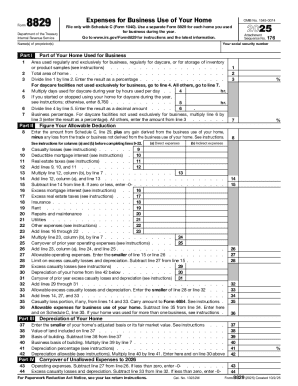

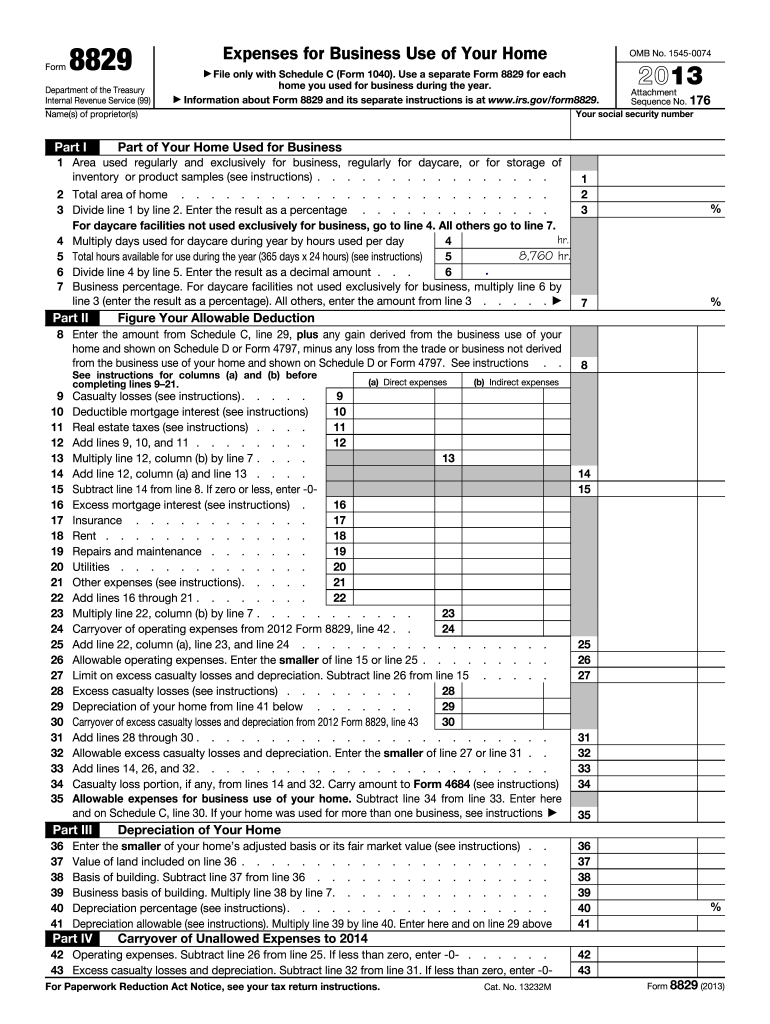

IRS 8829 2013 free printable template

Instructions and Help about IRS 8829

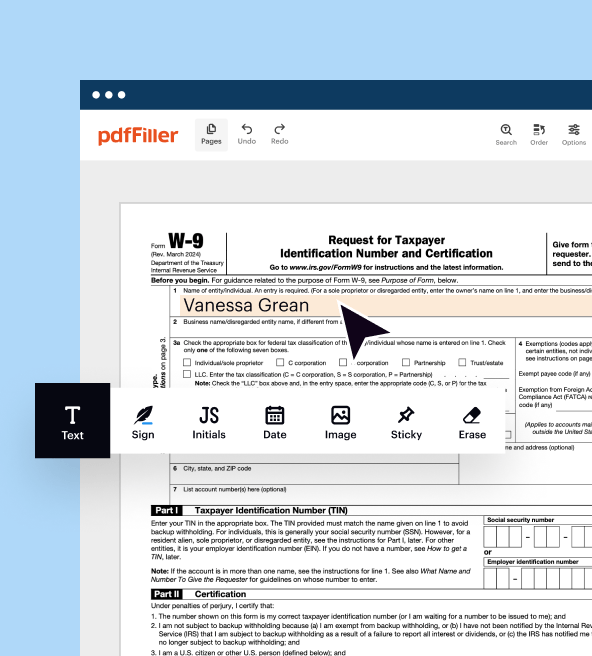

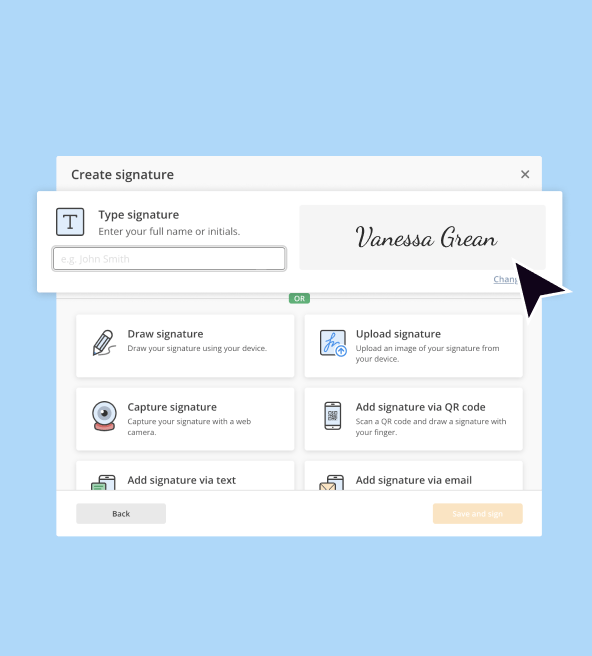

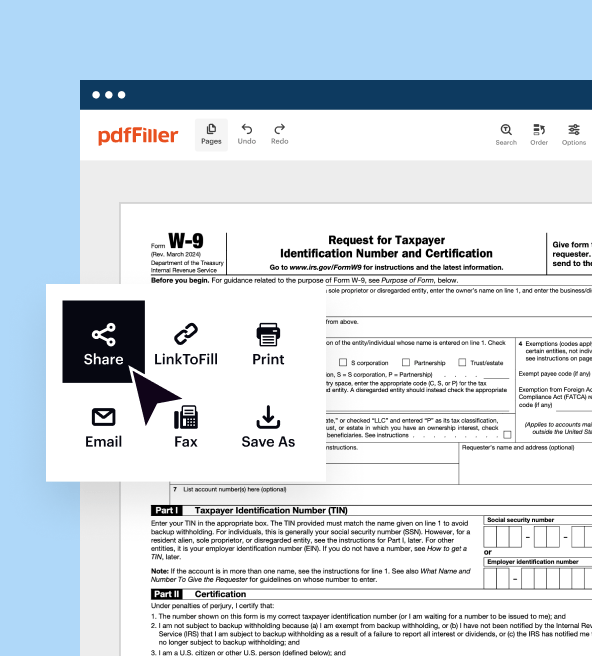

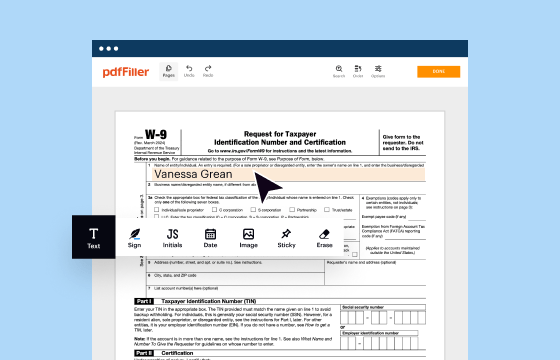

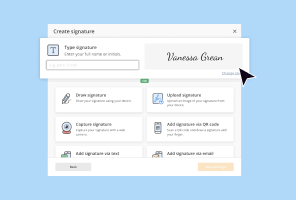

How to edit IRS 8829

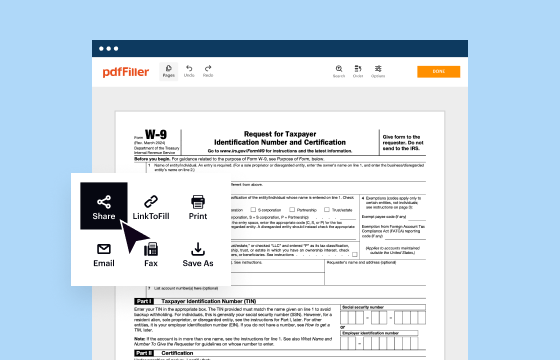

How to fill out IRS 8829

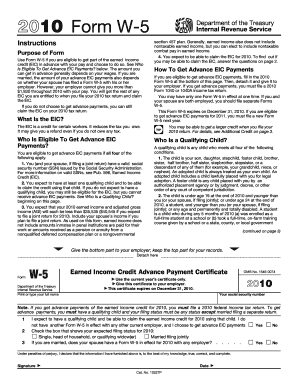

About IRS 8 previous version

What is IRS 8829?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8829

What should I do if I need to correct mistakes after filing my IRS 8829?

If you realize there are mistakes in your submitted IRS 8829, you should file an amended form as soon as possible to correct the errors. It's best practice to follow the IRS guidelines for amending returns, which typically involves using Form 1040-X alongside your corrected IRS 8829. Ensure you attach an explanation for the changes to avoid future issues.

How can I verify the receipt of my IRS 8829?

To verify the receipt of your IRS 8829, you can check your IRS account online or use the IRS ‘Where’s My Refund?’ tool if it pertains to a refund. Additionally, if you e-filed, you should receive an acknowledgment from the e-filing service. For paper filings, consider sending via certified mail to track delivery.

What are some common errors when filing the IRS 8829?

Common errors when completing the IRS 8829 include incorrect calculations of business expenses, failure to keep adequate records of expenses, and misclassifying personal versus business use of areas within your home. To avoid these mistakes, review each entry carefully and consider maintaining receipts and documentation throughout the year.

Are there specific requirements for e-filing my IRS 8829?

When e-filing your IRS 8829, ensure that you are using compatible tax preparation software that supports the form. Additionally, be aware of specific technical requirements such as browser compatibility and the acceptable format for submissions. Follow the software's guidance for completing the e-filing process to avoid rejection.

What steps should I take if my IRS 8829 submission is rejected?

If your IRS 8829 submission is rejected, carefully review the error codes provided in the rejection notice for guidance. Correct the indicated issues and resubmit your form promptly. Ensure all information aligns with IRS guidelines to decrease the chances of further rejection and consider reaching out to your tax preparer if you need assistance.

See what our users say