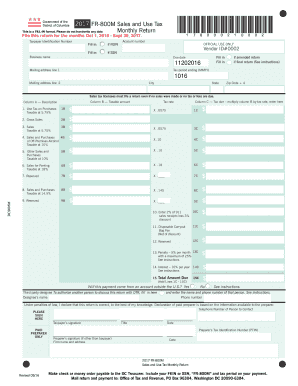

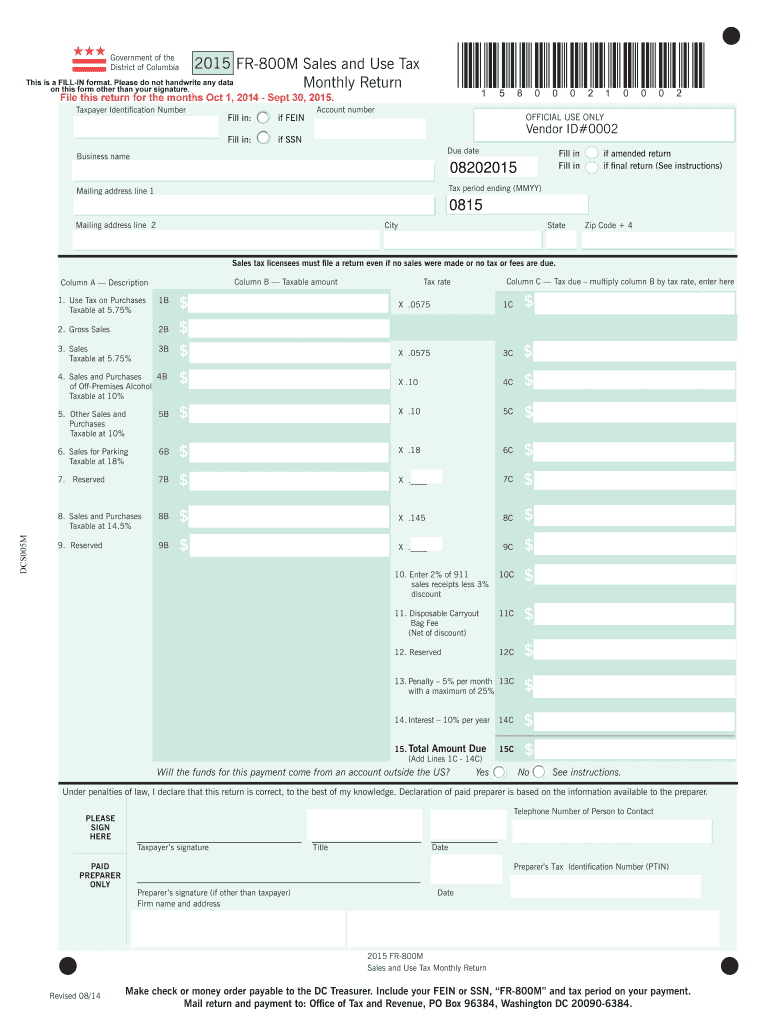

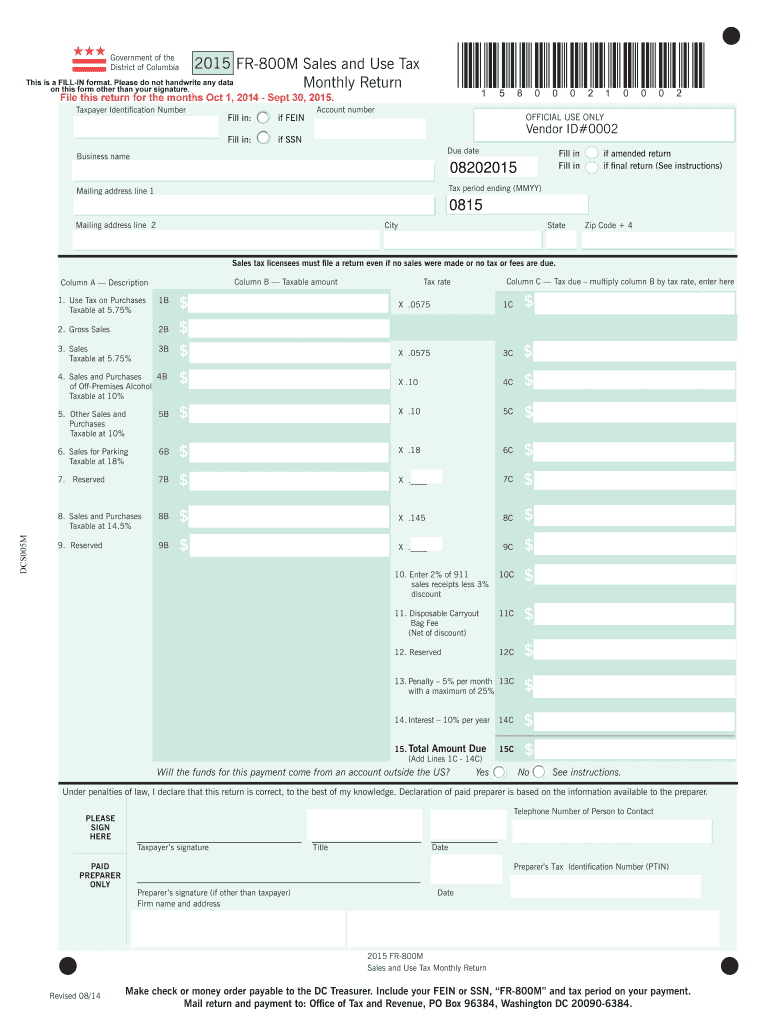

DC FR-800M 2015 free printable template

Show details

Make check or money order payable to the DC Treasurer. Include your VEIN or SSN, FR-800M and tax period on your payment. PLEASE. SIGN. HERE. PAID ... File this return for the months Oct 1, 2014 Sept

