FL DoR RTS-3 2017 free printable template

Show details

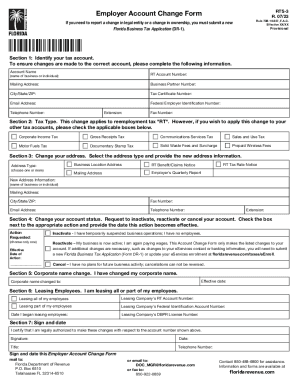

Employer Account Change Form RTS-3 R. 10/17 TC If you need to report a change in legal entity or a change in ownership you must submit a new Florida Business Tax Application DR-1. Signature Date Title Sign date and mail this Employer Account Change Form to Florida Department of Revenue P. O. Box 6510 Tallahassee FL 32314-6510 Call 850-488-6800 for assistance. or fax to 850-245-5896 Information and forms are available on our website at floridarevenue. Rule 73B-10. 037 Florida Administrative...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rts 3

Edit your rts 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rts 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rts 3 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rts 3. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR RTS-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rts 3

How to fill out FL DoR RTS-3

01

Download the FL DoR RTS-3 form from the Florida Department of Revenue website.

02

Read the instructions carefully to understand the required information.

03

Fill in the identifying information, including your name, address, and taxpayer identification number.

04

Provide details about the tax type and the periods for which you are requesting the tax refund or adjustment.

05

Complete the reason for filing the RTS-3 form, clearly explaining the circumstances of your request.

06

Ensure all calculations are accurate and that required supporting documentation is attached.

07

Review the entire form for completeness and accuracy before submission.

08

Submit the form to the designated office according to the instructions provided.

Who needs FL DoR RTS-3?

01

Anyone who has overpaid taxes or is seeking a refund from the Florida Department of Revenue.

02

Individuals or businesses that have experienced an error in tax reporting and need to correct it.

03

Taxpayers who believe they are eligible for specific credits or refunds.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a Florida state tax number?

How to obtain a Florida sales tax license. To apply for a Florida sales tax license, you may use the online form or download Form DR-1 and submit it to the Department of Revenue or a taxpayer service center. There is no fee to register for a Florida sales tax license.

What is an RTS 3?

Employer Account Change Form (RTS-3) – Department of Revenue Government Form in Florida – Formalu. Locations.

How do I get a Florida reemployment tax number?

The easiest way to get a Reemployment Tax Account Number is to register for an online account with the Florida Department of Revenue (DOR). Once you successfully enroll, you'll receive your seven-digit Reemployment Tax Account Number.

What is a Florida reemployment tax?

Reemployment tax is paid by employers and the tax collected is deposited into the Unemployment Compensation Trust Fund for the sole purpose of paying reemployment assistance benefits to eligible claimants.

What is an RTS form?

RTS- Recruitment Tracking and Scheduling Form.

How do I close my RT account in Florida?

Please follow the steps outlined below to close your FL Unemployment account: Complete an RTS-3 form, and send it to the state per the instructions on the bottom of the form. A completed copy also needs to be provided to Justworks for record-keeping.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the rts 3 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your rts 3 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit rts 3 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share rts 3 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete rts 3 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your rts 3. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is FL DoR RTS-3?

FL DoR RTS-3 is a form used to report certain financial information to the Florida Department of Revenue.

Who is required to file FL DoR RTS-3?

Individuals or entities who have specific tax obligations or transactions that need to be reported to the Florida Department of Revenue are required to file FL DoR RTS-3.

How to fill out FL DoR RTS-3?

To fill out FL DoR RTS-3, you need to provide the required information in each section of the form, ensuring accuracy and completeness before submission.

What is the purpose of FL DoR RTS-3?

The purpose of FL DoR RTS-3 is to provide the Florida Department of Revenue with necessary financial information for tax compliance and reporting purposes.

What information must be reported on FL DoR RTS-3?

The information that must be reported on FL DoR RTS-3 includes details about income, deductions, and any applicable tax liabilities.

Fill out your rts 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rts 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.