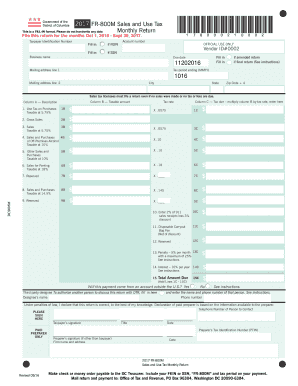

DC FR-800M 2012 free printable template

Show details

DCS001M Government of the District of Columbia Office of the Chief Financial Officer Office of Tax and Revenue Use 2012 FR-800M Sales andReturnTax Monthly Booklet October 1, 2011, September 30, 2012,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DC FR-800M

Edit your DC FR-800M form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DC FR-800M form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DC FR-800M online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit DC FR-800M. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DC FR-800M Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DC FR-800M

How to fill out DC FR-800M

01

Obtain the DC FR-800M form from the official website or local tax office.

02

Start by filling out your personal information, including your name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) in the designated section.

04

Report your total income for the tax year in the appropriate field.

05

Include any deductions or credits you qualify for as instructed.

06

Calculate your total tax liability by following the provided guidelines.

07

Review the form for accuracy and completeness.

08

Sign and date the form before submission.

Who needs DC FR-800M?

01

Individuals and businesses who are required to report income and pay taxes in Washington, D.C.

02

Taxpayers seeking to claim specific deductions or credits for their tax situation.

03

Residents and non-residents earning income within Washington, D.C.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to register my business in DC?

If you are starting a business in Washington DC, you are required to have a Washington DC Registered Agent to register your domestic business entity.

What is the DC D 4 form?

You must file a Form D-4A with your employer to establish that you are not a resident of DC and, therefore, not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and • You do not reside in DC for 183 days or more in the tax year.

Do I need to file DC corporate taxes?

Corporations that carry on or engage in a business or trade in D.C. or otherwise receive income from sources within D.C. must file Form D-20 with the D.C. Office of Tax and Revenue. The minimum payable tax is $250 if gross D.C. receipts are $1 million or less; $1,000 if they exceed $1 million.

How do I register my ein in DC?

If application is made by telephone (1-800-829-4933), you will receive your EIN immediately. If application is faxed, you will receive your EIN within one week.You may apply for an EIN: Online. Via Fax. Via Mail. Via Telephone (Domestic: 1-800-829-4933/ International: 267-941-1099)

What is a DC FR-500?

COMBINED REGISTRATION APPLICATION FOR BUSINESS DC TAXES/FEES/ASSESSMENTS. Page 1. GOVERNMENT OF THE DISTRICT OF COLUMBIA.

Does DC have a tax form?

Who must file a Form D-4? Every new employee who resides in DC and is required to have DC income taxes withheld, must fill out Form D-4 and file it with his/her employer.

Do non residents have to file a DC tax return?

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

How do I file DC sales tax?

You have a few options for filing and paying your Washington, D.C. sales tax: File online – File online with D.C. Freefile. File by mail – You can use paper form FR-800A to file and pay annually, FR-800Q to file and pay quarterly, and FR-800M to file and pay monthly. AutoFile – Let TaxJar file your sales tax for you.

Does DC have a city tax?

In addition to federal income taxes, taxpayers in the nation's capital pay local taxes to the District of Columbia. These include a district income tax, with rates ranging from 4% to 10.75%, a 6% sales tax and property taxes on real estate. The District has an average effective property tax rate of 0.55%.

How do I get a reseller's permit in DC?

The first step you need to take in order to get a resale certificate, is to apply for a District of Columbia Sales Tax Registration. This license will furnish a business with a unique DC sales tax number, otherwise referred to as a Sales Tax ID number. Once you have that, you are eligible to issue a resale certificate.

Do I need to collect sales tax in DC?

Imposition of Sales Tax: A person doing business in the District must collect District sales tax from the pur- chaser on: . Sales of tangible personal property delivered to a customer in the District; 2. Certain services; 3. Renting or leasing tangible personal property used in the District; 4.

Does DC have a tax return?

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute DC FR-800M online?

pdfFiller has made it easy to fill out and sign DC FR-800M. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in DC FR-800M without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit DC FR-800M and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit DC FR-800M on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share DC FR-800M from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is DC FR-800M?

DC FR-800M is a tax form used in the District of Columbia for businesses to report their franchise taxes.

Who is required to file DC FR-800M?

Businesses operating in the District of Columbia that meet certain income thresholds and other criteria are required to file DC FR-800M.

How to fill out DC FR-800M?

To fill out DC FR-800M, businesses should gather financial information, complete the form with accurate data, and follow the instructions provided by the DC Office of Tax and Revenue.

What is the purpose of DC FR-800M?

The purpose of DC FR-800M is to calculate and report the franchise tax owed by businesses operating in the District of Columbia.

What information must be reported on DC FR-800M?

DC FR-800M requires reporting of income, deductions, and other financial information relevant to the calculation of the franchise tax.

Fill out your DC FR-800M online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DC FR-800m is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.