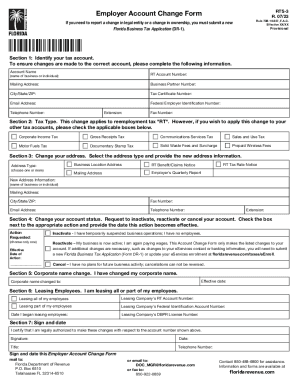

FL DoR RTS-3 2021 free printable template

Show details

RTS3

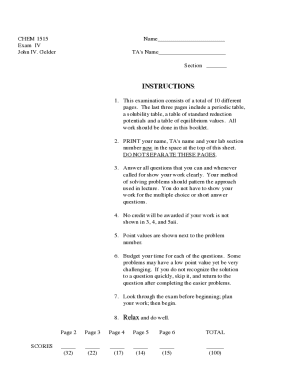

R. 06/21Employer Account Change Formula 73B10.037, F.A.C.

Effective 07/21If you need to report a change in legal entity or a change in ownership, you must submit a new

Florida Business Tax Application

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR RTS-3

Edit your FL DoR RTS-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR RTS-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DoR RTS-3 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit FL DoR RTS-3. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR RTS-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR RTS-3

How to fill out FL DoR RTS-3

01

Obtain the FL DoR RTS-3 form from the Florida Department of Revenue website or local office.

02

Fill in the taxpayer information, including name, address, and federal identification number.

03

Provide details about the type of tax and the reporting period.

04

Complete the specific sections related to the tax being reported.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form.

07

Submit the form online or via mail as instructed.

Who needs FL DoR RTS-3?

01

Individuals or businesses who are required to report and pay certain taxes in Florida.

02

Taxpayers who need to rectify previous tax filings or provide additional information to the Department of Revenue.

03

Anyone participating in state educational or other tax credit programs that require formal reporting.

Instructions and Help about FL DoR RTS-3

Applause Music Music Music Applause Music Music Music Applause Applause Applause Music darkness deeper the hole baby general I need to say Thunder improve Music Music Music come on Cobra real name science la pis' cine I can't be the name that be impressed

Fill

form

: Try Risk Free

People Also Ask about

When you sell on Fidelity Where does the money go?

Fidelity will credit the proceeds of a sale to your core account on the settlement date. Proceeds will automatically be used to pay down any margin debt if you have any, and the balance will remain in your core account. You may also have a check for the proceeds mailed to you.

How often do Fidelity funds pay dividends?

Fidelity offers a wide range of mutual fund products that can help you generate income. Find funds in Fidelity Fund Picks® that pay monthly or quarterly dividends.

How are dividends paid through Fidelity?

A dividend is a payment made by a company to share its profits with its shareholders. If your company stock pays a dividend, it goes into your Fidelity Account® as cash by default. But you could use that money to purchase more shares of company stock or other investments to help keep it invested and working for you.

How often does Fidelity pay dividends?

Fidelity offers a wide range of mutual fund products that can help you generate income. Find funds in Fidelity Fund Picks® that pay monthly or quarterly dividends.

How does Fidelity pay out dividends?

A dividend is a payment made by a company to share its profits with its shareholders. If your company stock pays a dividend, it goes into your Fidelity Account® as cash by default.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in FL DoR RTS-3 without leaving Chrome?

FL DoR RTS-3 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out FL DoR RTS-3 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your FL DoR RTS-3, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit FL DoR RTS-3 on an Android device?

You can make any changes to PDF files, like FL DoR RTS-3, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is FL DoR RTS-3?

FL DoR RTS-3 is a tax form used in Florida for reporting certain types of transactions and activities related to business and economic development.

Who is required to file FL DoR RTS-3?

Businesses and individuals engaged in specific activities that fall under the jurisdiction of the Florida Department of Revenue are required to file FL DoR RTS-3.

How to fill out FL DoR RTS-3?

To fill out FL DoR RTS-3, individuals must provide relevant business information, detailed descriptions of transactions, and any required financial data as dictated by the guidelines provided with the form.

What is the purpose of FL DoR RTS-3?

The purpose of FL DoR RTS-3 is to collect information necessary for the Florida Department of Revenue to assess compliance with state tax laws and to monitor business activities.

What information must be reported on FL DoR RTS-3?

FL DoR RTS-3 requires reporting of business identification details, transaction descriptions, amounts, dates, and other financial information relevant to the activities being reported.

Fill out your FL DoR RTS-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR RTS-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.