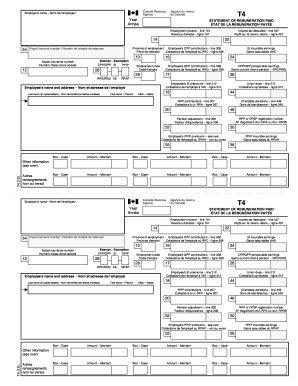

Canada T4 Summary 2013 modèle imprimable gratuit

Obtenez, créez, fabriquez et signez Canada T4 Summary

Comment éditer Canada T4 Summary en ligne

Sécurité sans compromis pour vos besoins en édition de PDF et de signature électronique

Canada T4 Summary Versions de formulaire

Comment remplir Canada T4 Summary

Comment remplir Canada T4 Summary

Qui a besoin de Canada T4 Summary?

Instructions et aide à propos de Canada T4 Summary

[Music] how to prepare a t4 slip hi my name is Alan Madden for Madden Chartered Accountant today I will explain step by step how to prepare a t4 slip if you are an employer or own your own corporation then this video is meant for you what is a t4 slip a t4 slip report salary and wages paid by a Canadian corporation to its employees in order to prepare a t4 slip you must follow these twelve easy steps step 1 fill in the corporations that is the employers' information enter the employers name in the top left box and enter the employers' payroll account number in box 54 step 2 fill in the employees' information write the employees name and address put the employees social insurance number in box 12 step 3 enter the province of employment if the employee is working in Ontario then the province of employment is Ontario step 4 [Music] write the year in which the salary was received for example 2016 step 5 determine if the employee is exempt from paying WEI known as employment insurance premiums generally speaking shareholders and family members of shareholders that owned more than 40% of the company's voting stock are AI exempt everyone else has to contribute to the WEI program in this example let's assume that the employee must contribute to the WEI program so box 28 is not checked step 6 determine if the employee is exempt from contributing to the Canada Pension Plan most Canadians must contribute to the Canada Pension Plan and so this example box 28 is not checked step 7 enter the amount of gross salary or wages paid to the employee in the 2016 calendar year in box 14 in this example let's assume the employee earned $35,000 in the 2016 calendar year step 8 enter the amount of CPP contribution deducted from the employees paychecks during the 2016 calendar year according to the CPP chart the CPP contribution rate is four point nine five percent of the employees' salary in excess of $3,500 in our sample the employee earned $35,000 in the 2016-year so their CPP contributions for the 2016 year are one thousand five hundred and $59 which is entered in box 16 this is calculated as follows 35 thousand left exemption amounts of 3500 multiplied by four point nine five percent deaf nine enter the total amount of employment insurance premiums deducted from the employees paychecks during the 2016 calendar year in box 18 according to the EHR the e I contribution rate is one point six three percent of the employees' salary in wages in our example the employee earned thirty-five thousand, and so they're AI premiums are five hundred seventy dollars and fifty cents which is one point six three percent times thirty-five thousand depth ten [Music] enter the total amount of income tax deducted from the employees paychecks during the 2016 calendar year in box twenty-two I recommend using the CRA s online payroll calculator to calculate the CPP I in income tax to be deducted from each paycheck issued to an employee in this example assume that a total of four thousand...

Les gens demandent aussi à propos de

Qu'est-ce qu'un T4 en anglais ?

Pour la FAQ de pdfFiller

Vous trouverez ci-dessous une liste des questions les plus courantes des clients. Si vous ne trouvez pas de réponse à votre question, n'hésitez pas à nous contacter.

Comment gérer mon Canada T4 Summary directement depuis Gmail ?

Comment puis-je compléter Canada T4 Summary en ligne ?

Comment puis-je remplir le formulaire Canada T4 Summary sur mon smartphone ?

Qu'est-ce que Canada T4 Summary?

Qui doit déposer Canada T4 Summary?

Comment remplir Canada T4 Summary?

Quel est le but de Canada T4 Summary?

Quelles informations doivent être déclarées sur Canada T4 Summary?

pdfFiller est une solution de bout en bout pour gérer, créer et éditer des documents et des formulaires dans le cloud. Gagnez du temps et évitez les tracas en préparant vos formulaires fiscaux en ligne.