Itemize Diploma Grátis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

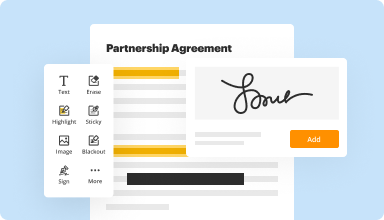

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

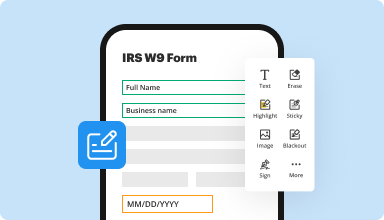

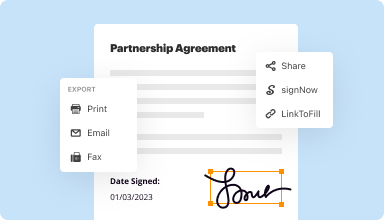

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

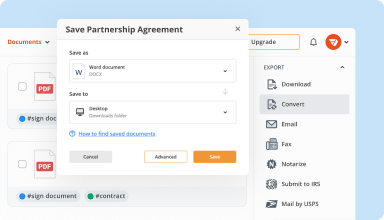

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

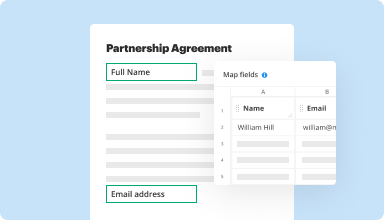

Collect data and approvals

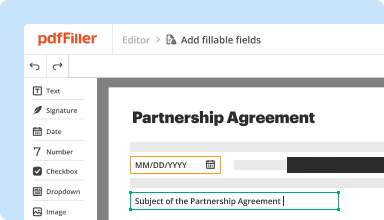

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

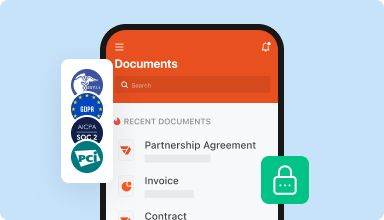

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

PDFfiller works well and is intuitively easy to follow. I used it for my company's W-2 and 1099's. The forms could be easily found, filled and printed without any problems.

2016-03-03

I lost you.... I found you then I tried to get a refund unable to figure out your site.... I tried for months you can see it was never used, CHASE tried to reach you...long story you had popped up I never noticed the name of this when I crashed that was it... I have all of the old emails off a hard drive on a back up device... I might re sign but 30 days is not worth losing 72.00 I dont use this much most of my forms are already loaded not sure yet I have become further disabled trying to recover back then your chat did not work nothing....

2016-06-08

Works great with laptop, but Was time consuming and difficult to work on IPad. Had to switch to my laptop in order to speed up the process and complet the job.

2016-07-24

Very professional, highly recommended.

I needed to create some fillable PDFs for a course I'm running and PDFfiller allowed me to do that with ease. I needed a bit of guidance on how to do it from their person in the chat box (who was very helpful and efficient) and, once they showed me what to do (it was easy), the software was great and pretty intuitive and allowed me to create fillable boxes neatly and easily - it gives you guidelines so you can line them up with each other. It's a pity they don't do a "one-off" fee of $5 or something, rather than a subscription because it's not something I need regularly, so I'd have been happy to just pay a little something toward using it, rather than signing up for the 30 day free trial. Highly recommended. Very professional. Lisa Cherry Beaumont of LisaCherryBeaumont.com

2020-01-07

PDF Filler is the Best

I really love using PDFiller it's a great tool for a new small business owner also with taking care of personal business as well. I love that you have so many tools, resources, and options.

2019-06-22

Filled My Document My Way

Appreciate the abilty to pull in my own form and add to it. I would like an option to duplicate my current sheet, making my document 2+ pages like the import (or add a document) button and without loosing my comments.

2024-06-17

I needed Pump Data sheet for my…

I needed Pump Data sheet for my customers to fill up and been wracking my brain where to get it , and PDFFiller have it ....Great one headache gone

2023-05-05

Avis

Multiples fonctionnalités, facile et pratique d'utilisation, surtout pour les formulaires

Que la période de gratuité soit comme telle, il faut que ça soit effectivement gratuit

2021-08-16

No training necessary

No training necessary! I was able to figure the tool out in a few minutes and got my first client signed. Thank you PDFFiller!

2020-04-19

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What education expenses are tax-deductible?

Distributions are tax-free as long as they are used for qualified education expenses, such as tuition and fees, required books, supplies and equipment and qualified expenses for room and board.

What kind of education expenses are tax-deductible?

Distributions are tax-free as long as they are used for qualified education expenses, such as tuition and fees, required books, supplies and equipment and qualified expenses for room and board.

What is considered a qualified education expense?

Qualified expenses are amounts paid for tuition, fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution. You must pay the expenses for an academic period* that starts during the tax year or the first three months of the next tax year.

Can you deduct education expenses in 2019?

The Tuition and Fees Deduction The deduction for tuition and fees is not available for the 2018 tax year. Those are the taxes you file in early 2019. ... If your modified adjusted gross income is above $80,000 (or above $160,000 for joint filers), you can't qualify for the deduction.

What college expenses are tax-deductible 2019?

The tax credit limit is $2,500 paid out for typical college costs like tuition, administrative fees, and textbooks, among other qualified costs. Claim the tax credit using IRS Form 8863, and make sure to include the college or university's employer identification number when you complete your tax forms.

Are continuing education expenses tax-deductible?

As of the 2018 tax year, education tuition costs are no longer deductible to individuals on Schedule A of their personal tax returns. The cost of continuing education credits for employees is also included as a business expense if it meets these criteria.

What education expenses are tax-deductible 2018?

The tuition and fees deduction disappears entirely for AGI above $80,000 and $160,000 for single and joint filers, respectively. If you qualify, the tuition and fees deduction allows you to exclude up to $4,000 of qualifying expenses from your income, so the exact benefit depends on your tax bracket.

Can I claim my child's college tuition on my taxes?

Yes, paying for your son's College tuition is deductible. ... Educational institutions you paid tuition to should send you this form by January 31. Yes, you can still claim your son as a dependent under the Qualifying Child rules. Your son can also file his tax return and receive a refund of the taxes withheld.

Can I deduct my child's college tuition 2019?

The Tuition and Fees Deduction The deduction for tuition and fees is not available for the 2018 tax year. Those are the taxes you file in early 2019. ... If your modified adjusted gross income is above $80,000 (or above $160,000 for joint filers), you can't qualify for the deduction.

Can I claim my college student as a dependent 2019?

In 2019, the bill will raise taxes on 7 percent of taxpayers generally but will raise taxes on 27 percent of taxpayers claiming at least one dependent over age 16. ... This means that under current law, parents of a child in her last years of high school or in college can claim a personal exemption for her as a dependent.

#1 usability according to G2

Try the PDF solution that respects your time.