FL DoR RTS-3 2013 free printable template

Show details

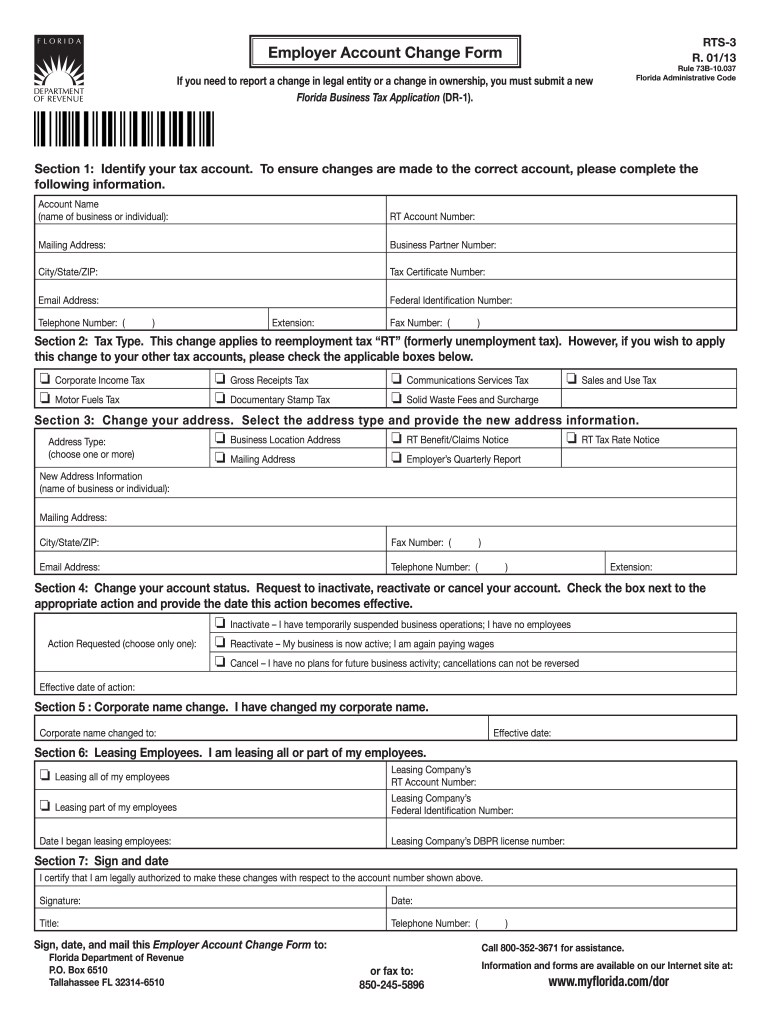

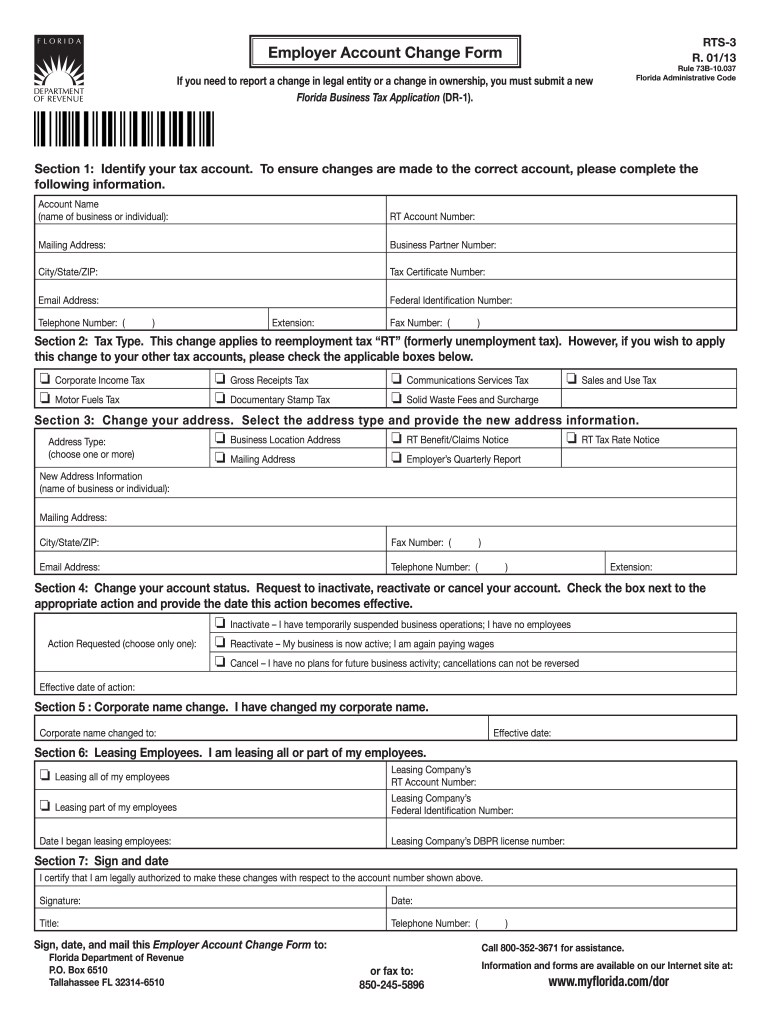

RTS-3 R. 01/13 Employer Account Change Form Rule 73B-10. 037 Florida Administrative Code If you need to report a change in legal entity or a change in ownership you must submit a new Florida Business Tax Application DR-1. Section 1 Identify your tax account. To ensure changes are made to the correct account please complete the following information* Account Name name of business or individual RT Account Number Mailing Address Business Partner Number City/State/ZIP Tax Certificate Number Email...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR RTS-3

Edit your FL DoR RTS-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR RTS-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DoR RTS-3 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL DoR RTS-3. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR RTS-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR RTS-3

How to fill out FL DoR RTS-3

01

Download the FL DoR RTS-3 form from the official Florida Department of Revenue website.

02

Enter your name and address in the designated sections at the top of the form.

03

Provide your Social Security Number or Federal Employer Identification Number (EIN) if applicable.

04

Specify the type of tax and the relevant period for which you are reporting.

05

Fill in the income and deduction details in the appropriate columns.

06

Calculate your total tax due or refund amount based on the provided information.

07

Review the form for accuracy and completeness.

08

Sign and date the form at the bottom before submission.

09

Submit the completed form either electronically or by mailing it to the appropriate address.

Who needs FL DoR RTS-3?

01

Individuals and businesses who are required to report and pay taxes to the Florida Department of Revenue.

02

Taxpayers who have had taxable transactions in Florida during the reporting period.

03

Anyone who needs to claim a refund or has a tax obligation for the specified period.

Instructions and Help about FL DoR RTS-3

Fill

form

: Try Risk Free

People Also Ask about

What disqualifies you from being a real estate agent in Florida?

A moral turpitude felony, or a crime against a minor or elder, or a sexual crime is likely a deal-breaker. These crimes are capital, or first-degree, offenses that often lead to outright rejections.

What is required to renew Florida real estate license?

