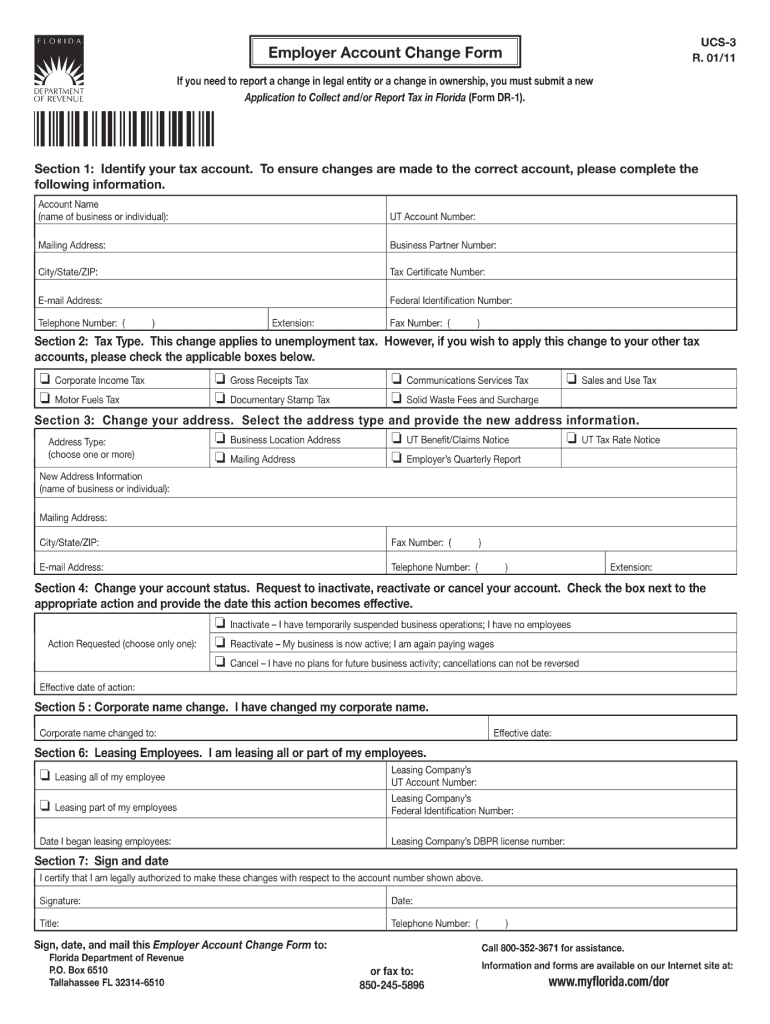

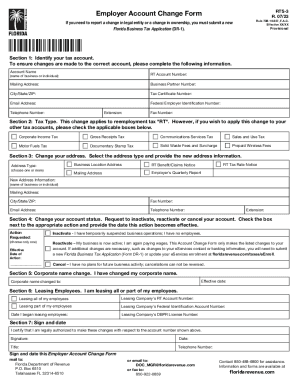

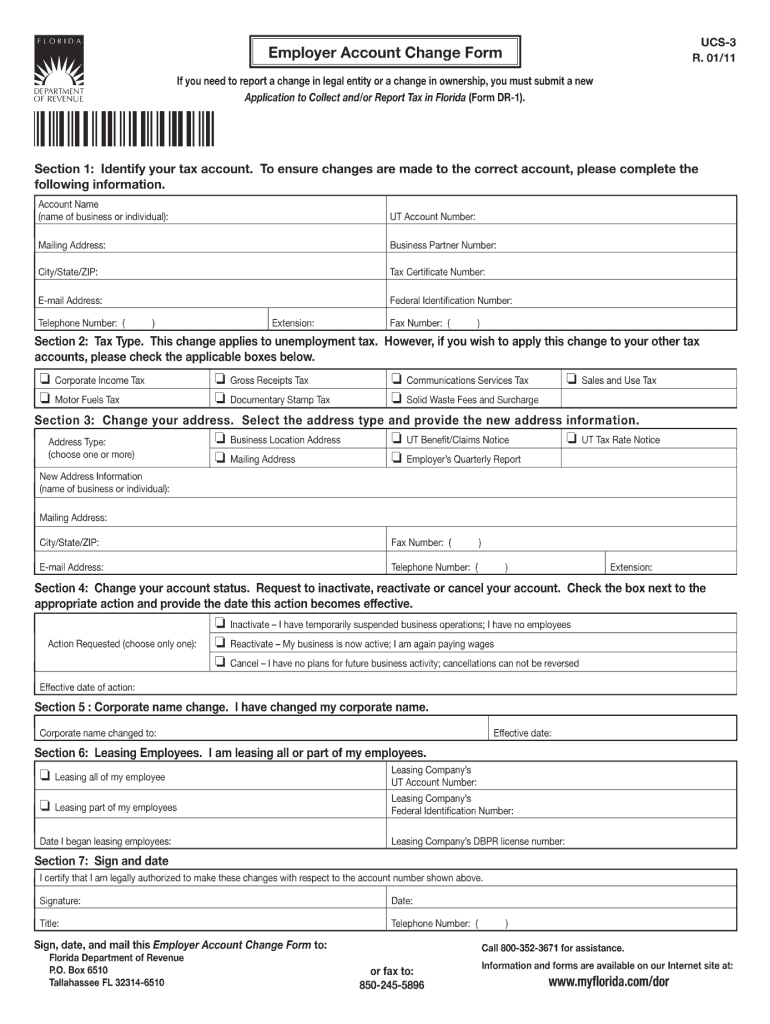

FL DoR RTS-3 2011 free printable template

Get, Create, Make and Sign FL DoR RTS-3

Editing FL DoR RTS-3 online

Uncompromising security for your PDF editing and eSignature needs

FL DoR RTS-3 Form Versions

How to fill out FL DoR RTS-3

How to fill out FL DoR RTS-3

Who needs FL DoR RTS-3?

Instructions and Help about FL DoR RTS-3

Hi this is an AutoCAD tutorial looking specifically at controlling the UCS and move orient taking yourself around a simple shape, so I'm going to start off and keep the grid on in this view and having a look at the object snaps don't need many here and point primarily, and we'll use a midpoint later on but just end point will do for this okay, so I'll start off with a rectangle, so that's our EC and return, and we'll just kick off anywhere so pick a base point for the rectangle and then in relation to that point we'll go at 4,000, 6000 okay sounds with a fairly big chunk here we'll do now is flip around using the orbit command so just to recap here though I'm in the 3d modeling workspace so change your workspace selector to 3d modeling okay orbit let's turn around you can use shift in your middle mouse button to do the same always used to crash or to cut 2011 and 12, but it seems a bit more stable in 2013 okay, and then we'll extrude that shapes or ext return grab the edge of the rectangle return and let's stretch it out lets extruder upwards by 3000 okay now we're going to try and model a pretty basic kind of cockpit shape you know like a bit that closes over a cockpit a kind of spaceship type looking thing so just a mock about kind of shape so what I'll do is settled the shape but by drawing on the side of this block now because I started off with a rectangle orientated like this I could use the standard UCS is that come with the software okay so when we're in the standards' orientation we're in the world coordinate system, so it says world here and there's a little