AL ADoR PPT 2024 free printable template

Show details

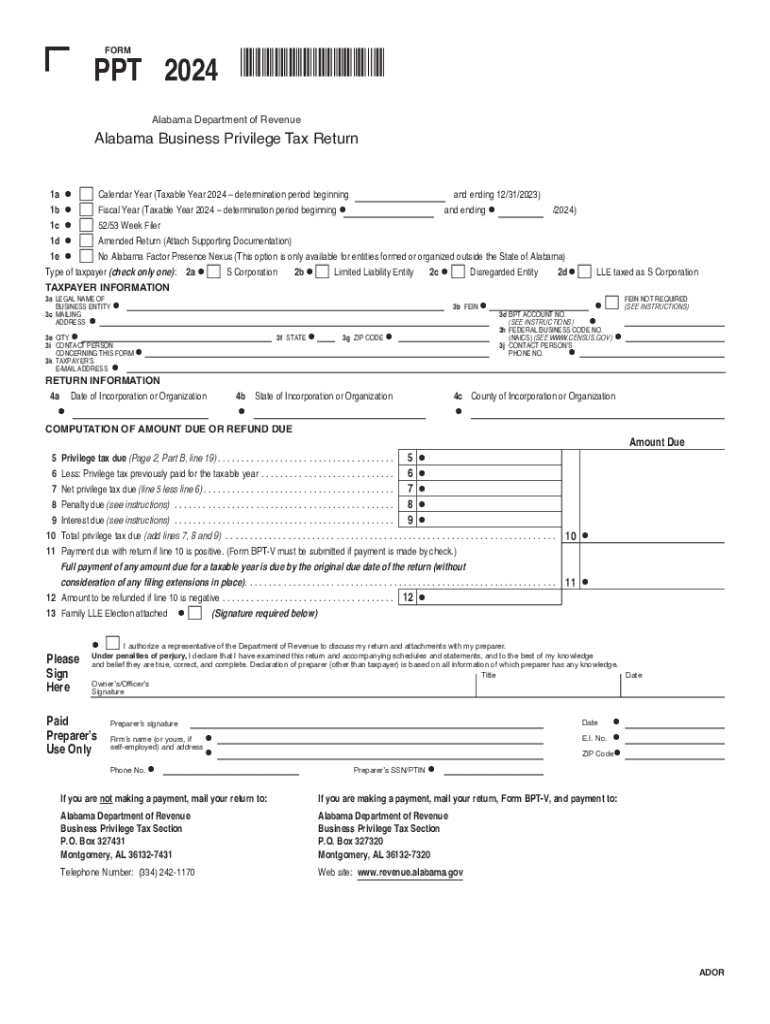

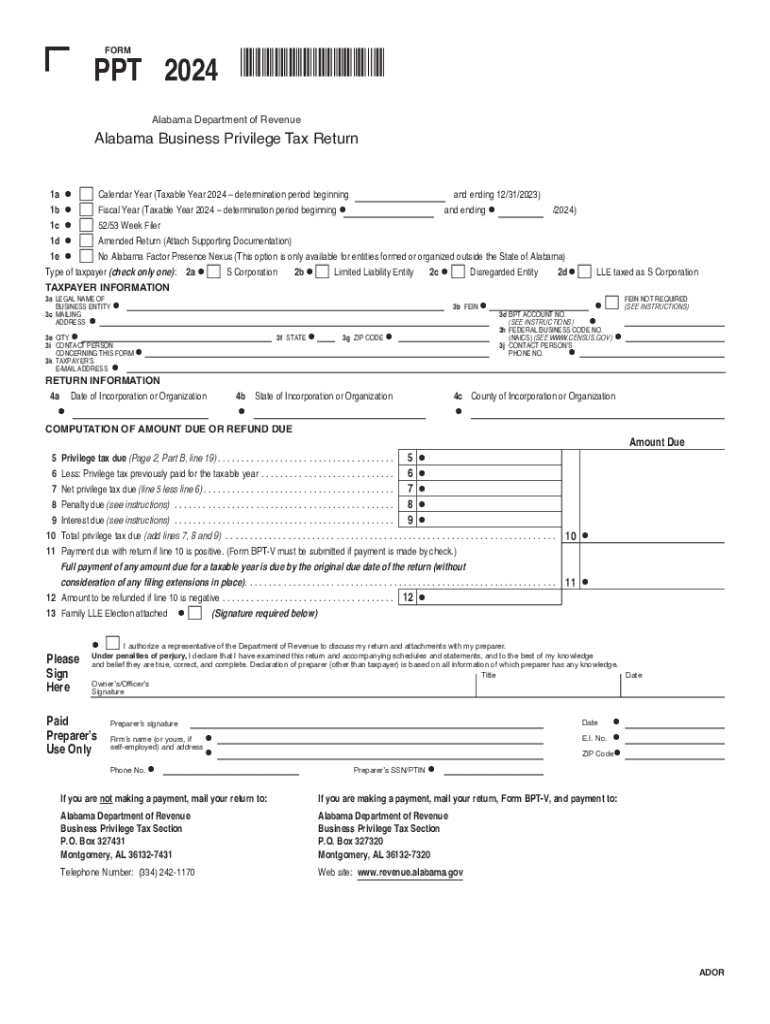

PPT 2023 230001PP FORM Alabama Department of Revenue Alabama Business Privilege Tax Return and Annual Report 1a Calendar Year Taxable Year 2023 determination period beginning and ending 12/31/2022 1b Fiscal Year Taxable Year 2023 determination period beginning and ending /2023 1c Amended Return Attach Supporting Documentation 1d 52/53 Week Filer 1e No Alabama Factor Presence Nexus Type of taxpayer check only one 2a S Corporation 2b Limited Liability Entity 2c Disregarded Entity 2d...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL ADoR PPT

Edit your AL ADoR PPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL ADoR PPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AL ADoR PPT online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AL ADoR PPT. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL ADoR PPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL ADoR PPT

How to fill out AL ADoR PPT

01

Gather all necessary documentation and data to support your application.

02

Open the AL ADoR PPT form on your device.

03

Fill in your personal information accurately, including name, address, and contact details.

04

Provide detailed information regarding the purpose of the request or application.

05

Include any relevant project or program details, ensuring clarity and completeness.

06

Attach supporting documents as required by the form.

07

Review your entries for accuracy and completeness.

08

Submit the form through the designated channel, either online or in person.

Who needs AL ADoR PPT?

01

Individuals seeking official approvals or permits related to regulatory requirements.

02

Organizations applying for grants or funding that require documentation of their activities.

03

Businesses needing to demonstrate compliance with local regulations.

04

Any entity looking to formalize their applications for specific projects or initiatives.

Fill

form

: Try Risk Free

People Also Ask about

What is the privilege tax rate in Alabama?

25 to $1.75 for each $1,000 of net worth in Alabama. If taxable income of the taxpayer is: Less than $1, the tax rate shall be $0.25 per $1,000. At least $1 but less than $200,000, the tax rate shall be $1.00 per $1,000.

What is the Alabama privilege tax for 2023?

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

What is the Alabama PPT tax?

