IRS 8379 Instructions 2010 free printable template

Show details

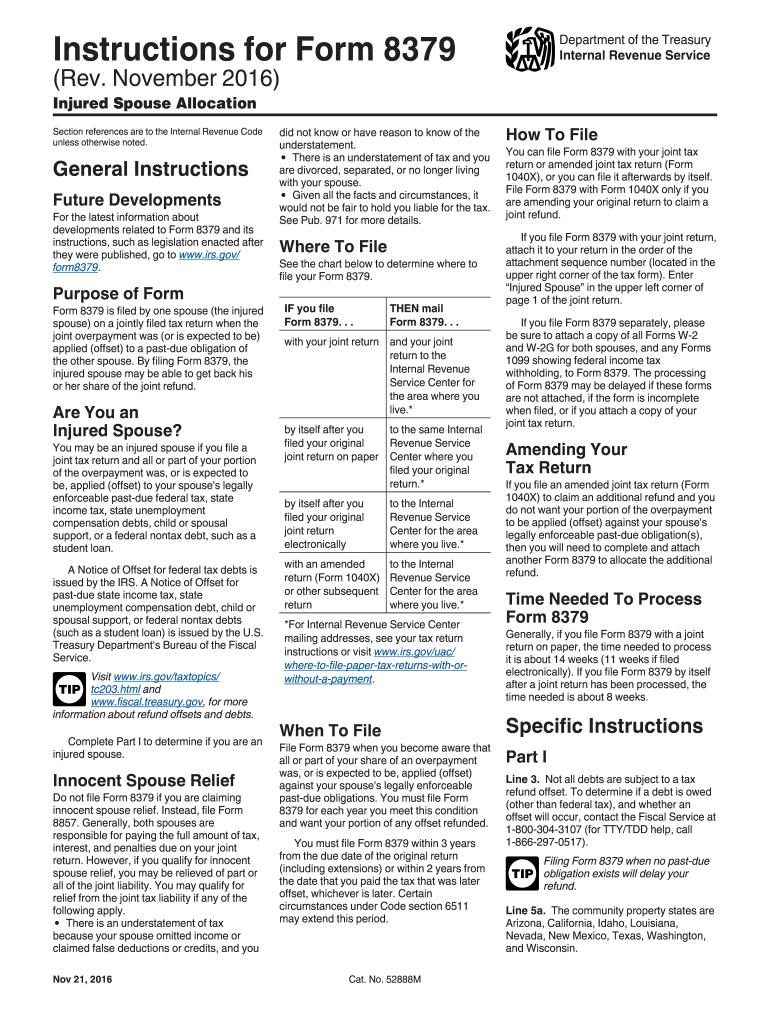

Instructions for Form 8379Department of the Treasury

Internal Revenue Service(Rev. November 2016)

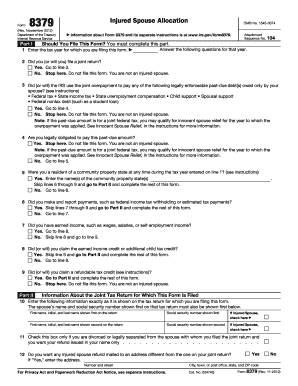

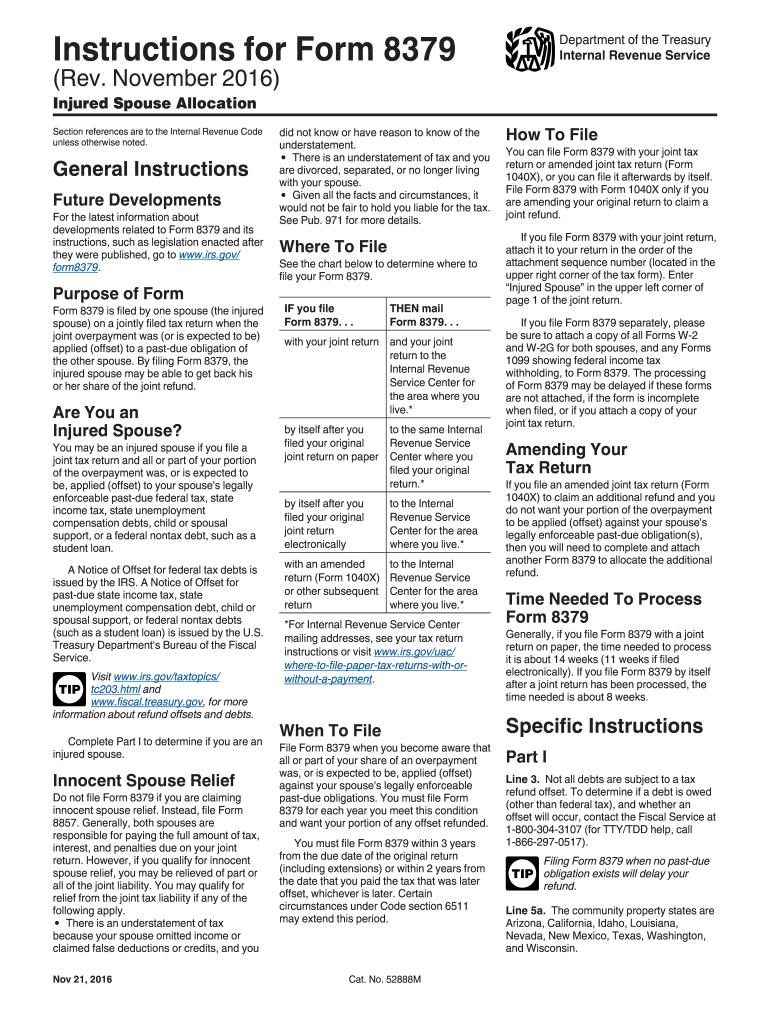

Injured Spouse Allocation

Section references are to the Internal Revenue Code

unless otherwise noted.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8379 Instructions

