MI DoT 4917 2016-2025 free printable template

Show details

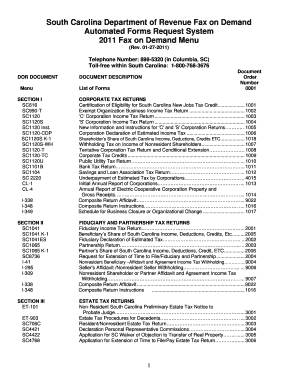

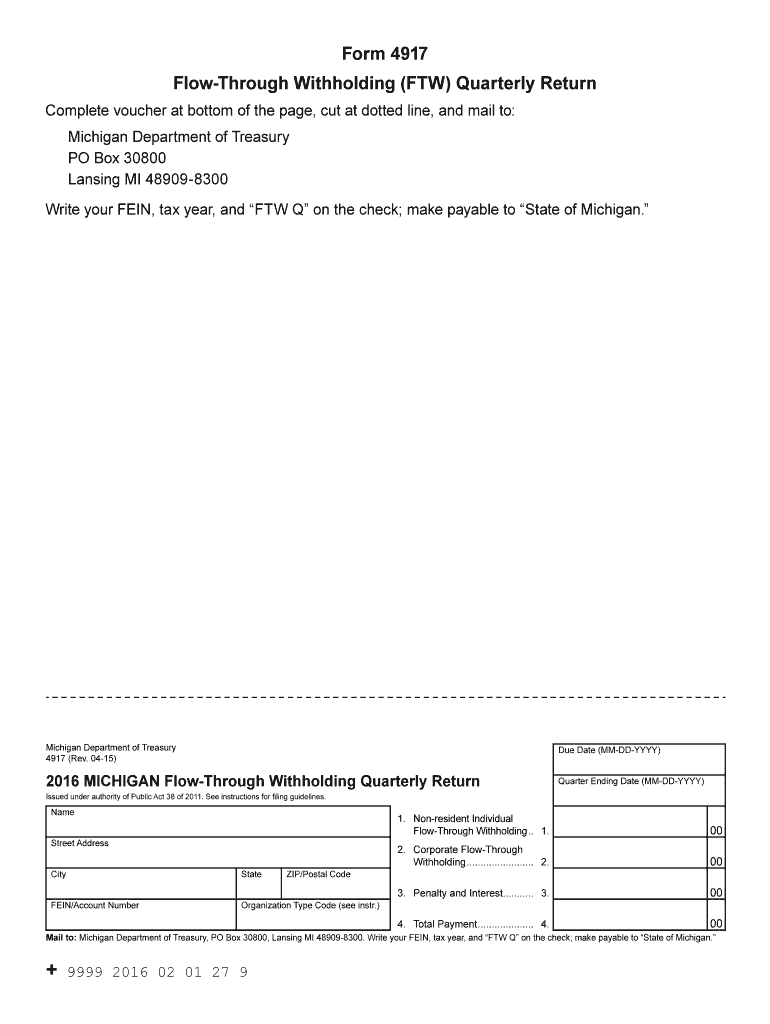

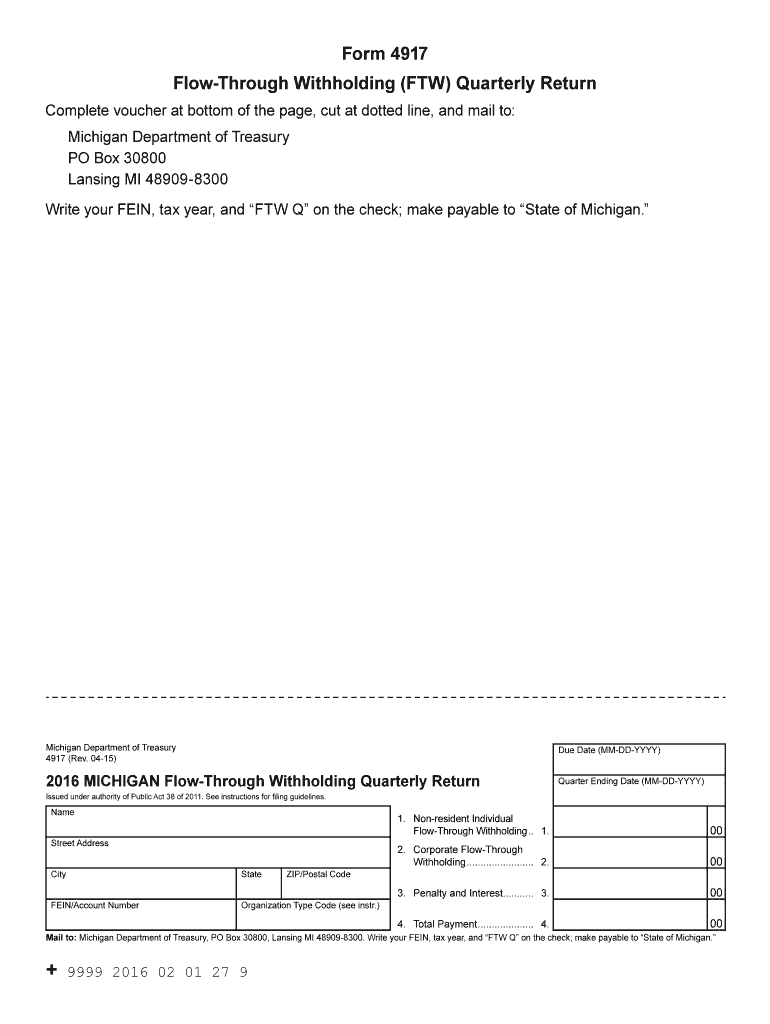

Non-resident Individual 2. Corporate Flow-Through Withholding. 2. 3. Penalty and Interest. 3. 4. Total Payment. 4. Mail to Michigan Department of Treasury PO Box 30800 Lansing MI 48909-8300. Write your FEIN tax year and FTW Q on the check make payable to State of Michigan. 9999 2016 02 01 27 9. Form 4917 Flow-Through Withholding FTW Quarterly Return Complete voucher at bottom of the page cut at dotted line and mail to Michigan Department of Treasury PO Box 30800 Lansing MI 48909-8300 Write...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mi form return

Edit your MI DoT 4917 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 4917 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI DoT 4917 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI DoT 4917. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 4917 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 4917

How to fill out MI DoT 4917

01

Begin by obtaining the MI DoT 4917 form from the Michigan Department of Transportation website or your local office.

02

Fill out the top section with your personal information including your name, address, and contact details.

03

Provide the vehicle details such as make, model, year, and Vehicle Identification Number (VIN) in the designated section.

04

Indicate the purpose of the application, whether it's for a title, registration, or other reason.

05

Complete any additional sections relevant to your specific request, such as lien information or special circumstances.

06

Review the form for accuracy, ensuring all required fields are completed.

07

Sign and date the form at the bottom as required.

08

Submit the completed form to the appropriate MI DoT office either in person or by mail along with any required fees.

Who needs MI DoT 4917?

01

Individuals applying for a vehicle title in Michigan.

02

People seeking to register a vehicle to legally operate it on Michigan roads.

03

Anyone changing ownership of a vehicle in Michigan.

04

Individuals needing to obtain a duplicate title or registration for their vehicle.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Michigan business return?

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Who must file Michigan form 4567?

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan.

What is the purpose of form 461?

