MI DoT 4917 2013 free printable template

Show details

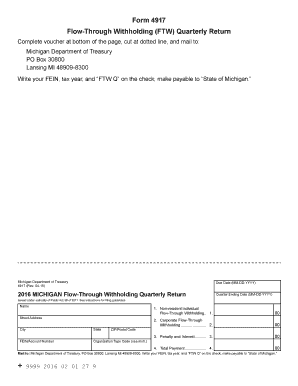

Form 4917 Flow-Through Withholding FTW Quarterly Return Complete voucher at bottom of the page cut at dotted line and mail to Michigan Department of Treasury PO Box 30800 Lansing MI 48909-8300 Write your FEIN tax year and FTW Q on the check make payable to State of Michigan. Reset Form 4917 Rev. 08-12 Due Date MM-DD-YYYY 2013 MICHIGAN Flow-Through Withholding Quarterly Return Quarter Ending Date MM-DD-YYYY Issued under authority of Public Act 38 of 2011. See instructions for filing...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 2013 michigan form return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 michigan form return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 michigan form return online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2013 michigan form return. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

MI DoT 4917 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2013 michigan form return

How to fill out 2013 Michigan form return:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income statements.

02

Start filling out your personal information, including your name, address, and social security number.

03

Follow the instructions provided on the form to report your income. This may include entering the amounts from your W-2 forms and other income sources.

04

Deduct any eligible expenses or deductions from your income, such as student loan interest or medical expenses.

05

Calculate your tax liability based on the information provided on the form and any applicable tax credits or deductions.

06

Pay any tax owed or request a refund if your calculations show that you are owed money.

07

Double-check all the information entered on the form for accuracy and sign and date it before mailing it to the appropriate address.

Who needs 2013 Michigan form return:

01

Individuals who were residents of Michigan in 2013 and had income that is subject to Michigan income tax.

02

Anyone who earned income in Michigan during the tax year, even if they are not a resident of the state.

03

Self-employed individuals, freelancers, and independent contractors who earned income in Michigan during the tax year.

04

Non-residents who had income from Michigan sources, such as rental income or income from a business operated in the state.

05

Individuals who want to claim any eligible tax credits or deductions specific to Michigan on their federal income tax return.

Instructions and Help about 2013 michigan form return

Fill form : Try Risk Free

People Also Ask about 2013 michigan form return

Do I need to file a Michigan business return?

Who must file Michigan form 4567?

What is the purpose of form 461?

Who needs to file form 461?

How far back can I amend Michigan tax return?

What is a Michigan form 461?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is michigan form return?

Michigan form return is a tax form that individuals and businesses in Michigan must fill out and submit to report their income and calculate any taxes owed to the state.

Who is required to file michigan form return?

Any individual or business that has earned income in Michigan and meets the state's filing requirements is required to file michigan form return.

How to fill out michigan form return?

To fill out michigan form return, you will need to gather all relevant financial information, such as income and deductions. Then, follow the instructions provided on the form to complete each section accurately.

What is the purpose of michigan form return?

The purpose of michigan form return is to allow individuals and businesses to report their income, claim any deductions or credits, and calculate their tax liability for the state of Michigan.

What information must be reported on michigan form return?

On michigan form return, you must report your total income, including wages, self-employment income, and investment income. You must also report any deductions or credits that you are eligible for.

When is the deadline to file michigan form return in 2023?

The deadline to file michigan form return in 2023 is April 17th.

What is the penalty for the late filing of michigan form return?

The penalty for the late filing of michigan form return is a 5% penalty on the unpaid tax for each month or part of a month that the return is late, up to a maximum penalty of 25%.

How can I get 2013 michigan form return?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 2013 michigan form return and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the 2013 michigan form return in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 2013 michigan form return right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit 2013 michigan form return straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing 2013 michigan form return.

Fill out your 2013 michigan form return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.