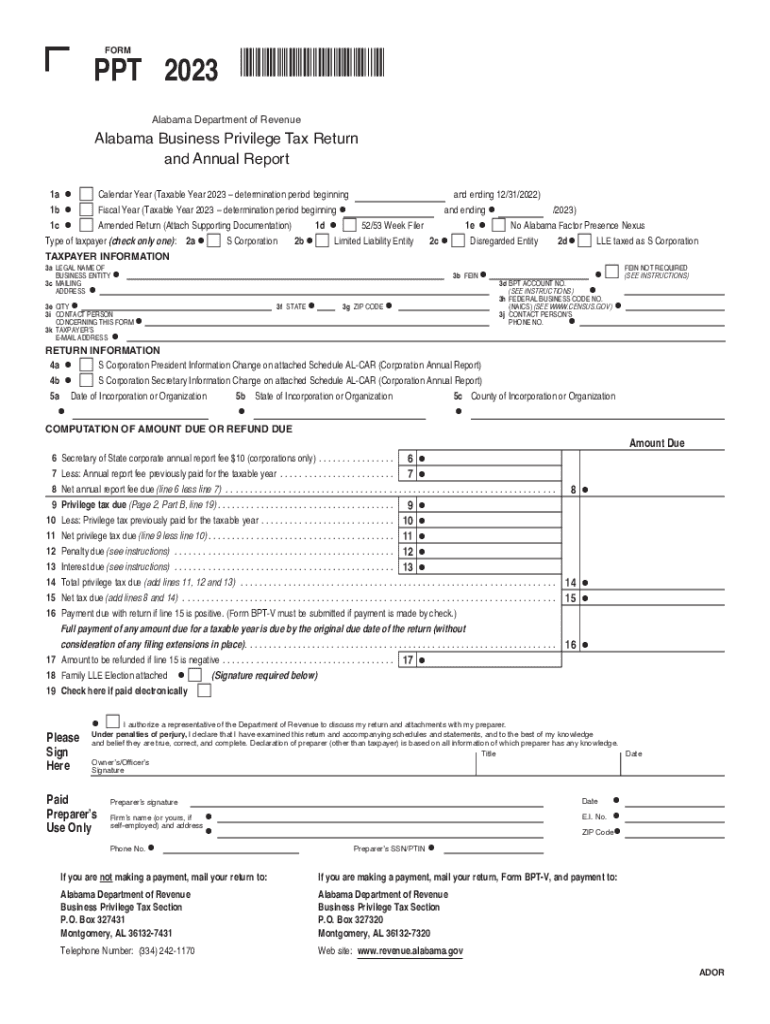

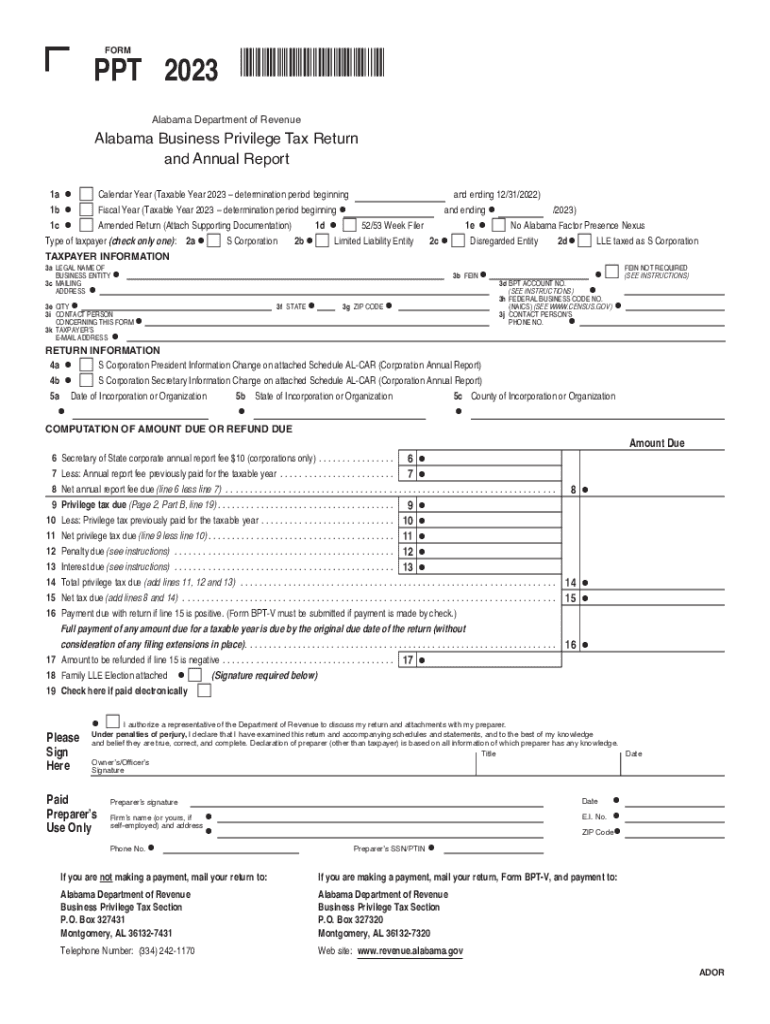

AL ADoR PPT 2023 free printable template

Get, Create, Make and Sign AL ADoR PPT

Editing AL ADoR PPT online

Uncompromising security for your PDF editing and eSignature needs

AL ADoR PPT Form Versions

How to fill out AL ADoR PPT

How to fill out AL ADoR PPT

Who needs AL ADoR PPT?

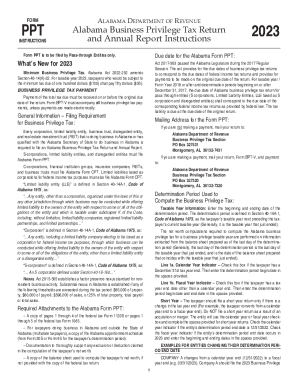

Instructions and Help about AL ADoR PPT

Any guidance provided by DCC related to the completion of income tax withholding forms should not be considered professional tax or legal advice if you have questions or concerns you should consult a tax professional it is important that you complete tax withholding forms as accurately as possible to ensure that the proper amount is withheld from your wages failure to have the correct amount withheld may result in additional taxes and penalties at the time you file your income taxes as required by law be sure to review your first few pay stubs closely to be sure that your withholding are as you want them to be you may adjust your withholding sat any time by completing new withholding forms in line a please enter your full name line B please enter your social security number line C enter your home address line D enter the city you live in line e enter the state you live in line F enter the zip code you live in line G and H you will skip note you will not have an answer in every line below you will only complete the lines which pertain to your particular situation n blank...

People Also Ask about

What is the privilege tax rate in Alabama?

What is the Alabama privilege tax for 2023?

What is the Alabama PPT tax?

What is a PPT form in Alabama?

What is the due date for Alabama business privilege tax?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AL ADoR PPT directly from Gmail?

Can I create an eSignature for the AL ADoR PPT in Gmail?

How do I edit AL ADoR PPT on an Android device?

What is AL ADoR PPT?

Who is required to file AL ADoR PPT?

How to fill out AL ADoR PPT?

What is the purpose of AL ADoR PPT?

What information must be reported on AL ADoR PPT?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.