Canada T4 Summary 2020 modèle imprimable gratuit

Afficher les détails

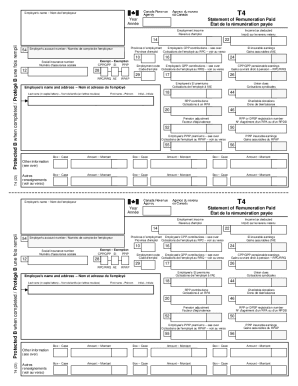

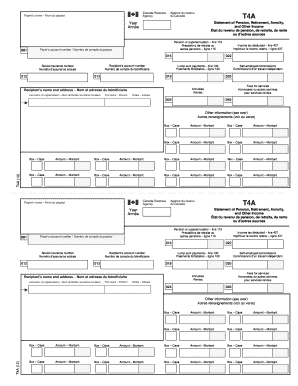

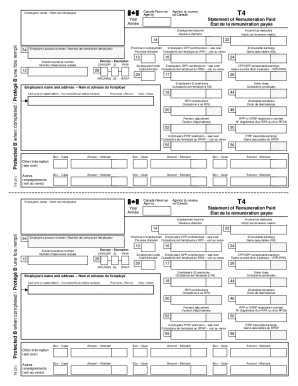

Consultez l avis de confidentialit au bas de la page suivante. T4 SUM 20 Position or office Titre ou poste If you file your T4 information return electronically do not fill out this T4 Summary. To get our forms and publications go to canada.ca/cra-forms or call 1-800-959-5525. Send this T4 Summary and the related T4 slips to Pour obtenir nos formulaires et publications allez canada.ca/arc-formulaires ou composez le 1-800-959-7775. For the year ending December 31 Pour l ann e se terminant le...

pdfFiller n'est affilié à aucune organisation gouvernementale

Obtenez, créez, fabriquez et signez Canada T4 Summary

Modifier votre Canada T4 Summary formulaire en ligne

Tapez du texte, des champs remplissables et insérez des images, des données en surbrillance ou en panne à la discrétion, ajoutez des commentaires, et plus encore.

Ajoutez votre signature légale

Dessinez ou tapez votre signature, téléchargez une image de signature ou saisissez-la avec votre appareil photo numérique.

Partagez votre formulaire instantanément

E-mail, fax, ou partagez votre Canada T4 Summary via l'URL. Vous pouvez également télécharger, imprimer ou exporter des formulaires vers votre service de stockage cloud préféré.

Comment éditer Canada T4 Summary en ligne

Suivez les directives ci-dessous pour profiter de l'éditeur PDF professionnel :

1

Connectez-vous à votre compte. Commencer l'essai gratuit et enregistrez-vous si vous n'avez pas encore de compte.

2

Préparez un fichier. Utilisez le bouton Ajouter nouveau pour démarrer un nouveau projet. Ensuite, à l'aide de votre appareil, téléchargez votre fichier dans le système en l'important depuis le courrier interne, le cloud, ou en ajoutant son URL.

3

Éditez Canada T4 Summary. Le texte peut être ajouté et remplacé, de nouveaux objets peuvent être inclus, les pages peuvent être réarrangées, des filigranes et des numéros de page peuvent être ajoutés, etc. Lorsque vous avez terminé l'édition, cliquez sur Terminé, puis allez à l'onglet Documents pour combiner, diviser, verrouiller ou déverrouiller le fichier.

4

Obtenez votre fichier. Sélectionnez le nom de votre fichier dans la liste des documents et choisissez votre méthode d'exportation préférée. Vous pouvez le télécharger au format PDF, l'enregistrer dans un autre format, l'envoyer par e-mail, ou le transférer dans le cloud.

Avec pdfFiller, il est toujours facile de travailler avec les documents.

Sécurité sans compromis pour vos besoins en édition de PDF et de signature électronique

Vos informations privées sont en sécurité avec pdfFiller. Nous utilisons un chiffrement de bout en bout, un stockage cloud sécurisé et un contrôle d'accès avancé pour protéger vos documents et maintenir la conformité réglementaire.

Canada T4 Summary Versions de formulaire

Version

Popularité du Formulaire

Complable & imprimable

Comment remplir Canada T4 Summary

Comment remplir Canada T4 Summary

01

Rassemblez toutes les informations relatives aux salaires et aux déductions pour l'année fiscale.

02

Remplissez le nom et l'adresse de l'employeur au début du formulaire.

03

Indiquez le numéro de compte de l'employeur attribué par l'Agence du revenu du Canada.

04

Inscrivez le nombre total de feuillets T4 émis pour les employés.

05

Calculez le total des salaires versés et des déductions effectuées pour l'année.

06

Remplissez les montants des retenues d'impôt sur le revenu, des cotisations de l'assurance-emploi et des cotisations au Régime de pensions du Canada.

07

Vérifiez que toutes les informations sont correctes et faites les ajustements nécessaires.

08

Soumettez le formulaire T4 et la déclaration des retenues à l'Agence du revenu du Canada avant la date limite.

Qui a besoin de Canada T4 Summary?

01

Les employeurs canadiens qui ont versé des salaires à des employés doivent remplir et soumettre le Canada T4 Summary.

02

Les entreprises qui ont des employés et doivent déclarer les salaires, les retenues d'impôt et d'autres déductions.