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DC FR-800M

Edit your DC FR-800M form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DC FR-800M form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DC FR-800M online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit DC FR-800M. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DC FR-800M Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DC FR-800M

How to fill out DC FR-800M

01

Obtain the DC FR-800M form from the official website or local tax office.

02

Fill in your identifying information, including your name, address, and taxpayer identification number.

03

Complete the income section by accurately reporting all sources of income.

04

Fill out the deductions and credits section, ensuring you have documentation for any claimed amounts.

05

Review the completed form for errors or omissions.

06

Sign and date the form in the designated areas.

07

Submit the form by the deadline, either electronically or by mail.

Who needs DC FR-800M?

01

Individuals who are residents of Washington D.C. and are required to report their income for tax purposes.

02

Taxpayers who owe taxes to the District of Columbia and need to file a tax return.

03

Those who qualify for tax credits or deductions provided by D.C. tax law and need to claim them.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to register my business in DC?

If you are starting a business in Washington DC, you are required to have a Washington DC Registered Agent to register your domestic business entity.

What is the DC D 4 form?

You must file a Form D-4A with your employer to establish that you are not a resident of DC and, therefore, not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and • You do not reside in DC for 183 days or more in the tax year.

Do I need to file DC corporate taxes?

Corporations that carry on or engage in a business or trade in D.C. or otherwise receive income from sources within D.C. must file Form D-20 with the D.C. Office of Tax and Revenue. The minimum payable tax is $250 if gross D.C. receipts are $1 million or less; $1,000 if they exceed $1 million.

How do I register my ein in DC?

If application is made by telephone (1-800-829-4933), you will receive your EIN immediately. If application is faxed, you will receive your EIN within one week.You may apply for an EIN: Online. Via Fax. Via Mail. Via Telephone (Domestic: 1-800-829-4933/ International: 267-941-1099)

What is a DC FR-500?

COMBINED REGISTRATION APPLICATION FOR BUSINESS DC TAXES/FEES/ASSESSMENTS. Page 1. GOVERNMENT OF THE DISTRICT OF COLUMBIA.

Does DC have a tax form?

Who must file a Form D-4? Every new employee who resides in DC and is required to have DC income taxes withheld, must fill out Form D-4 and file it with his/her employer.

Do non residents have to file a DC tax return?

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

How do I file DC sales tax?

You have a few options for filing and paying your Washington, D.C. sales tax: File online – File online with D.C. Freefile. File by mail – You can use paper form FR-800A to file and pay annually, FR-800Q to file and pay quarterly, and FR-800M to file and pay monthly. AutoFile – Let TaxJar file your sales tax for you.

Does DC have a city tax?

In addition to federal income taxes, taxpayers in the nation's capital pay local taxes to the District of Columbia. These include a district income tax, with rates ranging from 4% to 10.75%, a 6% sales tax and property taxes on real estate. The District has an average effective property tax rate of 0.55%.

How do I get a reseller's permit in DC?

The first step you need to take in order to get a resale certificate, is to apply for a District of Columbia Sales Tax Registration. This license will furnish a business with a unique DC sales tax number, otherwise referred to as a Sales Tax ID number. Once you have that, you are eligible to issue a resale certificate.

Do I need to collect sales tax in DC?

Imposition of Sales Tax: A person doing business in the District must collect District sales tax from the pur- chaser on: . Sales of tangible personal property delivered to a customer in the District; 2. Certain services; 3. Renting or leasing tangible personal property used in the District; 4.

Does DC have a tax return?

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit DC FR-800M straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing DC FR-800M right away.

How do I fill out the DC FR-800M form on my smartphone?

Use the pdfFiller mobile app to fill out and sign DC FR-800M on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out DC FR-800M on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your DC FR-800M. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is DC FR-800M?

DC FR-800M is a tax form used in Washington D.C. for reporting financial information and activity for various entities including corporations and organizations.

Who is required to file DC FR-800M?

Entities that engage in business activities in Washington D.C. and are subject to the entity-level taxes are required to file the DC FR-800M.

How to fill out DC FR-800M?

To fill out DC FR-800M, taxpayers must provide their identification information, financial activity details, and any deductions or credits that apply, ensuring all entries are accurate and complete.

What is the purpose of DC FR-800M?

The purpose of DC FR-800M is to facilitate the reporting of income and expenses by business entities operating in Washington D.C. for tax assessment purposes.

What information must be reported on DC FR-800M?

Information that must be reported on DC FR-800M includes gross income, deductions, credits claimed, and other financial details pertinent to the entity's operations.

Fill out your DC FR-800M online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DC FR-800m is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.