this makes it very easy to get it done within minutes

the customer support is excellent . The ease of using PDF filler is commendable.

What do you dislike?

very rarely the website crashes & have to re do everything

Recommendations to others considering the product:

yes ! definitely!!

What problems are you solving with the product? What benefits have you realized?

my work requires signatures on the applications & this makes it very easy to get it done within minutes

2019-01-28

Excellent Tool for Editing PDF Files

We use PDFFiller frequently to edit PDF documents to send to clients or vendors. The online platform is very user friendly and has a wide variety of functionality. It does most of the things one would need to do, including adding text, erasing sections, checking boxes, and adding signatures.

I wish it was easy to merge PDF documents.

2019-07-25

The overall experience was good, the only thing I would say is to increase the number of signatures from 10 to 100 in the case of signatures for the same document.

2024-08-08

I wanted to merge multiple PDFs to…

I wanted to merge multiple PDFs to make a unique Journal. but BOOK BOLT didn't have that feature, I was disappointed.. Then I was watching a YouTube video and it mentioned this PDF editor.. I have created my unique Journal and I am ready to sell it on Amazon... Thank you so much. This is a money making software. Hats off to you ALL!!! Peace, Power and Success. David Star is Zodicus Prime..

2021-09-09

This is an excellent product/service…

This is an excellent product/service that was very useful to me, especially because I have a chromebook and can't install windows based pdf editing software. After the trial period, I had a family emergency that caused me to forget to cancel my trial (I love pdf filler but planned to subscribe later when I will need it more) so I was auto charged for the subscription once my trial ended. I contacted support to explain what happened and they responded and resolved my issue within just a few minutes. They were prompt, professional, and understanding. I feel great about the service and customer support that I recieved and plan to subscribe to pdf filler in the near future. I wild gladly recommend pdf filler to anyone who wants a great way to edit pdf files with the confidence of working with a company that has excellent customer service.

2020-04-30

Blend Currency Settlement Feature

Blend Currency Settlement makes dealing with multiple currencies straightforward. This feature simplifies payments, reduces risks, and ensures your transactions are smooth and efficient. You can rely on it to handle settlements with ease, taking the complexity out of currency exchanges.

Key Features of Blend Currency Settlement

Supports numerous currencies for global transactions

Real-time exchange rates to ensure competitive pricing

Automated conversion process to save time and reduce errors

User-friendly interface for easy navigation and management

Secure transactions to protect financial data

Potential Use Cases and Benefits

E-commerce businesses expanding internationally can manage payments effectively

Freelancers working with clients globally can receive payments in their local currency

Importers and exporters can streamline transactions across different currencies

Travel agencies can settle transactions in various currencies with ease

Financial institutions looking to optimize currency management can enhance their services

If you struggle with managing multiple currencies, Blend Currency Settlement is your answer. It helps you avoid delays and uncertainty linked to currency conversion. This feature provides you with the tools to focus on your core business, giving you peace of mind. With Blend, you can streamline your financial operations, save time, and reduce costs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How are forex trades settled?

FX Settlement. A corporate FX transaction involves a bank, on behalf of their corporate client, paying for the currency it sold at an agreed rate to another bank and receiving a different currency in return for the funds being cleared and settled in the local clearings.

How long do FX trades take to settle?

Most stocks and bonds settle within two business days after the transaction date. This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

How long do stock trades take to settle?

For most stock trades, settlement occurs two business days after the day the order executes. Another way to remember this is through the abbreviation T+2, or trade date plus two days. For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

Why do stocks take 2 days to settle?

This means an investor who buys two days before the record date will not receive the dividend. This is the day the stock goes ex-dividend. A stock purchase can settle after the ex-dividend date and the investor will still receive the dividend, as long as the trade or purchase date was before the ex-dividend date.

Why do stocks take 3 days to settle?

Clients are given 3 days to pay for the trade, or deliver securities to close short positions. Trading errors and misunderstandings are a significant part of the business. Three-day settlement allows time to make corrections.

How do FX transactions settled?

FX Settlement. A corporate FX transaction involves a bank, on behalf of their corporate client, paying for the currency it sold at an agreed rate to another bank and receiving a different currency in return for the funds being cleared and settled in the local clearings.

What is FX trade life cycle?

What is the life cycle of forex trading? Forex trade is booked in front office of a bank or on a dealer like Bloomberg etc. It of course goes through some pre-trade checks in which trade eligibility is checked. Now trade is in the hands of middle office where risk is managed for the trade.

What is meant by trade life cycle?

Introduction to the Trade Life Cycle. The trade ends with the settlement of the order placed. All the steps involved in a trade, from the point of order receipt (where relevant) and trade execution through to settlement of the trade, are commonly referred to as the 'trade lifecycle'.

#1 usability according to G2

Try the PDF solution that respects your time.