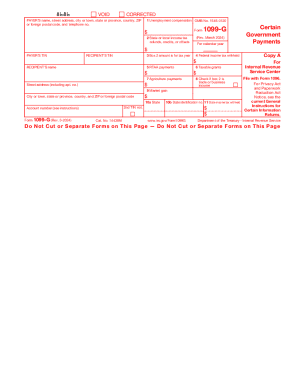

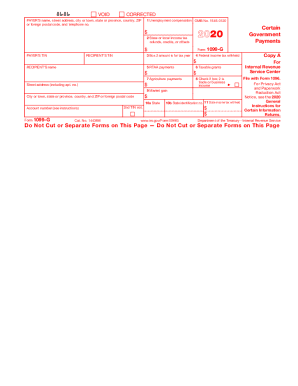

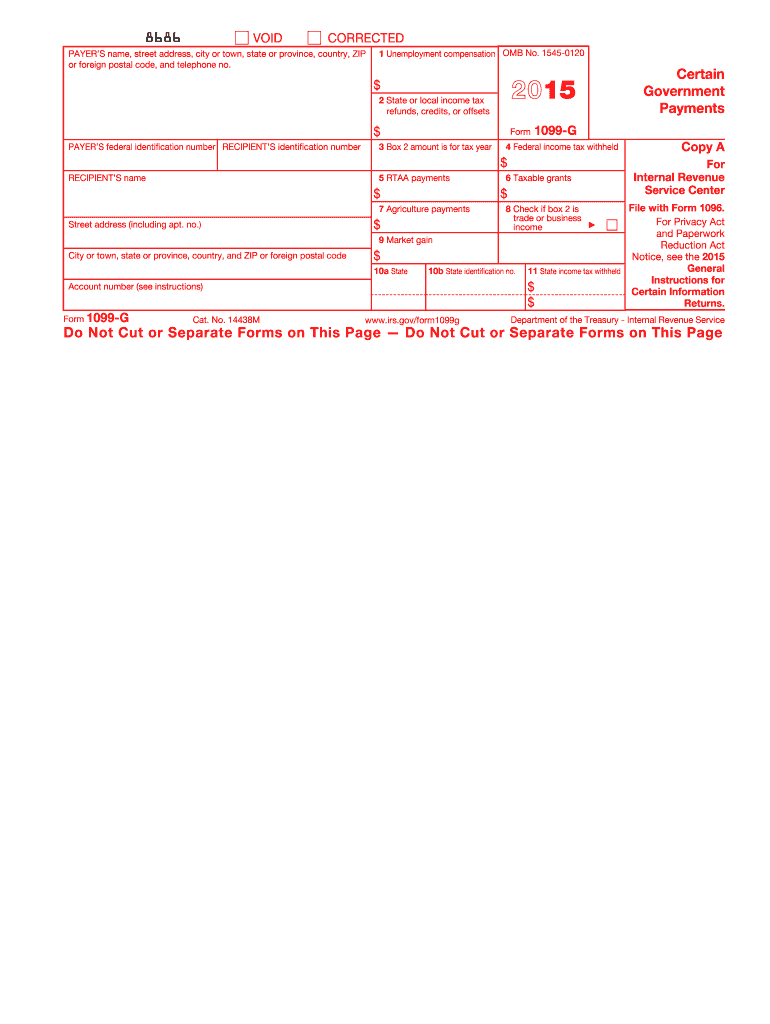

IRS 1099-G 2015 free printable template

Instructions and Help about IRS 1099-G

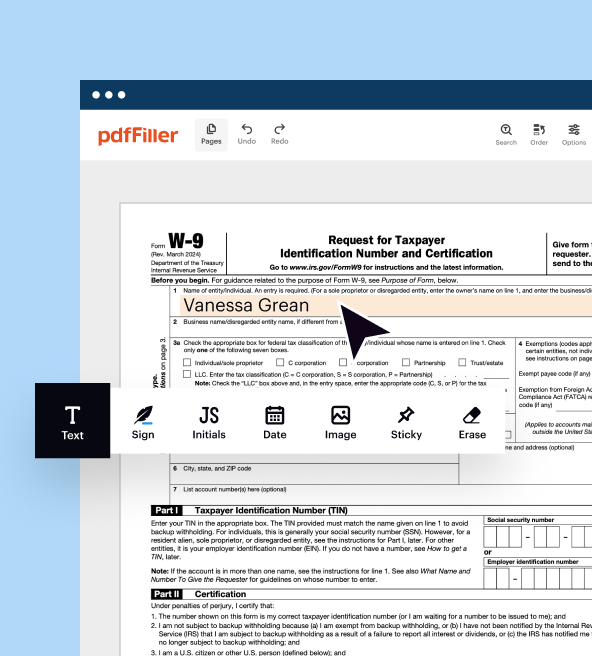

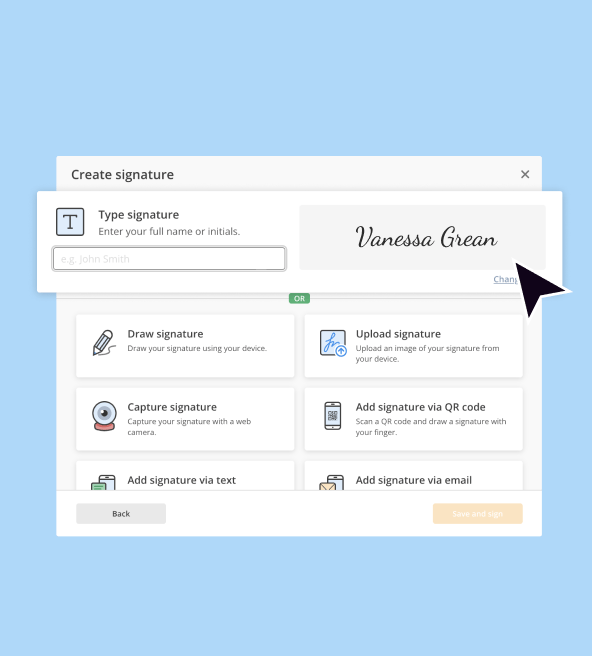

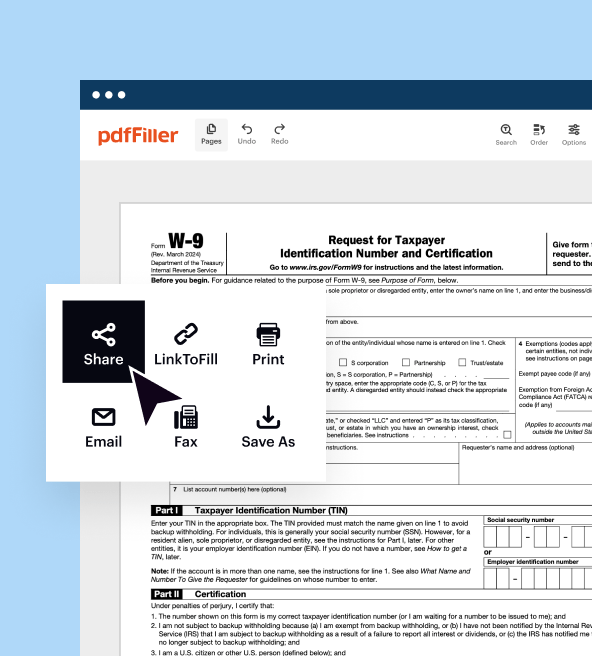

How to edit IRS 1099-G

How to fill out IRS 1099-G

About IRS 1099-G 2015 previous version

What is IRS 1099-G?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-G

What should I do if I realize I made a mistake on my 2015 1099 g form after submitting it?

If you discover an error on your 2015 1099 g form after submission, you can file an amended return with the correct information. It's important to clearly indicate that it is a corrected form. Additionally, keep a record of the original and corrected forms for your files.

How can I verify if my 2015 1099 g form was received and processed by the IRS?

To check the status of your 2015 1099 g form, you may contact the IRS or use their online tools, if available. Make sure you have your personal information handy to facilitate the inquiry and verify receipt.

Are there special considerations for filing a 2015 1099 g form on behalf of a nonresident or foreign payee?

Yes, when filing a 2015 1099 g form for a nonresident or foreign payee, it’s essential to follow specific IRS guidelines regarding tax treaties and withholding requirements. Consult a tax professional to ensure compliance with applicable laws.

What are some common mistakes to avoid when submitting a 2015 1099 g form?

Common errors include incorrect taxpayer identification numbers, misreporting amounts, and failing to check for conformity with IRS e-filing systems. Double-check all entered data against official records to minimize the risk of errors.

What steps should I take if I receive an IRS notice related to my submitted 2015 1099 g form?

If you receive an IRS notice about your 2015 1099 g form, carefully review the correspondence for details regarding the issue. Prepare any necessary documentation and respond by the specified deadline, ensuring to address the points raised in the notice.

See what our users say