Edit your IRS 8379 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8379 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8379 Instructions online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 8379 Instructions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8379 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8379 Instructions

How to fill out IRS 8379 Instructions

01

Obtain IRS Form 8379 from the IRS website or your tax preparation software.

02

Fill out your personal information at the top of the form, including your name, SSN, and address.

03

Specify the tax year you are filing the form for.

04

Indicate the reason for your request for injured spouse relief.

05

Complete Part I by entering your spouse's name and SSN.

06

In Part II, list any income you earned, including wages, interest, and other sources.

07

In Part III, allocate any joint expenses between you and your spouse.

08

Sign and date the form.

09

Submit the completed IRS 8379 with your tax return or send it separately if you have already filed your return.

Who needs IRS 8379 Instructions?

01

Taxpayers who are married and filing jointly but believe their refund may be applied to their spouse's tax obligations.

02

Individuals who meet the criteria for injured spouse relief, including having earned income that was reported on a joint return.

Fill

form

: Try Risk Free

People Also Ask about

How does an injured spouse form work?

The injured spouse on a jointly filed tax return files Form 8379 to get back their share of the joint refund when the joint overpayment is applied to a past-due obligation of the other spouse.

How do I fill out an injured spouse?

To request injured spouse relief, file Form 8379, Injured Spouse Allocation. You can file it with your tax return by mail or electronically. You can also mail it separately when you receive notice that your refund was applied to an outstanding debt.

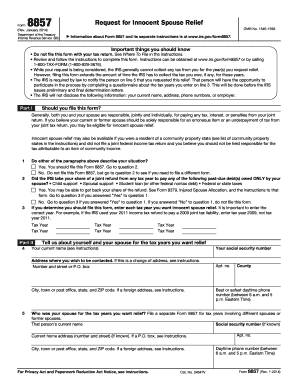

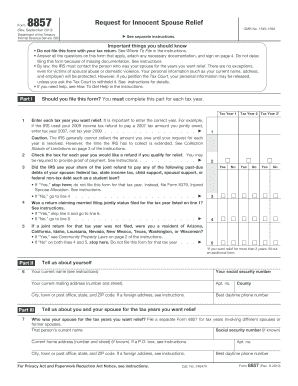

What is the difference between IRS form 8857 and 8379?

Form 8379 can be e-filed. An innocent spouse (Form 8857, Request for Innocent Spouse Relief) is asking the IRS not to hold him or her liable for tax resulting from actions of the other spouse in a joint return. Form 8857 is not transmitted with an e-filed return, but must be paper-filed separately.

What are the conditions to claim injured spouse?

The "injured spouse" on Form 8379 refers to a spouse who has been affected by the application of a joint tax refund to offset their spouse's debts. Because they have been financially harmed ("injured") by this use of the refund, that spouse is able to reclaim their share of the refund from the IRS.

What are the conditions to claim injured spouse?

You may be eligible for injured spouse relief if: You filed a joint return with your spouse. Your tax refund was applied to your spouse's overdue debts. You weren't responsible for the debt.

Can the IRS deny an injured spouse claim?

Can the IRS Deny an Injured Spouse Claim? Yes, the IRS may determine that someone filing Form 8379 is ineligible for an injured spouse allocation, or that they are not entitled to as much as they believe.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8379 Instructions for eSignature?

IRS 8379 Instructions is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my IRS 8379 Instructions in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your IRS 8379 Instructions and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete IRS 8379 Instructions on an Android device?

On Android, use the pdfFiller mobile app to finish your IRS 8379 Instructions. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IRS 8379 Instructions?

IRS 8379 Instructions provide guidance on how to file Form 8379, which is used to request a relief of joint tax liability due to injured spouse status.

Who is required to file IRS 8379 Instructions?

Individuals who are married but filed jointly and want to claim their portion of a tax refund that may be offset to pay their spouse's debts are required to file IRS 8379.

How to fill out IRS 8379 Instructions?

To fill out IRS 8379, you need to provide your personal information, including your social security number and the income details. The form will guide you through the required sections to identify your claim for relief.

What is the purpose of IRS 8379 Instructions?

The purpose of IRS 8379 Instructions is to provide taxpayers with a clear understanding of how to claim relief from joint tax liability in order to recover their share of tax refunds.

What information must be reported on IRS 8379 Instructions?

The information that must be reported on IRS 8379 includes taxpayer details, income information, and any debts that may affect the tax refund, along with supporting documentation.

Fill out your IRS 8379 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8379 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.