Convert On Salary Resolution Grátis

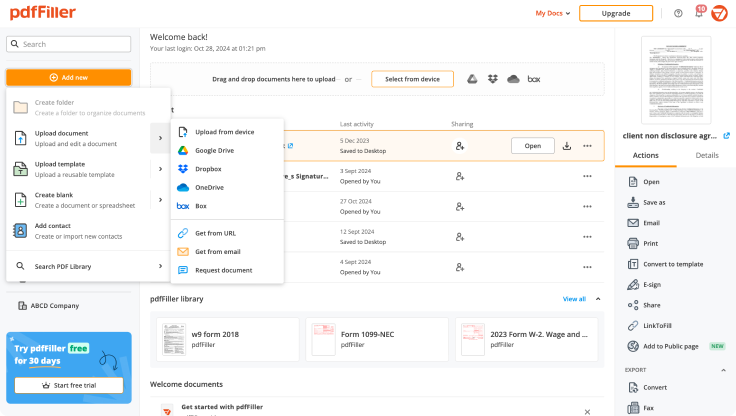

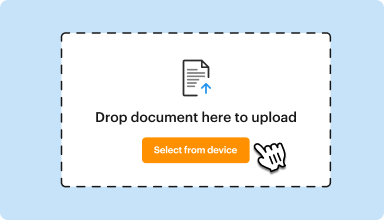

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

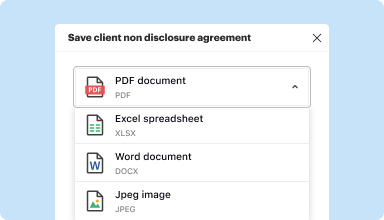

Edit, manage, and save documents in your preferred format

Convert documents with ease

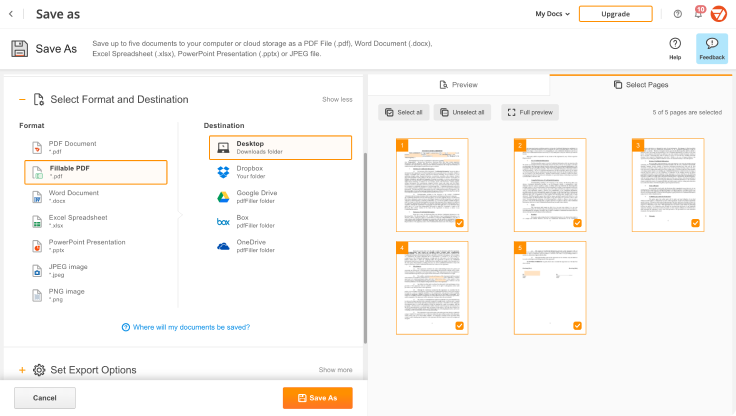

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

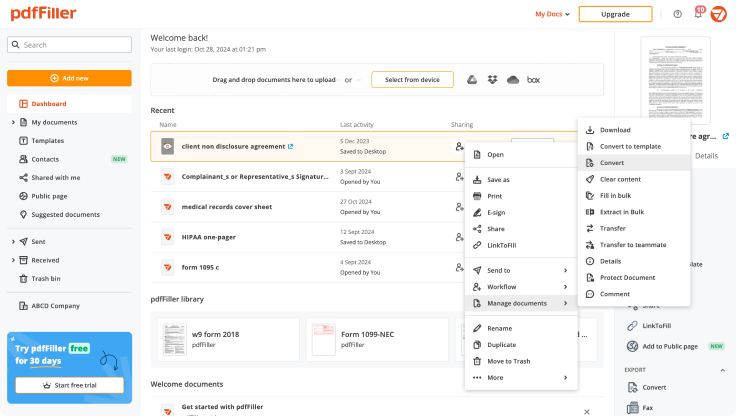

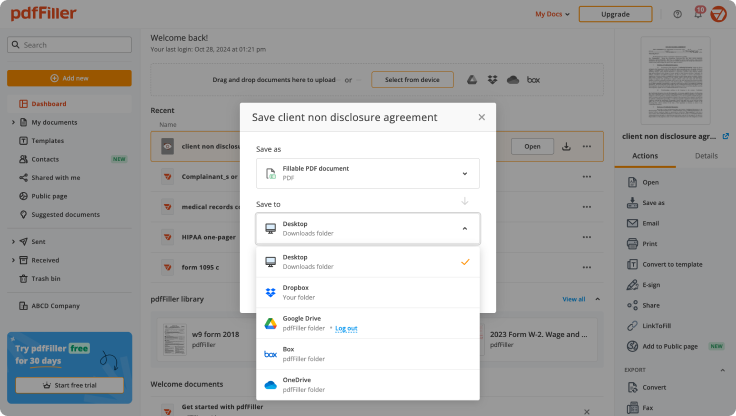

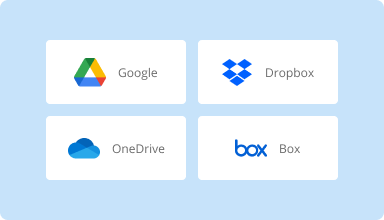

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

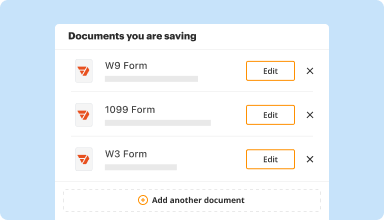

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

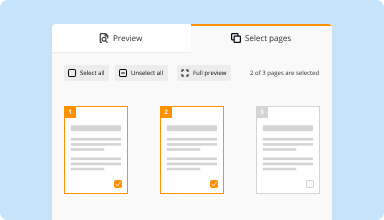

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

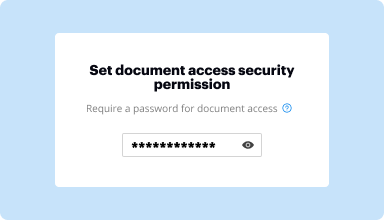

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

The system worked very nicely overall. I have uploaded several documents now and found it very nice for completing PDF and Pre-made fillable Word documents as well. I only had one minor glitch the first time I used it, but have not seen it repeated in several usages since. Overall I would definitely recommend this if you have to regularly fill and edit forms.

2016-03-02

This website is amazing and so very…

This website is amazing and so very helpful for my classes I'm taking where I have to fill out documents...saves a lot of paper and printer ink!

2019-10-08

This program has saved my processing life! Any and all documents i need from a Verification of Rent to a Processor's Cert are at my fingertips. I love it!

2023-08-11

Intuitive & straightforward

This online software seems pretty intuitive to use and I've had a good experience of collecting signatures online, so far.

2022-11-23

I have used it a few times thus far it to complete on line forms. I find it easy to use and navigate. Helpful tool to avoid unnecessary printing, writing, scanning, storing.

2021-03-21

pdfFiller provides what it offers-you…

pdfFiller provides what it offers-you can add text, and signs (such as the check sign where applicable on boxes) and there are a lot of other features to share the document, from email to links etc. Best part is that it doesn't alter the original PDF format.

2021-02-16

Although I do find it a bit difficult to find some of the forms that I am searching for I do like the program completely because it offers me the flexibility to take care of my business and to edit the necessary forms needed for my work. But I wish you would get a larger database of forms and templates for us to draw upon.

2020-10-16

I mislead them on my intentions for the service level that I required. Once I brought it to their attention, I answered 3 questions; and the matter was immediately resolved. Outstanding customer service comms. !!!

2020-08-27

This is my first time dealing with PDFFILLER! There were some issues and they quickly assisted in resolving the areas in question . I would recommend them to business professionals and someone like me that has a periodic need for administrative documents.

