MI DoT 4917 2015 free printable template

Show details

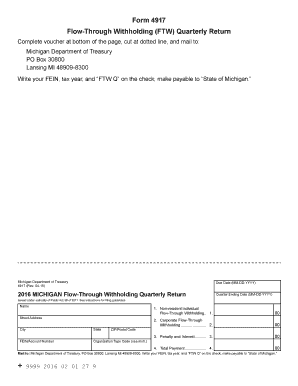

Non-resident Individual 2. Corporate Flow-Through Withholding. 2. 3. Penalty and Interest. 3. 4. Total Payment. 4. Mail to Michigan Department of Treasury PO Box 30800 Lansing MI 48909-8300. Write your FEIN tax year and FTW Q on the check make payable to State of Michigan. 9999 2015 02 01 27 1. Form 4917 Flow-Through Withholding FTW Quarterly Return Complete voucher at bottom of the page cut at dotted line and mail to Michigan Department of Treasury PO Box 30800 Lansing MI 48909-8300 Write...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 4917

Edit your MI DoT 4917 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 4917 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI DoT 4917 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI DoT 4917. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 4917 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 4917

How to fill out MI DoT 4917

01

Obtain a copy of the MI DoT 4917 form from the Michigan Department of Transportation website or local office.

02

Fill out your personal information in the designated fields, including your full name, address, and contact number.

03

Provide your driver's license number and any relevant vehicle information, such as make, model, and year.

04

Indicate the purpose of your application or any specific requests as per the guidelines provided on the form.

05

Review all entered information for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the completed form according to the instructions, either electronically or by mail, along with any required fees.

Who needs MI DoT 4917?

01

Individuals applying for a driver’s license, vehicle registration, or specific transportation services within Michigan.

02

Residents or visitors needing to report a vehicle-related issue or request information pertaining to transportation services.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Michigan business return?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Who must file Michigan form 4567?

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan.

What is the purpose of form 461?

Purpose of Form See Pub. 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts, for more information on NOL carryovers. Use Form 461 to figure the excess business loss. See Who Must File and the instructions for Line 16, later, to find where to report the excess business loss on your return.

Who needs to file form 461?

File Form 461 if you're a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $270,000 ($540,000 for married taxpayers filing a joint return).

How far back can I amend Michigan tax return?

If you are claiming a refund on your amended return, you must file it within four years of the due date of the original return (including approved extensions).

What is a Michigan form 461?

Taxpayers who have a federal excess business loss limitation must file Form MI-461 to determine the Michigan portion of federal business income or loss included in AGI.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MI DoT 4917 online?

pdfFiller has made it simple to fill out and eSign MI DoT 4917. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my MI DoT 4917 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your MI DoT 4917 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit MI DoT 4917 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing MI DoT 4917, you need to install and log in to the app.

What is MI DoT 4917?

MI DoT 4917 is a form used by the Michigan Department of Transportation to report specific data related to transportation and infrastructure projects.

Who is required to file MI DoT 4917?

Individuals and entities involved in transportation infrastructure projects in Michigan, such as contractors and engineers, are required to file MI DoT 4917.

How to fill out MI DoT 4917?

To fill out MI DoT 4917, gather the necessary project information, follow the provided instructions on the form, and ensure all required sections are completed accurately.

What is the purpose of MI DoT 4917?

The purpose of MI DoT 4917 is to collect and compile data regarding transportation projects to ensure compliance with regulations and assess project impacts.

What information must be reported on MI DoT 4917?

MI DoT 4917 requires reporting information such as project details, contractor information, work performed, dates of service, and financial data related to the project.

Fill out your MI DoT 4917 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 4917 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.