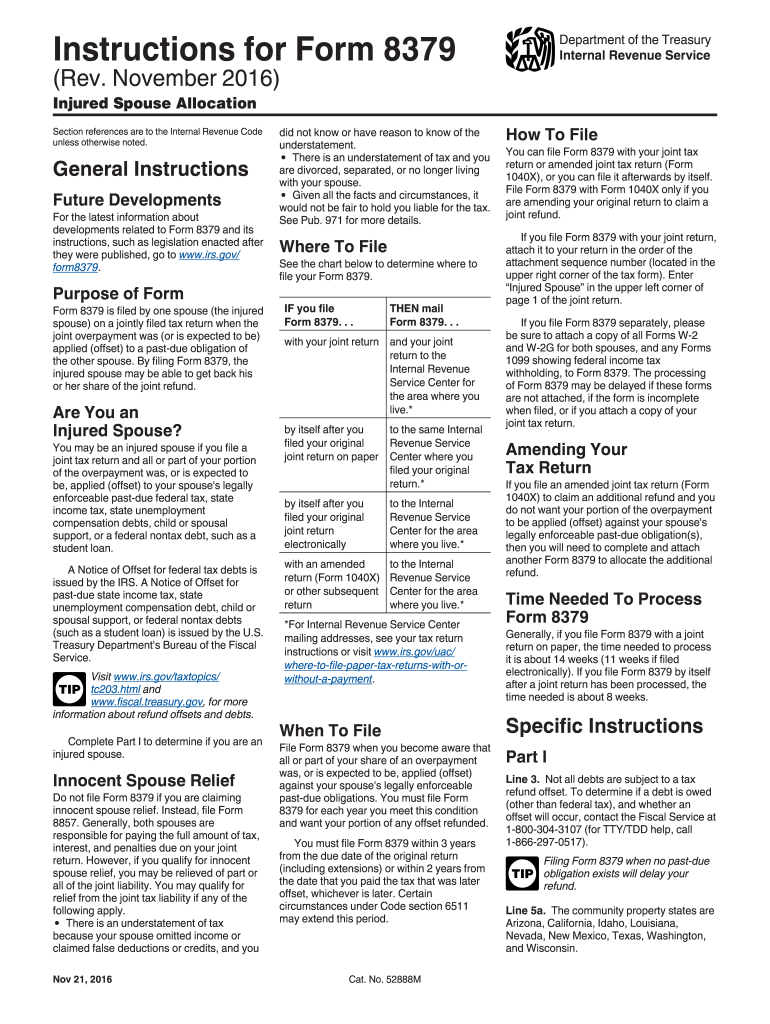

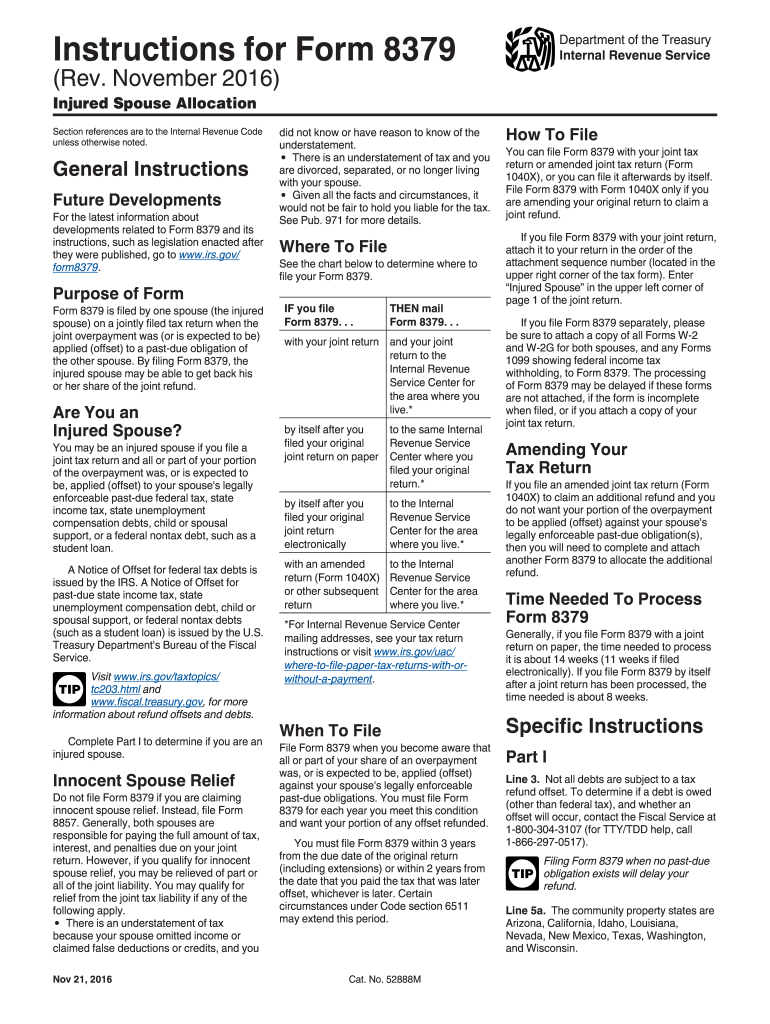

IRS 8379 Instructions 2016 free printable template

Get, Create, Make and Sign IRS 8379 Instructions

How to edit IRS 8379 Instructions online

Uncompromising security for your PDF editing and eSignature needs

IRS 8379 Instructions Form Versions

How to fill out IRS 8379 Instructions

How to fill out IRS 8379 Instructions

Who needs IRS 8379 Instructions?

Instructions and Help about IRS 8379 Instructions

In this video were going to be talking about the form 83-79 injured spouse and just real quick the injured spouse form is used in a scenario where one of the spouses has some sort of debt and whether it be you know back child support or unpaid taxes and the IRS is going to then garnish the refund for that that debt in which case one of these spouses would be negatively or adversely affected, so you would file this form allocate the monies to whom they belong the dependents and everything else in which case it will then split the IRS will only garnish that of the spouse with the debt so not going to go into a ton of detail but a couple of different ways to get to the form you can come over here to the miscellaneous forms and top right there is the form 83-79 you can also just type in injured which is the way I remember it I stink it remembering form numbers and then were going to click in here on injured spouse allocation read this guy click continue so there is a significant disclosure that hey your refund is going to come very much delayed so just anticipate the fact that things are going to be slow now you're going to go through and read these guys, and they can be a little tricky, but I'm going to select yes the debt is only owed by my spouse for one of these items okay, and I'm also going to select that I did make and report payments such as federal income tax withholding or estimated tax payments okay so check those two guys if you look at the w-2s the spouse and the primary roughly have about the same amount in wages and the spouse roughly has fifty grand and were going