AL ADoR PPT 2015 free printable template

Show details

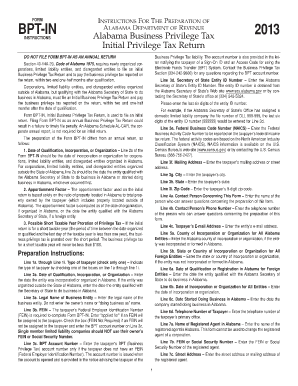

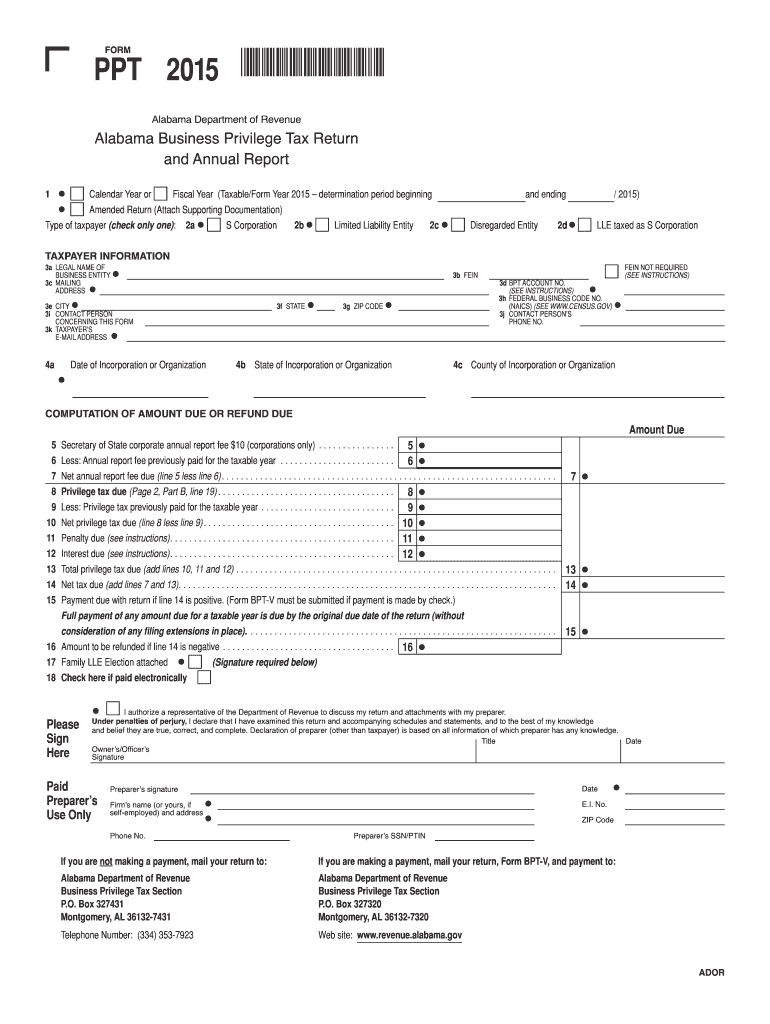

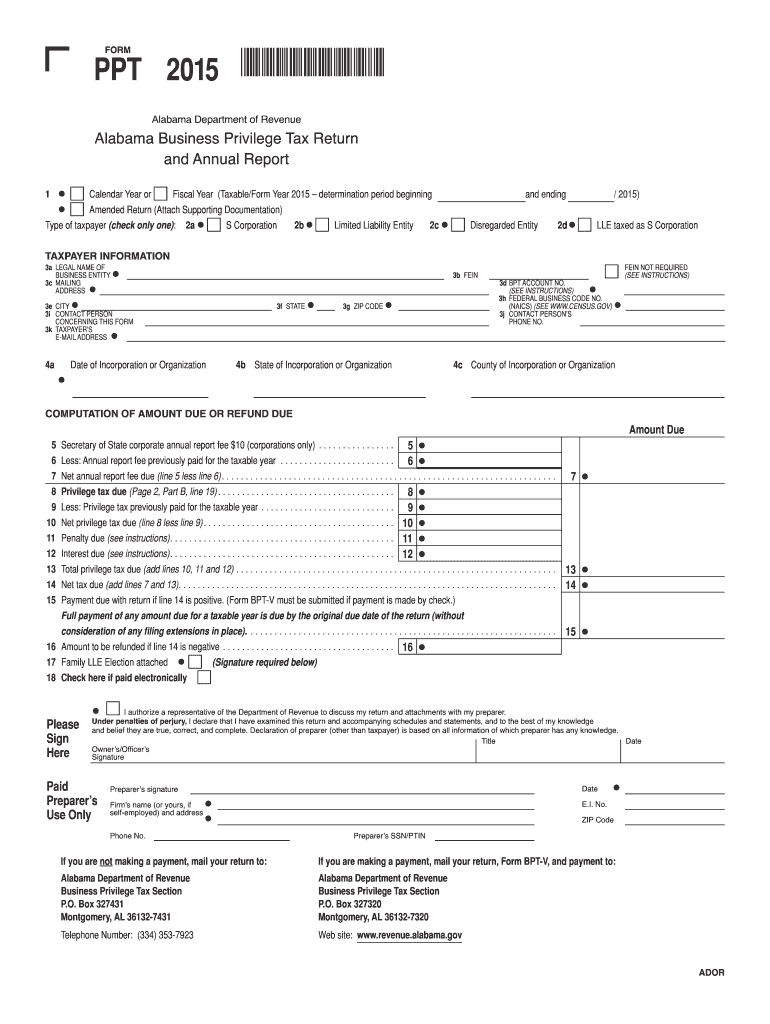

FORM PPT 2015 150001PP Alabama Department of Revenue Alabama Business Privilege Tax Return and Annual Report Calendar Year or Fiscal Year Taxable/Form Year 2015 determination period beginning and ending / 2015 Amended Return Attach Supporting Documentation Type of taxpayer check only one 2a S Corporation 2b Limited Liability Entity 2c Disregarded Entity 2d LLE taxed as S Corporation TAXPAYER INFORMATION 3a LEGAL NAME OF BUSINESS ENTITY 3c MAILING ADDRESS 3e CITY 3i CONTACT PERSON...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL ADoR PPT

Edit your AL ADoR PPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL ADoR PPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AL ADoR PPT online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit AL ADoR PPT. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL ADoR PPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL ADoR PPT

How to fill out AL ADoR PPT

01

Gather all necessary data and documentation related to the project or program.

02

Open the AL ADoR PPT template on your computer.

03

Fill out the title slide with the project name, date, and your name.

04

Complete the introduction slide with a brief overview of the project.

05

Fill in the objectives slide, outlining the main goals of the project.

06

Provide a detailed methodology slide explaining the methods used in the project.

07

Add a results slide to present key findings with graphs or tables.

08

Include a conclusions slide summarizing the outcomes and implications.

09

Insert a recommendations slide for future actions based on findings.

10

Review all slides for clarity and correctness before finalizing the presentation.

Who needs AL ADoR PPT?

01

Researchers preparing project presentations.

02

Students working on academic projects.

03

Project managers summarizing project details.

04

Organizations seeking to document and present findings.

05

Stakeholders interested in project outcomes and recommendations.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum payment for PPT in Alabama?

Minimum privilege tax is $100; plus the $10 Secretary of State annual report fee for corporations. For the taxable year beginning after December 31, 2022, taxpayers who would otherwise be subject to the minimum tax due of $100 shall pay $50 in lieu thereof.