Prior to your initial expiration date, listed on your license, you will be required to complete post-license education. (45 hours Post-Education for Sales Associates and 60 hours Post-Education for Brokers). Thereafter you will be required to complete 14 hours of continuing education biannually.

Is Florida real estate exam open book?

What Is on the Florida Real Estate Exam? This exam is a closed book test, and reference materials are not allowed in the room during the exam. There are 100 multiple choice questions on the exam.

How hard is the Florida real estate exam?

You need to answer 75% or more of the questions correctly to pass the exam. Florida's exam questions are notoriously tough. Most people who struggled to pass the test the first time reported that they hadn't studied hard enough or taken enough practice tests to be ready.

What is DBPR RE 13 broker transaction form?

This transaction is used when a broker wishes to qualify more than one sole proprietorship or real estate company.

What is the passing rate for the Florida real estate exam?

Florida Real Estate Exam Pass Rate But how likely are you to get a real estate license if you take the exam? Aceable's real estate salesperson exam pass rate in Florida is 95%. That's well over the state average exam pass rate which sits at just 55%.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get FL DoR RTS-3?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the FL DoR RTS-3 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I edit FL DoR RTS-3 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share FL DoR RTS-3 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete FL DoR RTS-3 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your FL DoR RTS-3 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is FL DoR RTS-3?

FL DoR RTS-3 is a tax form used by the Florida Department of Revenue to report certain financial information regarding sales tax.

Who is required to file FL DoR RTS-3?

Businesses and individuals who collect sales tax in Florida are required to file the FL DoR RTS-3 form.

How to fill out FL DoR RTS-3?

To fill out the FL DoR RTS-3, one must provide relevant sales information, tax collected, and any adjustments, following the instructions provided by the Florida Department of Revenue.

What is the purpose of FL DoR RTS-3?

The purpose of FL DoR RTS-3 is to ensure compliance with Florida sales tax regulations by reporting collected taxes and sales data.

What information must be reported on FL DoR RTS-3?

The FL DoR RTS-3 must report total sales, taxable sales, amount of sales tax collected, exemptions, and any adjustments to sales.

Fill out your FL DoR RTS-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR RTS-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.