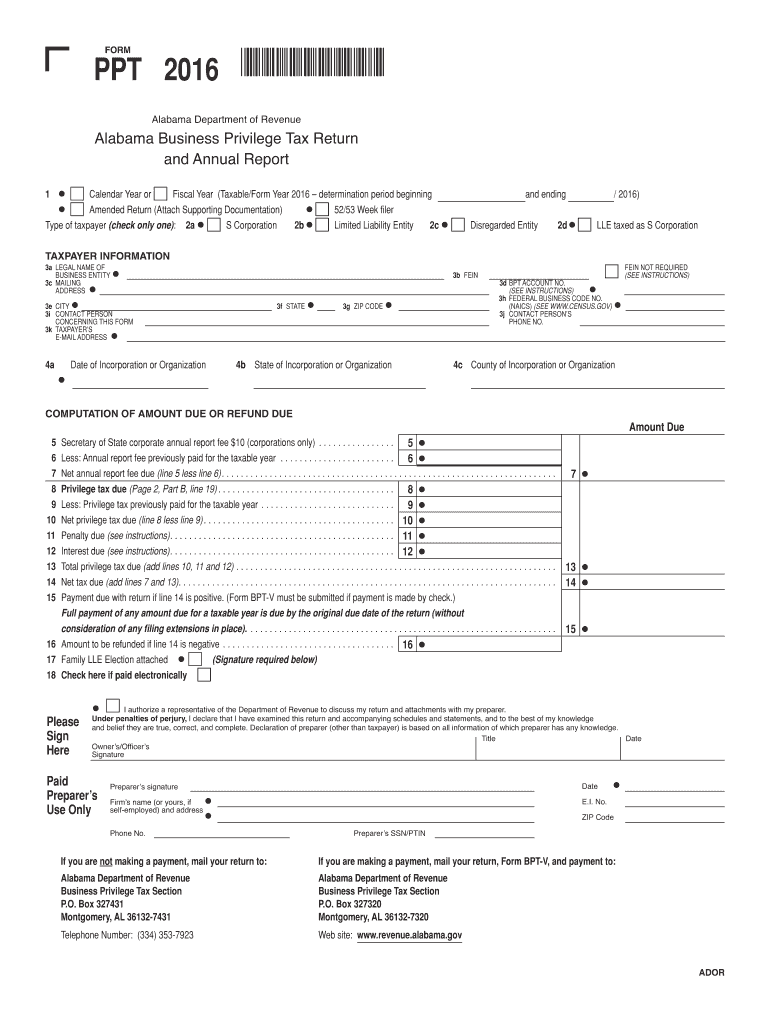

AL ADoR PPT 2016 free printable template

Show details

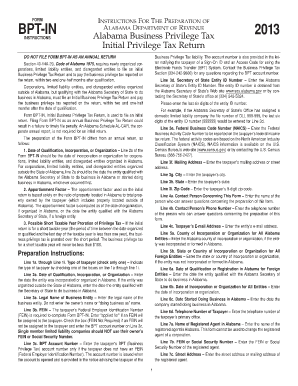

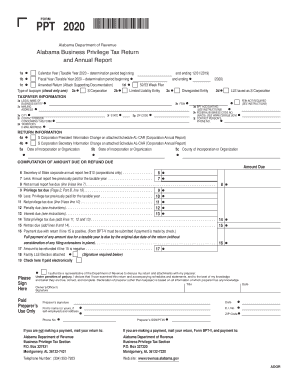

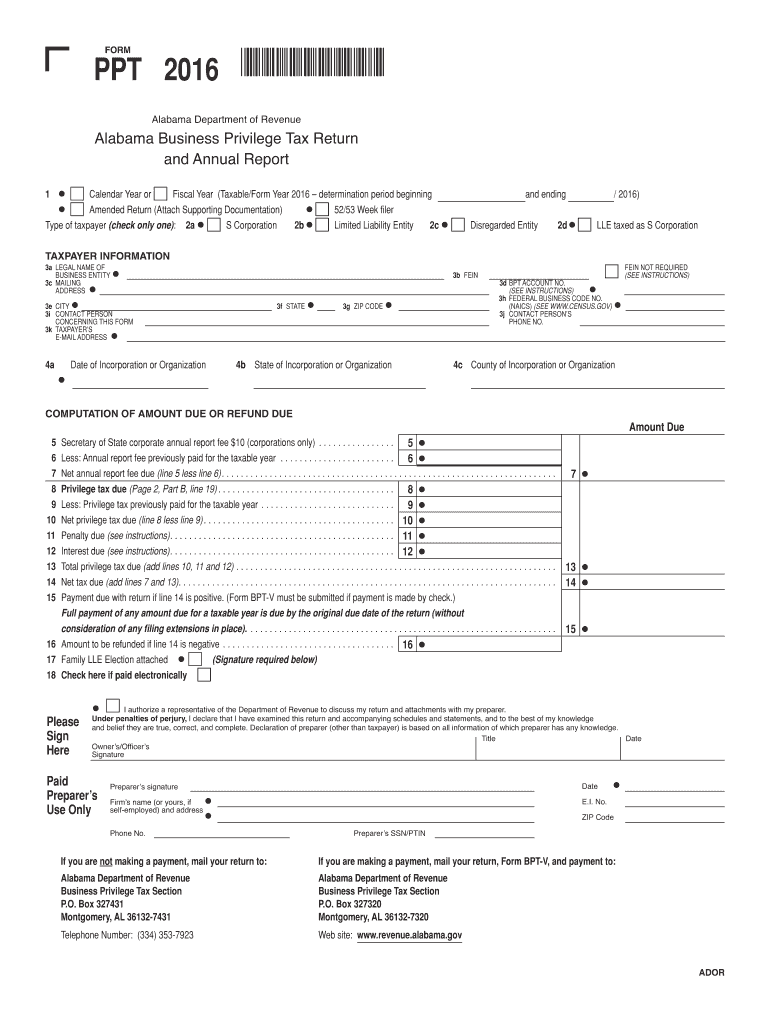

O. Box 327431 Montgomery AL 36132-7431 Telephone Number 334 353-7923 Web site www. revenue. alabama.gov ADOR PPT PAGE 2 1a. FEIN BUSINESS PRIVILEGE TAXABLE/FORM YEAR 160002PP 1b. 18 Alabama enterprise zone credit see instructions. 18 19 Privilege Tax Due line 17 less line 18 minimum 100 for maximum see instructions Enter also on Form PPT page 1 line 8 Privilege Tax Due must be paid by the original due date of the return. FORM PPT 2016 160001PP Alabama Department of Revenue Alabama Business...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL ADoR PPT

Edit your AL ADoR PPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL ADoR PPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL ADoR PPT online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AL ADoR PPT. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL ADoR PPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL ADoR PPT

How to fill out AL ADoR PPT

01

Gather all required data and documents relevant to the AL ADoR.

02

Open the AL ADoR PPT template on your computer.

03

Start with the cover slide, including the title and your name or organization.

04

Proceed to the introduction slide and summarize the purpose of the report.

05

Fill in each section of the PPT, ensuring to follow the structure provided in the template.

06

Input your findings in the appropriate slides, using bullet points for clarity.

07

Incorporate visuals like charts or graphs to present data effectively.

08

Include a conclusion slide summarizing key insights and recommendations.

09

Review the entire PPT for any grammatical errors or formatting issues.

10

Save the document in a preferred format and prepare for presentation.

Who needs AL ADoR PPT?

01

Project managers who need to report on project progress.

02

Researchers compiling data for academic or professional purposes.

03

Business analysts presenting findings to stakeholders.

04

Any organization needing to communicate results or findings clearly.

Instructions and Help about AL ADoR PPT

Fill

form

: Try Risk Free

People Also Ask about

What is the privilege tax rate in Alabama?

25 to $1.75 for each $1,000 of net worth in Alabama. If taxable income of the taxpayer is: Less than $1, the tax rate shall be $0.25 per $1,000. At least $1 but less than $200,000, the tax rate shall be $1.00 per $1,000.