Remplir

form

: Essayez sans risque

Les gens demandent aussi à propos de

How do I save a tax return as a PDF?

Click the Your Federal or Your State Return. This will open the document in a PDF format. Right click the document and click "Save as" or "Save target As" (depending on your browser). If this option is not available, open the PDF and choose to "Save As" directly from the PDF viewer.

How do I save a T4 as a PDF?

Choose on the left side the form you want to print in PDF or XPS. On the top right side click on the printer drop down menu and choose the PDF printer or XPS writer. Click OK. Next time you are printing a receipt, invoice or cheque you will be able to choose a location and save the XPS or PDF file.

How do I download a T4 form?

How Can I Get My T4? If you need a T4 slip for the current tax year, your employer should be able to provide it to you. For previous tax years, you can request a copy from the Canada Revenue Agency (CRA) or by calling 1-800-959-8281. Get Your T4 and Other Tax Forms Online From CRA's “Auto-fill my return”

How do I print my T4 summary?

2:32 9:16 Sage 50 --Canadian Edition - Preparing T4 slips and summary YouTube Start of suggested clip End of suggested clip Select the year for which you are printing the t4s. Select the employees from the list. If print inMoreSelect the year for which you are printing the t4s. Select the employees from the list. If print in the T4 sleeps for all the employees.

What is Canadian form T4?

T4 Statement of Remuneration Paid (slip)

How do I print a T4 as a PDF?

Click on Print/PDF sidebar or press Ctrl+P on your keyboard. At the top of the Print/PDF sidebar, choose the slip type you want to print: Original, Amended or Cancelled. In TaxCycle T4/T4A, make sure you also choose the type of slip to print: T4, T4A, T4PS, T4A-RCA, Québec RL-1 or RL-2 slips.

Les avis de nos utilisateurs parlent d'eux-mêmes

Lisez plus ou essayez pdfFiller pour profiter des avantages par vous-même

Pour la FAQ de pdfFiller

Vous trouverez ci-dessous une liste des questions les plus courantes des clients. Si vous ne trouvez pas de réponse à votre question, n'hésitez pas à nous contacter.

Comment gérer mon Canada T4 Summary directement depuis Gmail ?

Canada T4 Summary et d'autres documents peuvent être modifiés, remplis et signés directement dans votre boîte de réception Gmail. Vous pouvez utiliser le complément pdfFiller pour cela, ainsi que d'autres fonctionnalités. Lorsque vous allez sur Google Workspace, vous pouvez trouver pdfFiller pour Gmail. Utilisez le temps que vous consacrez à la gestion de vos documents et signatures électroniques pour des choses plus importantes, comme aller à la salle de sport ou chez le dentiste.

Comment puis-je compléter Canada T4 Summary en ligne ?

Remplir et signer Canada T4 Summary est maintenant simple. La solution vous permet de modifier et de réorganiser le texte PDF, d'ajouter des champs remplissables et de signer électroniquement le document. Lancez un essai gratuit de pdfFiller, la meilleure solution d'édition de documents.

Comment puis-je éditer Canada T4 Summary dans Chrome ?

Ajoutez l'extension pdfFiller pour Google Chrome à votre navigateur Web pour commencer à éditer Canada T4 Summary et d'autres documents directement depuis une page de recherche Google en un seul clic. Le service vous permet d'apporter des modifications à vos documents lorsque vous les consultez dans Chrome. Créez des documents remplissables et modifiez des PDF existants depuis n'importe quel appareil connecté à Internet avec pdfFiller.

Qu'est-ce que Canada T4 Summary?

Le Canada T4 Summary est un formulaire utilisé par les employeurs pour résumer les revenus, les déductions et les contributions des employés en matière d'impôts sur le revenu au Canada pour une année fiscale donnée.

Qui doit déposer Canada T4 Summary?

Tous les employeurs qui ont versé des salaires, des traitements ou d'autres paiements à leurs employés doivent déposer un Canada T4 Summary.

Comment remplir Canada T4 Summary?

Pour remplir le Canada T4 Summary, les employeurs doivent rassembler les informations des T4 individuels de leurs employés, totaliser les montants des revenus et des déductions, puis indiquer ces montants sur le résumé.

Quel est le but de Canada T4 Summary?

Le but du Canada T4 Summary est de fournir au gouvernement un résumé des paiements et des déductions des employés, facilitant ainsi le calcul des impôts dus par chaque employé.

Quelles informations doivent être déclarées sur Canada T4 Summary?

Les informations à déclarer incluent le total des salaires payés, des montants déduits pour l'impôt sur le revenu, ainsi que les contributions au Régime de pensions du Canada (RPC) et à l'assurance-emploi (AE).

Remplissez votre Canada T4 Summary en ligne avec pdfFiller !

pdfFiller est une solution de bout en bout pour gérer, créer et éditer des documents et des formulaires dans le cloud. Gagnez du temps et évitez les tracas en préparant vos formulaires fiscaux en ligne.

Canada t4 Summary n'est-ce pas le formulaire que vous recherchez ?Recherchez un autre formulaire ici.

Mots-clés pertinents

Formulaires Connexes

Si vous pensez que cette page doit être retirée, veuillez suivre notre processus de décollage DMCA

ici

.

Ce formulaire peut inclure des champs pour les informations de paiement. Les données saisies dans ces champs ne sont pas couvertes par la conformité PCI DSS.