Fill Numbers Notice Grátis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

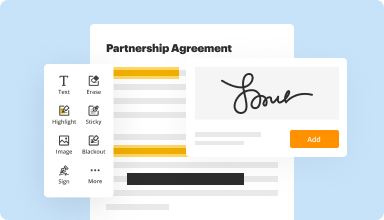

Fill out, edit, or eSign your PDF hassle-free

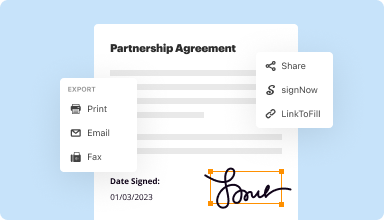

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

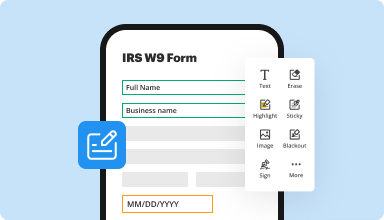

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

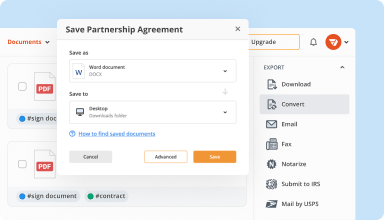

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

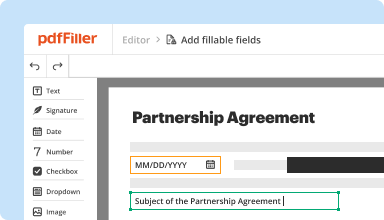

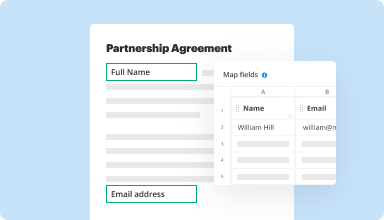

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

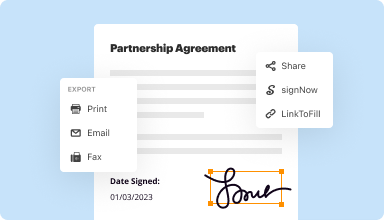

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I have just been informed by my college that I can't use this format. After paying for it and working with it for months, they prefer I use a format with expandable boxes for each indicator. This is a user friendly method but my only difficulty as been that the only information I can add to the PDF is what fits in the fixed boxes. This would be a suggestion in the formatting of this PDF.

2014-11-28

Overall a great product. My only qualm with the software is the picture quality of the pages displayed when a user is selecting pages to "save as." The images are not clear enough for anyone to distinguish pages. A zoom function would be much appreciated.

2015-12-06

I used this program for one item in the past and just discovered today I can use it for many other types of forms such as Income Tax etc. Very easy to use, thank you. Wendell Juhl

2019-06-14

What do you like best?

The flexibility to fill out e-doc and version control function.

What do you dislike?

Better to have a ruler to a-line the texts

What problems are you solving with the product? What benefits have you realized?

It helps a lot to fill out the PDF docs and file online. It’s fast, efficient and easy to make changes as needed.

The flexibility to fill out e-doc and version control function.

What do you dislike?

Better to have a ruler to a-line the texts

What problems are you solving with the product? What benefits have you realized?

It helps a lot to fill out the PDF docs and file online. It’s fast, efficient and easy to make changes as needed.

2019-01-28

My Favorite PDF Signing Software

I've been using PdfFiller for many years and I've gotten used to the interface and so to me, it's pretty easy to use, but I've dabbled with other online document signing software and I admit those are pretty easy to use.

Some of its competitors seems to have pretty user friendly interfaces.

2020-02-12

So Easy to Use Anybody Could Do It

I have had a great experience with this program so far it has eliminated my need for some of the other programs I have tried which ultimately has saved a lot of money while also making my job a little easier.

PDFiller is so easy to use that you anybody can do it. It walks you through everything but you may not even need to do that its very clear and easy to navigate. This program also has saved me so much time and money on other options in which you would have to get more than one program to accomplish what just this one program does.

