Block Out Payment Title Grátis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

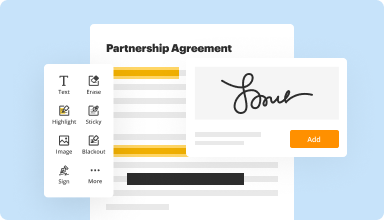

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

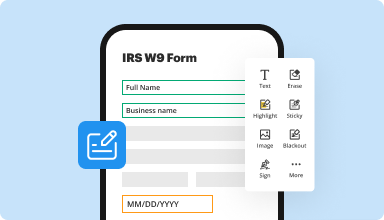

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

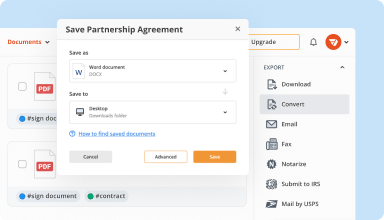

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

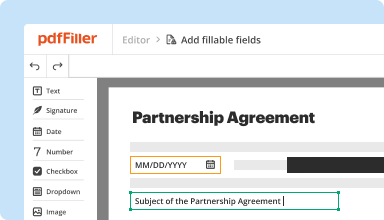

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

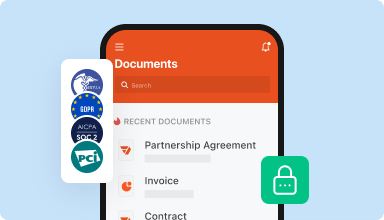

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I like the improvements to the program & the variety of options. I would like to see the "circle" option with a little more flexibility - right now it is very thick & not practical. I also could not adjust the position of text boxes that were misaligned without deleting and recreating them.

2014-10-14

Love how easy it is to use. With selling our house and buy one out of state, pdf filler has made it so easy to sign documents and email. No scanning for us!

2015-03-16

What do you like best?

Easy to use and has a wide variety of tools. Makes it easy to go paperless. Great price for the number of features it offers. Highly recommend.

What do you dislike?

More mobile compatibility for when I am on the go.

Recommendations to others considering the product:

I highly recommend. It is well worth the price.

What problems are you solving with the product? What benefits have you realized?

Added the ability to have forms sent and signed the same day when working with partners out of state. Stores my forms in one location making them easy to locate.

Easy to use and has a wide variety of tools. Makes it easy to go paperless. Great price for the number of features it offers. Highly recommend.

What do you dislike?

More mobile compatibility for when I am on the go.

Recommendations to others considering the product:

I highly recommend. It is well worth the price.

What problems are you solving with the product? What benefits have you realized?

Added the ability to have forms sent and signed the same day when working with partners out of state. Stores my forms in one location making them easy to locate.

2017-12-07

It really is an easy to use application…

It really is an easy to use application and i needed something like this and I didnt have much time so I know if I can use that fast then its a great app!

2020-03-11

We were out of town and needed an…

We were out of town and needed an expensive package delivered to an alternate address. We needed a signed release for the courier to deliver without a signature, and this was the best way to create and eventually email that release form.

2022-07-25

Phenomenal customer support.

I use pdf filler occasionally for signing docs, I recently had an issue with the website and dreaded contacting Cust support-and when I finally did it was by far the easiest, quickest interaction I've ever had with a cust support rep.Dee was polite, efficient, and knowledgeable. I was stunned, and impressed-thank you Dee

2022-02-07

I used this for a work purpose

I used this for a work purpose. It made my task a lot easier. Only needed it as a one off, so cancelled my subscription by contacting them. Fast, efficient customer support.

2022-01-07

great experience

great experience. Service is easy to use and very convenient. Customer service is extremely responsive, knowledgeable. Excellent service!

2020-07-21

This company is the best, I have been using it since 2012 and love it, so easy to use, saves me so much time when filling out documents and everyone is super friendly with amazing costumer service!!!

Thanks PDFFILLER !!!!

2020-06-19

Block Out Payment Title Feature

The Block Out Payment Title feature simplifies your payment processes. It allows you to manage and restrict payment options effectively. By enabling this feature, you can control what titles are available for payments. This means you can create a streamlined experience for your customers.

Key Features

Customizable title restrictions for payments

User-friendly interface for effortless management

Real-time updates on title availability

Integration with existing payment systems

Potential Use Cases and Benefits

Prevent unauthorized transactions by restricting specific payment titles

Enhance customer experience by displaying only relevant payment options

Improve security by limiting transaction types during sensitive periods

Maintain compliance with financial regulations more easily

This feature addresses common payment issues you may face. By blocking out certain payment titles, you reduce the risk of errors and enhance your control over transactions. You can provide a safe, efficient purchasing environment for your customers while protecting your revenue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What happens if you don't pay Title max back?

If you don't pay what you owe, the lender may decide to repossess your vehicle.

What happens if you default on a title loan?

Defaulting on a loan will damage your credit, and your lender will eventually repossess the car. As a result, you're left with bad credit and no car, and you'll probably still owe money. Offering to voluntarily surrender your vehicle can improve the situation, but you'll still see lower credit scores.

What happens if you default on a Title Max loan?

If you start to miss your monthly payments and continue to miss them without any communication to your lender, the delinquency can result in car title loan default. A car title loan default is the failure to repay a loan according to the terms agreed upon in your contract.

What happens if you don't pay your title loan?

The Roll-Over If you can't pay off the loan in the typical 30day period, the lender may offer to roll over the loan into a new loan. ... If you don't pay what you owe, the lender may decide to repossess your vehicle.

Does default on a title loan affect your credit?

Most title lenders won't even check your credit score before approving you. Title loans are often an avenue for people with low credit to get money in emergencies. Usually, a title loan will not affect your credit either way.

How can I get out of a title loan without losing my car?

The Ideal Solution. The simplest route is to pay off your loan, but that's easier said than done. ...

Swap out the Car. If you don't have the funds, you can always sell the car to generate cash. ...

Refinance or Consolidate. ...

Negotiate. ...

Default. ...

Filing Bankruptcy. ...

Avoiding Title Loans. ...

Military Borrowers.

How long do you have to pay a title loan back?

The repayment period for a car title loan can be customized to fit your unique needs. The loan can be paid back anytime early without penalty, but the typical loan is written from 1 year to 3 years depending on the circumstances. Our goal is to help you out of financial hardship and difficulties.

How long do I have to pay a title loan?

A car title loan is similar to a payday loan it's a small loan for a short period of time, usually 30 days. In exchange for the loan, you give the lender the title to your car until the loan is paid in full.

What happens if you don't pay a title loan back?

If you can't pay off the loan in the typical 30day period, the lender may offer to roll over the loan into a new loan. But the roll-over process always adds fees and interest to the amount you originally borrowed. ... If you don't pay what you owe, the lender may decide to repossess your vehicle.

How can I get out of a title loan?

The Ideal Solution. The simplest route is to pay off your loan, but that's easier said than done. ...

Swap out the Car. If you don't have the funds, you can always sell the car to generate cash. ...

Refinance or Consolidate. ...

Negotiate. ...

Default. ...

Filing Bankruptcy. ...

Avoiding Title Loans. ...

Military Borrowers.

#1 usability according to G2

Try the PDF solution that respects your time.