What is the Alabama privilege tax for 2023?

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

What is the Alabama PPT tax?

Minimum privilege tax is $100; plus the $10 Secretary of State annual report fee for corporations. For the taxable year beginning after December 31, 2022, taxpayers who would otherwise be subject to the minimum tax due of $100 shall pay $50 in lieu thereof.

What is a PPT form in Alabama?

The CPT form is filed with the Alabama Department of Revenue. PPT – S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue.

What is the due date for Alabama business privilege tax?

Taxable year 2021 Form CPT would be due on April 15, 2021 for a calendar year C-corporation. For C-corporations with a fiscal year of June 30, the Alabama business privilege tax return is due no later than two and a half months after the beginning of a taxpayer's taxable year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AL ADoR PPT to be eSigned by others?

To distribute your AL ADoR PPT, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute AL ADoR PPT online?

pdfFiller has made it easy to fill out and sign AL ADoR PPT. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit AL ADoR PPT on an Android device?

The pdfFiller app for Android allows you to edit PDF files like AL ADoR PPT. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is AL ADoR PPT?

AL ADoR PPT stands for Alabama Annual Disclosure of Reportable Personal Property Tax, which is a document required by the state of Alabama for reporting taxable personal property.

Who is required to file AL ADoR PPT?

Individuals and businesses that own personal property in Alabama, which is subject to taxation, are required to file the AL ADoR PPT.

How to fill out AL ADoR PPT?

To fill out the AL ADoR PPT, report your personal property details such as type, location, and estimated value on the form provided by the state. Ensure accuracy and submit it by the filing deadline.

What is the purpose of AL ADoR PPT?

The purpose of AL ADoR PPT is to report personal property for tax assessment, ensuring that property owners are compliant with state tax laws.

What information must be reported on AL ADoR PPT?

The AL ADoR PPT requires information such as the owner's name, address, a description of the personal property, its location, and the estimated value of the assets.

Fill out your AL ADoR PPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL ADoR PPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.