Once in a while I have to exit out of it because it freezes up, but I'm always able to go right back into it without having to wait.

2019-09-30

PDFfiller Review

Overall, the experience is very good. I plan on using it for a very long time.

It's very easy to navigate. PDF Filler makes it easy for small business owners as myself to have the professional look when conducting business.

It's a lot of features that I don't need. This sometimes causes confusion and extra time navigating around the site.

2019-01-22

pdfFiller is exceptionally easy to use

So far it's a great software to use

Quality and secure application to allow those clients to sign documents.

Everything bad is always the cost to find a way to be more effective.

2022-09-29

I love this PDF filler it is very easy…

I love this PDF filler it is very easy to use my can use easily. it is very is to upload documents to his school assignment page. I would definitely recommend this app to others.

2020-11-09

Fill Numbers Notice Feature

The Fill Numbers Notice feature helps you stay organized by alerting you when it's time to fill in important numerical data. This tool simplifies your workflow and enhances accuracy, making your tasks smoother.

Key Features

Real-time alerts for missing numbers

Customizable reminder settings

User-friendly interface for easy navigation

Data integration with existing systems

Support for various numerical formats

Potential Use Cases and Benefits

Improve accuracy in financial reporting

Enhance data entry efficiency in project management

Streamline inventory management by tracking stock levels

Ensure timely updates in customer databases

Facilitate better planning in budget tracking

This feature solves your problem of missed updates and incomplete records. By providing timely notifications, you can fill in numbers promptly and maintain data integrity. Ultimately, this leads to better decision-making and increased productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I respond to a cp2000 notice?

Evaluate your situation and decide on the right response. Start by validating that you owe more taxes. ...

Respond to the IRS. If you agree with the notice, send the CP2000 response form back to the IRS with payment (if applicable). ...

Prevent future underreporting and resulting penalties.

What happens if you don't respond to cp2000?

If the IRS disagrees with your CP2000 response, the IRS usually sends a Statutory Notice of Deficiency (90-day letter). After you get that letter, you can't request an Appeals conference. You'll have 90 days to petition the U.S. Tax Court. After the 90-day letter, you'll get a final bill from the IRS.

How long does it take for the IRS to respond to cp2000?

If the dispute involves accuracy penalties that have already been assessed, the reconsideration can take up to 3 years. It is common for the IRS to acknowledge receipt of the CP2000 response and ask for additional time to review the case (usually IRS Letter 4314C). Taxpayers should not be concerned.

What is IRS cp2000?

If you received a CP2000, it means that the IRS thinks the income and/or payment information they have on file doesn't match the information you reported on your tax return.

How long does the IRS have to respond?

Allow at least 30 days for a response (and it often takes longer). Keep a copy of everything you send. Most correspondence can be handled without calling or visiting an IRS office. In fact, in my experience, it is usually better to handle it in writing.

Will a cp2000 notice stop my refund?

If you owe back taxes to the IRS, they may keep your refund. The CP2000 notice means that the income and/or payment information the IRS has on file for you doesn't match the information you reported in your return. ... If so, you can call at the number and speak with an IRS agent.

Will a cp2000 delay my refund?

The CP2000 could cause a delay in any refunds you have coming. But, because the system is automated and the notice has not been fully processed and no final determination made, you may receive the refund with no delay.

How long does it take for IRS to respond to cp2000?

This is normal procedure at the IRS. Likely, the letter asks for an additional 60 or 90 days for the IRS to respond. In most cases, the response will be much shorter. Taxpayers can get a status update on their CP2000 by calling the IRS (the number listed on the CP2000 notice).

How do I check the status of my cp2000?

Taxpayers can get a status update on their CP2000 by calling the IRS (the number listed on the CP2000 notice). Taxpayers cannot look at their IRS account transcripts or their IRS online account and get the status or even see if the IRS received and is processing their response.

How do I get a copy of my cp2000?

How can I get a copy of my original return? You can request a return transcript on our “Get Transcript” page. You can also get one by calling our automated phone application at 800-908-9946 or by completing and sending us a Form 4506-T, Request for Transcript of Tax Return.

#1 usability according to G2

Try the PDF solution that respects your time.