2020-05-03

Convert On Salary Resolution Feature

The Convert On Salary Resolution feature simplifies your salary management process. It allows you to convert salaries based on different criteria, making adjustments easy and efficient.

Key Features

Seamless salary conversion based on specified parameters

User-friendly interface for straightforward adjustments

Real-time updates to ensure accuracy and transparency

Flexible settings to meet various organizational needs

Integration with existing payroll systems for smooth operation

Potential Use Cases and Benefits

HR departments managing diverse salary structures

Companies conducting salary reviews and adjustments

Organizations implementing merit-based pay raises

Businesses transitioning to new currency or pay scales

Managers assessing team compensation across departments

This feature addresses the common challenges in salary management. By allowing quick and accurate salary conversions, you can eliminate manual errors, save time, and enhance employee satisfaction. You will find it easier to make informed decisions that align with your company's goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the formula for salary calculation?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

What is the formula to calculate salary?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

How monthly salary is calculated?

First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week, and then multiply the total by 52. Now that you know your annual gross income, divide it by 12 to find the monthly amount. Finally, dividing by 12 reveals a gross income of $2,080 per month.

Is salary calculated for 30 days?

In some organizations, the per-day pay is calculated as the total salary for the month divided by a fixed number of days, such as 26 or 30. In the fixed days' method, an employee, whether he joins or leaves the organization in a 30 day or a 31-day month, will get the same pay amount for the same number of pay days.

How annual salary is calculated?

Calculating an Annual Salary from an Hourly Wage Multiply the number of hours you work per week by your hourly wage. Multiply that number by 52 (the number of weeks in a year). If you make $20 an hour and work 37.5 hours per week, your annual salary is $20 x 37.5 × 52, or $39,000.

What does a monthly salary mean?

Gross monthly income is the amount of income you earn in one month, before taxes or deductions are taken out. Your gross monthly income is helpful to know when applying for a loan or credit card.

How do you calculate an employee's salary?

Gross pay for salaried employees is calculated by dividing the total annual pay for that employee by the number of pay periods in a year. For example, if a salaried employee's annual pay is $30,000, and the employee is paid twice a month, the gross pay for each of the 24 pay periods is $1250.

What is the formula to calculate basic salary?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

#1 usability according to G2

Try the PDF solution that respects your time.