Purpose of Form See Pub. 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts, for more information on NOL carryovers. Use Form 461 to figure the excess business loss. See Who Must File and the instructions for Line 16, later, to find where to report the excess business loss on your return.

Who needs to file form 461?

File Form 461 if you're a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $270,000 ($540,000 for married taxpayers filing a joint return).

How far back can I amend Michigan tax return?

If you are claiming a refund on your amended return, you must file it within four years of the due date of the original return (including approved extensions).

What is a Michigan form 461?

Taxpayers who have a federal excess business loss limitation must file Form MI-461 to determine the Michigan portion of federal business income or loss included in AGI.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in MI DoT 4917 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit MI DoT 4917 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the MI DoT 4917 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your MI DoT 4917 in seconds.

How do I complete MI DoT 4917 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your MI DoT 4917, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is MI DoT 4917?

MI DoT 4917 is a specific form used in the state of Michigan for reporting certain financial transactions and obligations related to the Department of Transportation.

Who is required to file MI DoT 4917?

Individuals or businesses that engage in activities requiring the reporting of financial transactions to the Michigan Department of Transportation are required to file MI DoT 4917.

How to fill out MI DoT 4917?

To fill out MI DoT 4917, you should provide accurate information regarding your financial transactions, following the instructions provided with the form. This includes detailing amounts, dates, and the nature of the transactions.

What is the purpose of MI DoT 4917?

The purpose of MI DoT 4917 is to ensure transparency and accountability in financial dealings related to transportation projects within Michigan, allowing for proper oversight by the Department of Transportation.

What information must be reported on MI DoT 4917?

Information that must be reported on MI DoT 4917 includes the type of transaction, amounts involved, dates, and any relevant identification numbers associated with the transactions.

Fill out your MI DoT 4917 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 4917 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.