What is the minimum business privilege tax in Alabama 2023?

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

What is the privilege tax rate in Alabama?

Alabama Business Privilege Tax Return – Fees and Due Dates Alabama tax rates range from $0.25 to $1.75 for each $1000 of your entity's Alabama net worth.

What does PPT mean in school?

The Planning and Placement Team (PPT) is the interdisciplinary team of parents and educators that make decisions regarding your child's special education. The team may also include, at the discretion of the parent or the school district, other individuals who have knowledge or special expertise about your child.

What is a PPT form in Alabama?

The CPT form is filed with the Alabama Department of Revenue. PPT – S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete AL ADoR PPT online?

pdfFiller has made it simple to fill out and eSign AL ADoR PPT. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the AL ADoR PPT electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your AL ADoR PPT in seconds.

How do I edit AL ADoR PPT on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign AL ADoR PPT right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is AL ADoR PPT?

AL ADoR PPT is a form used for reporting and documentation in relation to the Alabama Department of Revenue for tax purposes.

Who is required to file AL ADoR PPT?

Individuals or entities that have tax obligations in Alabama and have specific transactions that meet reporting criteria are required to file AL ADoR PPT.

How to fill out AL ADoR PPT?

To fill out AL ADoR PPT, one must provide the necessary financial information, including transaction details, taxpayer identification, and must ensure all fields are completed accurately.

What is the purpose of AL ADoR PPT?

The purpose of AL ADoR PPT is to enable the Alabama Department of Revenue to assess tax liabilities and ensure compliance with state tax laws.

What information must be reported on AL ADoR PPT?

The information that must be reported on AL ADoR PPT includes taxpayer identification, details of taxable transactions, associated amounts, and any applicable exemptions or deductions.

Fill out your AL ADoR PPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL ADoR PPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.