to say that the two children on the return or being claimed by her including herself or his himself so were going to give the number of exemptions three you would then go ahead and add or move any of these dollar amounts over to the spouses side those that you want you can see that the federal tax withheld is going to be pulled from the return nothing for you to do there again just another little note down here at the bottom 11 to 14 weeks delay on receiving your refund whenever this form is attached to the return we are then going to click continue it is then reiterating hey you know this is going to take forever that you're putting this on their okay, so we want you to be very clear and your taxpayer to be very clear that there's nothing we can do about this once you tag the form on the return the IRS is going to take their sweet time reviewing it, so you've got 7 to 21 days, and you can tag another 14 weeks you know for three and a half months on top of that great cool not my problem, but this is how you feel fill out the form click continue it's important for you to know obviously that you're not going to get your prep fees, so this may be one of those returns where you want to collect cash check or credit card because you're going to be waiting 112 years together okay, so that's where that is you can see that the injured person is the spouse and not the primary filer...

People Also Ask about

How do I fill out an injured spouse?

How do I allocate income on injured spouse form?

What qualifies for injured spouse?

How does the injured spouse form work?

Can I fill out form 8379 online?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8379 Instructions for eSignature?

How can I fill out IRS 8379 Instructions on an iOS device?

Can I edit IRS 8379 Instructions on an Android device?

What is IRS 8379 Instructions?

Who is required to file IRS 8379 Instructions?

How to fill out IRS 8379 Instructions?

What is the purpose of IRS 8379 Instructions?

What information must be reported on IRS 8379 Instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.