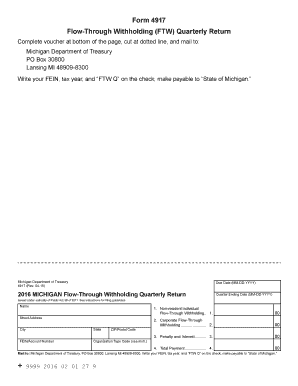

MI DoT 4917 2012 free printable template

Show details

Michigan Department of Treasury 4917 Rev. 11-11 Due Date MM-DD-YYYY 2012 MICHIGAN Flow-Through Withholding Quarterly Return Quarter Ending Date MM-DD-YYYY Issued under authority of Public Act 38 of 2011. See instructions for filing guidelines. Name 1. Non-resident Individual Flow-Through Withholding. 1. Street Address 2. Corporate Flow-Through Withholding. 2. 3. Penalty and Interest. 3. 4. Total Payment. 4. City State ZIP/Postal Code FEIN/Account Number Organization Type Code see instr* Mail...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 4917

Edit your MI DoT 4917 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 4917 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI DoT 4917 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI DoT 4917. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 4917 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 4917

How to fill out MI DoT 4917

01

Obtain the MI DoT 4917 form from the Michigan Department of Transportation website or your local office.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide the vehicle information, including make, model, year, and vehicle identification number (VIN).

04

Indicate the purpose for completing the form, such as registering a vehicle or applying for a title.

05

If applicable, include any previous title information and the details of the last registered owner.

06

Sign and date the form at the designated area to certify that the information is accurate.

07

Submit the completed form along with any required documents or payments to your local Michigan Department of Transportation office.

Who needs MI DoT 4917?

01

Anyone who is registering a vehicle or applying for a title in the state of Michigan.

02

Individuals who are transferring ownership of a vehicle.

03

Motorists who need to provide information for licensing and registration purposes.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Michigan business return?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Who must file Michigan form 4567?

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan.

What is the purpose of form 461?

Purpose of Form See Pub. 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts, for more information on NOL carryovers. Use Form 461 to figure the excess business loss. See Who Must File and the instructions for Line 16, later, to find where to report the excess business loss on your return.

Who needs to file form 461?

File Form 461 if you're a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $270,000 ($540,000 for married taxpayers filing a joint return).

How far back can I amend Michigan tax return?

If you are claiming a refund on your amended return, you must file it within four years of the due date of the original return (including approved extensions).

What is a Michigan form 461?

Taxpayers who have a federal excess business loss limitation must file Form MI-461 to determine the Michigan portion of federal business income or loss included in AGI.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MI DoT 4917 online?

Completing and signing MI DoT 4917 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in MI DoT 4917 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your MI DoT 4917, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the MI DoT 4917 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your MI DoT 4917 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is MI DoT 4917?

MI DoT 4917 is a form used by the Michigan Department of Transportation for reporting specific transportation-related information.

Who is required to file MI DoT 4917?

Entities that engage in regulated transportation activities in Michigan are required to file MI DoT 4917.

How to fill out MI DoT 4917?

To fill out MI DoT 4917, individuals should provide accurate and complete information as per the guidelines provided by the Michigan Department of Transportation.

What is the purpose of MI DoT 4917?

The purpose of MI DoT 4917 is to collect data for monitoring and regulation of transportation activities within Michigan.

What information must be reported on MI DoT 4917?

MI DoT 4917 requires reporting details such as the type of transportation activity, vehicle information, operator details, and other relevant statistics.

Fill out your MI DoT 4917 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 4917 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.