Excise Signature Form Grátis

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

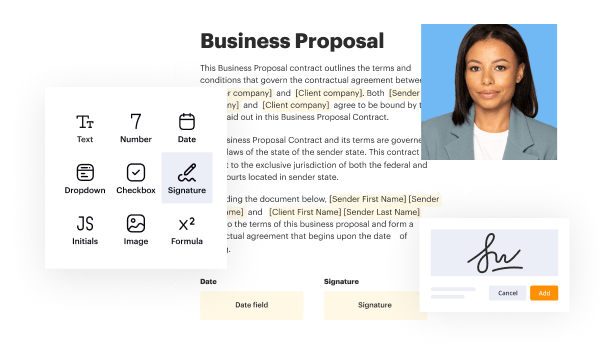

Excise Signature Form Feature

Discover the Excise Signature Form feature, designed to make your compliance and record-keeping seamless. This feature ensures that your signature capture process is simple and efficient. Now you can manage excise documentation with confidence.

Key Features

Potential Use Cases and Benefits

With the Excise Signature Form feature, you can address your compliance challenges effectively. It simplifies the signature process, reduces the risk of errors, and provides a clear audit trail. By implementing this feature, you can save time and focus on what matters most—growing your business.

Instructions and Help about Excise Signature Form Grátis

Excise Signature Form: easy document editing

The Portable Document Format or PDF is a common file format used for business records because you can access them from any device. It will keep the same layout no matter you open it on Mac or an Android smartphone.

Data protection is another reason why do we prefer to use PDF files for storing and sharing personal data and documents. That’s why it is essential to pick a secure editing tool for managing documents. Particular platforms grant access to an opening history to track down people who read or completed the document.

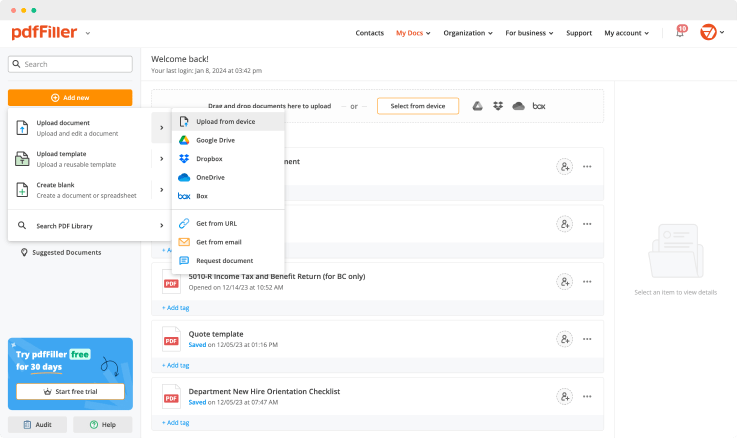

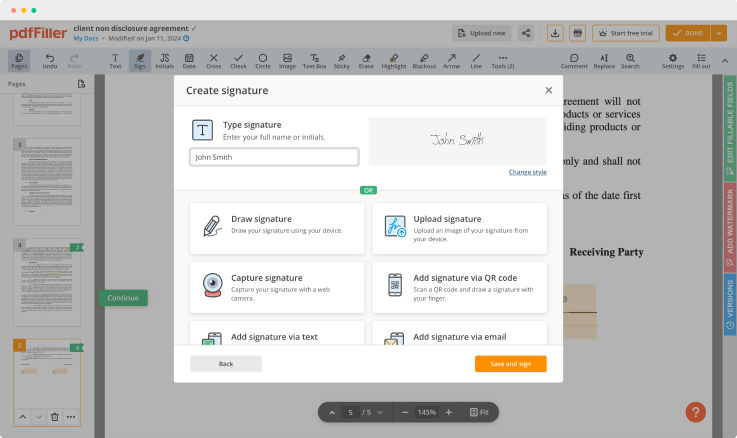

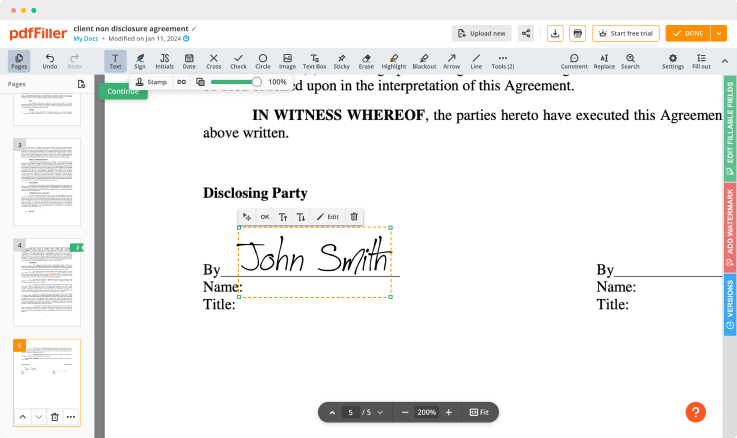

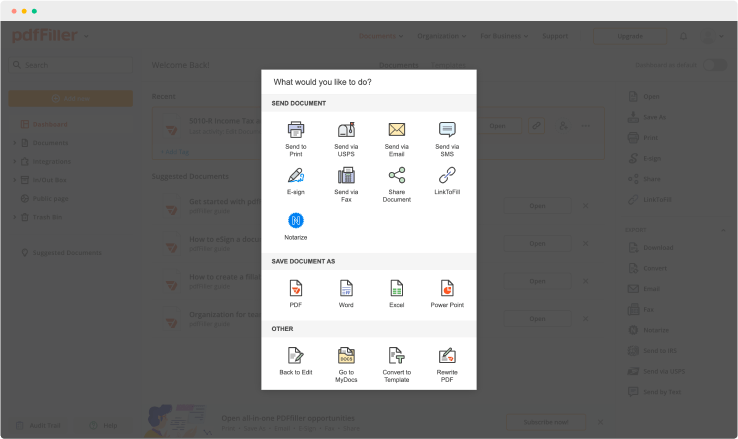

pdfFiller is an online document creating and editing tool that allows to create, modify, sign, and share PDF using just one browser tab. Thanks to the numerous integrations with the popular solutions for businesses, you can upload an information from any system and continue where you left off. Forward it to others by email, fax or via sharing link, and get a notification when someone opens and completes it.

Use editing features to type in text, annotate and highlight. Change a template’s page order. Once a document is completed, download it to your device or save it to cloud storage. Ask your recipient to complete the fields. Add images to your PDF and edit its appearance. Add fillable fields and send documents for signing.

Get your documents completed in four simple steps:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Excise Signature Form Grátis