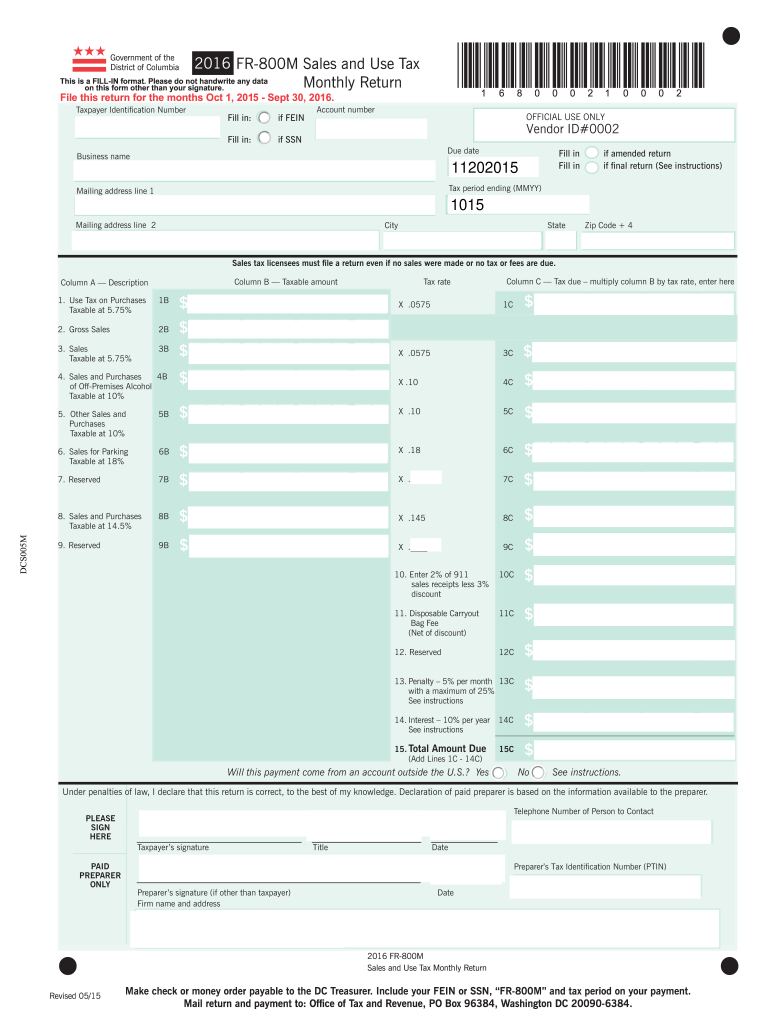

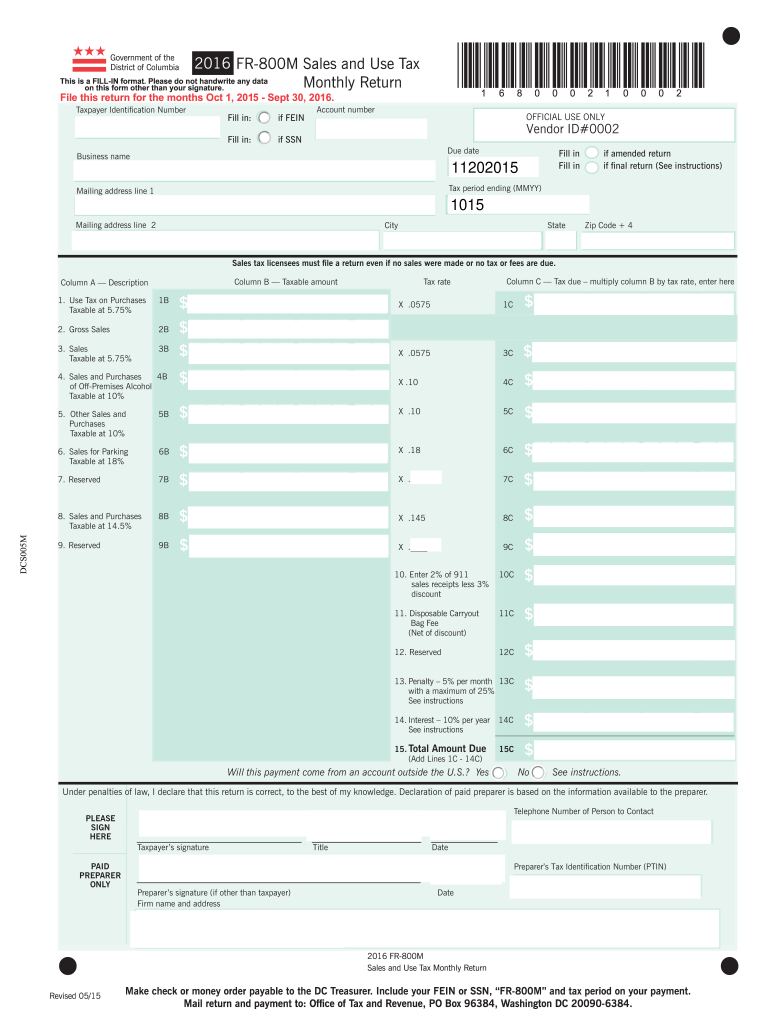

DC FR-800M 2016 free printable template

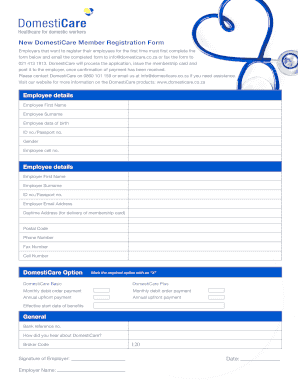

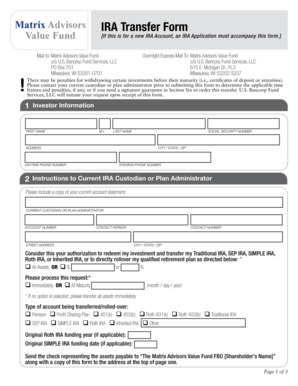

Get, Create, Make and Sign DC FR-800M

How to edit DC FR-800M online

Uncompromising security for your PDF editing and eSignature needs

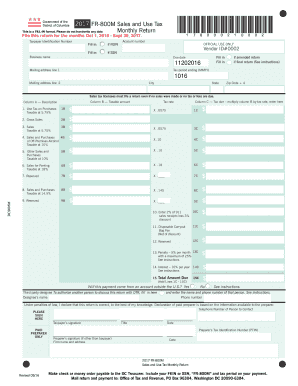

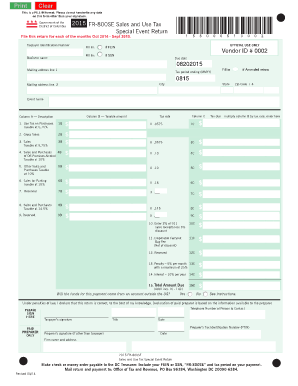

DC FR-800M Form Versions

How to fill out DC FR-800M

How to fill out DC FR-800M

Who needs DC FR-800M?

Instructions and Help about DC FR-800M

It's everyone's not so favorite time of year tax season and for DC landlords that means it's time to file the d30 tax form wondering what I'm talking about continue watching this video, so you're probably asking what is the d30 for the unknowing landlord the district considers renting a property to be a business function as such your rental income is considered business income which requires business tax return to report the income for those of you who are individuals this does apply to you but be aware it only has to do with your state return it is not so scary specifically what you need to file is a d30 unincorporated franchise tax return the d30 is actually a quite simple form it's two pages and allows you to deduct your expenses before coming up with the tax owed that's probably leading you to the next question what is the tax this year the tax rate is nine point nine five percent of your net income or minimum tax of two hundred and fifty dollars whichever is greater like your personal taxes you must file the d30 by April fifteenth now for any of you who collect under twelve thousand dollars gross be advised you actually have zero tax liability, but we do recommend that you file the return is a zero return this will save some headaches when it's time to renew your license whether it's next this year next year or two years down the road if you're thinking I'm not a DC resident this