Última actualização em

Aug 16, 2021

Correct Amount Notice Grátis

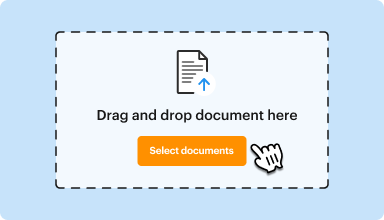

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

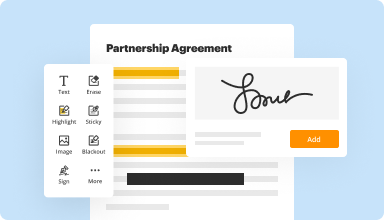

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

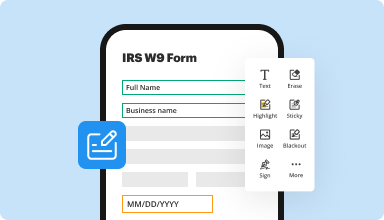

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

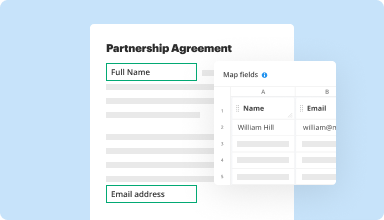

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

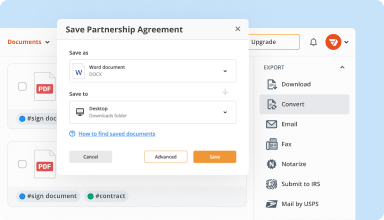

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

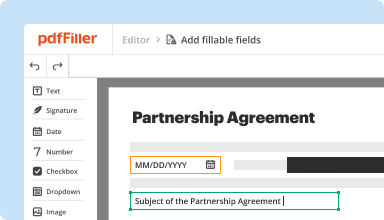

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

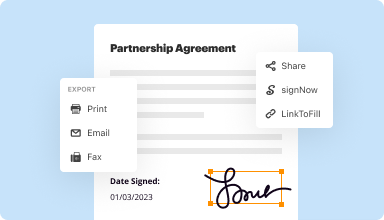

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

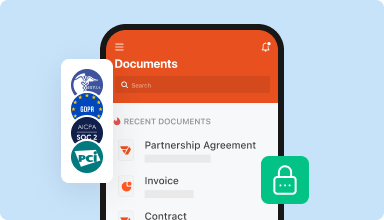

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I love this service. It makes my job as a small accounting business owner very easy to navigate with access to all necessary forms in one convenient place

2015-08-26

The application is smooth and easier to maneuver through all the features. I am impressed with the set-up of tools and the ability to move easily throughout the site to get documents edited, saved and printed.

2017-08-30

I have had limited use since I became a subscriber. I have difficulty printing the PDF file

I was working on and asked your online help desk what I could do to remedy that but

without success.

2019-02-19

I found the website to be very useful…

I found the website to be very useful when I needed it to read and edit pdf files.

The website is very easy to navigate and use.

2022-10-04

I always receive excellent customer…

I always receive excellent customer service! any issues or questions I have are always resolved in a professional and timely manner.

Thank you!

2022-02-09

Excellent service. Website is easy to navigate and the forms available are excellent. In my case, even though the website is user friendly, I think a short webinar to familiarize customers would be of great benefit. I would certainly recommend PDFiler to others.

2021-02-27

IT IS SUPER EASY RIGHT OUT OF THE GATE. I AM NOT SURE HOW TO FIND A DIFFERENT IRS FORM. I AM THINKING MY ADOBE DC MAY DO THIS AND I JUST DON'T KNOW IT. I FOUND THIS ON THE INTERNET AND IT IS SAVING ME HOURS.

2021-01-18

I actually wish I needed this service. Twice now their support live chat saved my life with recovering a file and cancelled my subscription within seconds of requesting. 10/10.

2020-11-03

Just getting to know how to use it, but it is exactly what I needed to make my documents sent to clients easier for them to fill out and quickly return to me.

2020-10-10

Correct Amount Notice Feature

The Correct Amount Notice feature helps you manage your finances more effectively by ensuring you always receive accurate payment information. It minimizes errors and confusion, providing you peace of mind.

Key Features

Real-time updates on payment amounts

Automatic notifications for changes

User-friendly interface for easy navigation

Integrated support for various payment methods

Comprehensive reporting capabilities

Potential Use Cases and Benefits

Individuals can avoid overdraft fees by receiving timely alerts on payment changes

Businesses can ensure accurate invoicing, boosting customer satisfaction

Financial planners can monitor budgets more effectively with accurate data

Service providers can reduce disputes by keeping clients informed

Users can enhance their financial planning with reliable payment details

By using the Correct Amount Notice feature, you reduce the risk of financial mishaps. It keeps you informed, ensuring you have the correct amount of information when you need it. This way, you can plan better and avoid unnecessary stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What does it mean when it says adjusted refund amount?

Adjusted refund amount means the IRS either owes you more money on your return, or you owe more money in taxes. For example, the IRS may use your refund to pay an existing tax debt and issue you a CP 49 notice.

What is adjusted refund amount 0.00 means?

It means the IRS or state changed something on your tax return and adjusted your refund accordingly. Community : Discussions : Taxes : Get your taxes done : What does an adjusted refund amount mean.

What does adjust amount mean?

Adjusted Amount means the per-share amount calculated by dividing (x) the sum of (A) Equity Value plus (b) Net Proceeds from IPO by (y) the number of Fully Diluted Shares Post IPO (in each case as defined below).

Can IRS adjusted my refund?

Overview. The IRS will change your routinely refund for many reasons, for example to correct a math error, to pay an existing tax debt or to pay a non-tax debt. If you make a math mistake on your return and the IRS catches it, you are mailed a letter advising you of the change, and it's not considered a big deal.

Where is my adjusted refund?

You can check the status of your Form 1040-X, Amended U.S. Individual Income Tax Return using the Where's My Amended Return? Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return. As a reminder, amended returns take up to 16 weeks to process.

Why is my IRS refund less than expected?

Refund Less than Expected If you receive a refund for a smaller amount than you expected, you may cash the check. You'll get a notice explaining the difference. Follow the instructions on the notice. If it's determined that you should have received more, you will later receive a check for the difference.

Why is my state refund different from what I filed?

You may have received a lower refund than expected because your refund was applied to a past due debt. Some examples of past due debt include federal or state income taxes, state unemployment compensation debts, child support, or federal nontax debt such as student loans.

How do I find out why my state tax refund was reduced?

Past due child support. Debts owed to a federal agency. Unemployment debts owed to the state. Past due federal student loans. Unpaid state income tax.

#1 usability according to G2

Try the PDF solution that respects your time.