square at the center of the three axes that's the only time you'll see the square is when you're in the WCS in the world coordinate system, so I want to look at this side that this side of the cube okay so what I can do is change to the right UCS okay I'm keeping the grid on just so you can see it flipped around to suit, and we'll draw a triangle on the side of this shape so remember if we're going to extrude than it has to be a closed shape, so I'll draw the triangle using a poly line, so the command is pl-110 first corner second corner third corner and then close so see and return okay just hover over your shape make sure it's closed, and then we'll X true that ext return click this triangle and return and the extrusion always operates in the kind of the z direction of the shape that you're dealing with yeah it's the Zed direction when the object was drawn that's important okay we're going to keep the original cube just for now because it helps us with a bit of setting out later on okay, so that's the kind of the rough shape now what we'll do is we'll kind of slice off the top here we're kind of level off the top so to do that I want to create shape in this side which is the front coordinate system and then extrude it, so it can then chop through the top of the object, so we'll change now from the right UCS to the front UCS and always make sure that this does react otherwise...

People Also Ask about

When you sell on Fidelity Where does the money go?

How often do Fidelity funds pay dividends?

How are dividends paid through Fidelity?

How often does Fidelity pay dividends?

How does Fidelity pay out dividends?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the FL DoR RTS-3 in Gmail?

How can I edit FL DoR RTS-3 on a smartphone?

How can I fill out FL DoR RTS-3 on an iOS device?

What is FL DoR RTS-3?

Who is required to file FL DoR RTS-3?

How to fill out FL DoR RTS-3?

What is the purpose of FL DoR RTS-3?

What information must be reported on FL DoR RTS-3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.