doesn't apply to me think again important to understand for non DC residents and even foreign owners that since this is considered business income you must file the return with the district for those of you who live in other states you speak with your tax professional regarding whether you need to declare the income in your home state or your personal tax return as well failure to pay the tax can cause liens and other consequences so make sure you get the form done and file the taxes now if you're using turbo tax or filing service like H&R Block or Jackson Hewitt you should make sure this form is included in their service offerings too many times landlords later find out these services do not prepare and file this form as it's a business tax form, so you're also probably wondering where can I find the form you can find the form by going to WW taxpayer service center com and clicking on the 2013 business tax forms and publications under tax forms and publications just make sure you file this by April the 15th unfortunately we come in answer to many questions related to this form as this is a tax matter and requires professional advice, but we are here always happy to refer you to qualify tax professional should you have questions feel free to email us support @ rent Gaffe calm, and we'll be happy to get you that referral good luck and as always happy land lording you

People Also Ask about

How do I get a sales tax permit in DC?

How to file sales tax in Washington DC?

What is the sales tax in DC?

What is DC sales tax amnesty?

How do I file DC sales tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my DC FR-800M in Gmail?

How can I edit DC FR-800M from Google Drive?

How do I complete DC FR-800M on an Android device?

What is DC FR-800M?

Who is required to file DC FR-800M?

How to fill out DC FR-800M?

What is the purpose of DC FR-800M?

What information must be reported on DC FR-800M?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.