Minimum privilege tax is $100; plus the $10 Secretary of State annual report fee for corporations. For the taxable year beginning after December 31, 2022, taxpayers who would otherwise be subject to the minimum tax due of $100 shall pay $50 in lieu thereof.

What is a PPT form in Alabama?

The CPT form is filed with the Alabama Department of Revenue. PPT – S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue.

What is the due date for Alabama business privilege tax?

Taxable year 2021 Form CPT would be due on April 15, 2021 for a calendar year C-corporation. For C-corporations with a fiscal year of June 30, the Alabama business privilege tax return is due no later than two and a half months after the beginning of a taxpayer's taxable year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AL ADoR PPT?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the AL ADoR PPT. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out AL ADoR PPT using my mobile device?

Use the pdfFiller mobile app to fill out and sign AL ADoR PPT on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit AL ADoR PPT on an Android device?

The pdfFiller app for Android allows you to edit PDF files like AL ADoR PPT. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is AL ADoR PPT?

AL ADoR PPT is a specific reporting form used to disclose details related to allocation and distribution of property transfers for tax purposes.

Who is required to file AL ADoR PPT?

Individuals and entities involved in property transfers within Alabama may be required to file AL ADoR PPT, particularly if the transfer meets certain thresholds specified by the state.

How to fill out AL ADoR PPT?

To fill out AL ADoR PPT, follow the provided instructions carefully, ensuring all required sections are completed accurately, including property information, parties involved, and taxes owed.

What is the purpose of AL ADoR PPT?

The purpose of AL ADoR PPT is to track property transfers for taxation, ensuring compliance with state tax laws and providing necessary information for tax assessment.

What information must be reported on AL ADoR PPT?

Information that must be reported includes details about the property being transferred, the parties involved, the value of the transfer, and any applicable tax deductions or exemptions.

Fill out your AL ADoR PPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL ADoR PPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.