Include Amount Record Grátis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

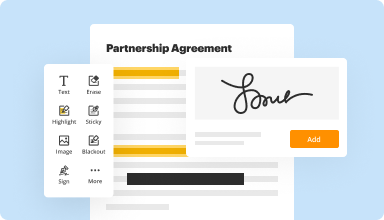

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

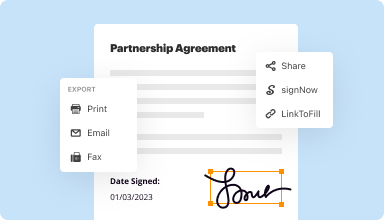

Fill out & sign PDF forms

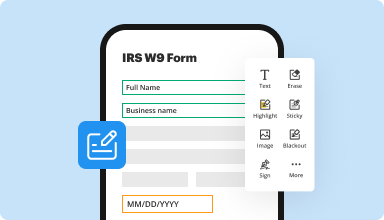

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

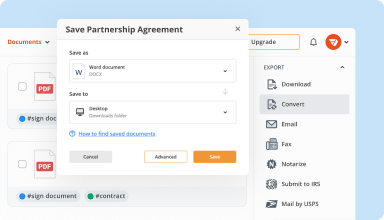

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

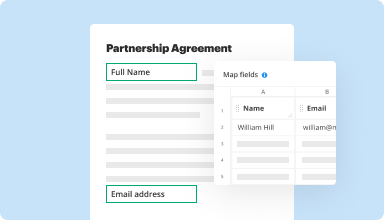

Collect data and approvals

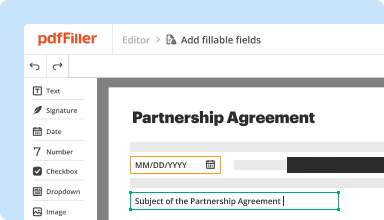

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

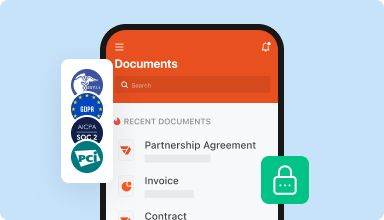

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Piece of cake; especially for those of us who don't have precious amounts of time to learn new software. I highly recommend it to business people like myself

2014-09-16

On a learning curve,so it has been slow but I really like the ease of putting in my own form and filling in my data. Helps with creating readable Dues Notices

2014-11-20

The website said there will be no charge for 30 days but my card got charged 1 dollar. This is clear misleading attitude. I did not find half a star to give.

2019-10-25

What do you like best?

I like the fact that it is easy to use and has all of the forms that I am looking for. I use this product on a monthly basis and find that it is easy to use and that the documents are easy to find.

What do you dislike?

There are times that I can't find a form that I know I have filled out. Also there are times that I am unable to get back to the home screen to find a new form.

Recommendations to others considering the product:

I would highly recommend this product to others and in fact I have done so. This product is easy to use and inexpensive compared to other products like it.

What problems are you solving with the product? What benefits have you realized?

Form 2848, Form 1099Misc and W2s

I like the fact that it is easy to use and has all of the forms that I am looking for. I use this product on a monthly basis and find that it is easy to use and that the documents are easy to find.

What do you dislike?

There are times that I can't find a form that I know I have filled out. Also there are times that I am unable to get back to the home screen to find a new form.

Recommendations to others considering the product:

I would highly recommend this product to others and in fact I have done so. This product is easy to use and inexpensive compared to other products like it.

What problems are you solving with the product? What benefits have you realized?

Form 2848, Form 1099Misc and W2s

2019-01-28

I am very happy with the customer services of pdfFiller.

I am very happy with the services of pdfFiller.com

Their customer service is excellent. A payment was automatically made from my credit card. However, after talking to the customer service, I got my refund which I never thought would be possible.

2024-04-26

Expensive for irregular user but overall excellent!

Expensive if you are an occasional user, and I wish the "fill in the blanks" were a little more automatic with alignment. But overall excellent!

2023-04-04

I signed up with pdffiller. I needed to cancel my subscription and dealt with *** at the support team. Service was excellent, they gave quick attention to my issue and promptly cancelled my account with no hassle. Very impressive professional service. Highest marks for the INTEGITY of AirSlate company.

2023-03-17

What do you like best?

User friendly. Can do anything I really need, from editing pdfs, splitting up and saving parts of documents, signed documents, etc.

What do you dislike?

The sign in page can be a bit wonky and hard to see if you're signed in. If you've been signed out and start uploading it puts you into the trial mode, and once you figure out whats going on you have to start over.

What problems are you solving with the product? What benefits have you realized?

Signing documents is really important for me, which is the biggest benefit. But the ability to edit and fill out pdf documents has been wonderful as well.

2020-08-21

PDFfiller has been relatively easy to use and been an important tool for the conversion of files to PDF for me, during this time of working from home during the pandemic of Covid-19

2020-05-06

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you record a discount received?

A cash discount received, sometimes called an early settlement discount, is recorded in the accounting records using two journals. The first journal is to record the cash paid to the supplier. The second journal records the cash discount received to clear the remaining balance on the suppliers account.

How do you account for discount received?

Accounting for the Discount Allowed and Discount Received The entry to record the receipt of cash from the customer is a debit of $950 to the cash account, a debit of $50 to the sales discount contra revenue account, and a $1,000 credit to the accounts receivable account.

What type of account is discount received?

Discounts allowed represent a debit or expense, while discount received are registered as a credit or income. Both discounts allowed and discounts received can be further divided into trade and cash discounts. The latter require double-entry bookkeeping. This sales strategy is common in both B2C and B2B transactions.

How do you account for trade discount?

Definition of Trade Discount (Early-payment discounts of 1% or 2% are usually recorded by the seller in an account such as Sales Discounts and by the buyer using the periodic inventory method in an account such as Purchase Discounts.)

What is discount allowed in income statement?

A discount allowed is when the seller of goods or services grants a payment discount to a buyer. A discount received is the reverse situation, where the buyer of goods or services is granted a discount by the seller. The examples just noted for a discount allowed also apply to a discount received.

Where does sales discounts go on the income statement?

Sales discounts (along with sales returns and allowances) are deducted from gross sales to arrive at the company's net sales. Hence, the general ledger account Sales Discounts is a contra revenue account. Sales discounts are not reported as an expense.

Is discount received debited or credited?

Discounts allowed represent a debit or expense, while discount received are registered as a credit or income. Both discounts allowed and discounts received can be further divided into trade and cash discounts.

Is discount received a revenue?

When the seller allows a discount, this is recorded as a reduction of revenues, and is typically a debit to a contra revenue account. When the buyer receives a discount, this is recorded as a reduction in the expense (or asset) associated with the purchase, or in a separate account that tracks discounts.

#1 usability according to G2

Try the PDF solution that respects your time.