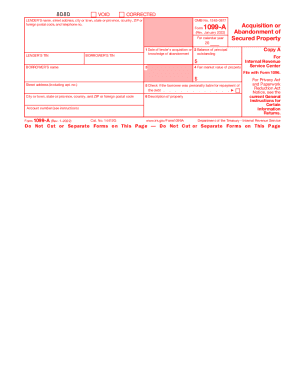

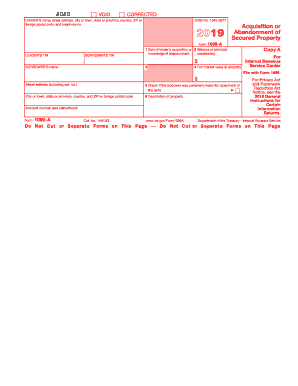

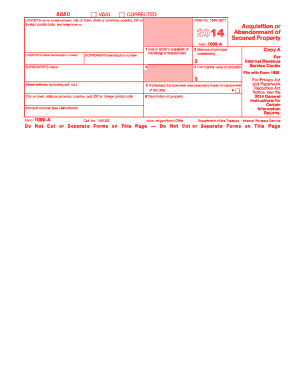

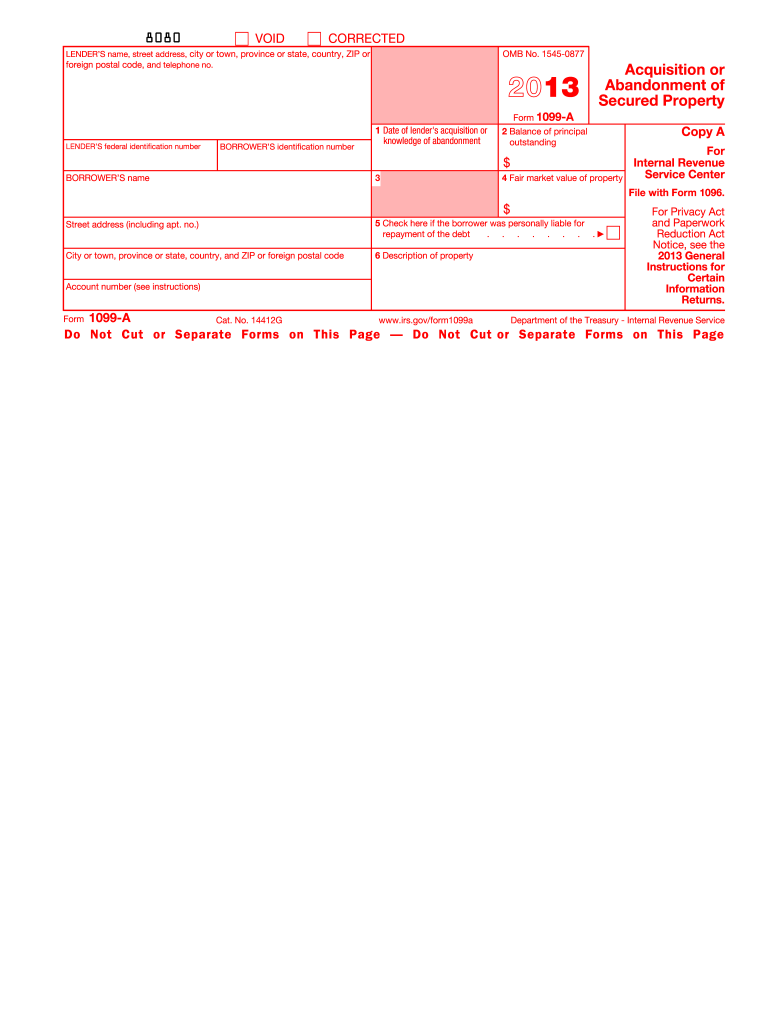

IRS 1099-A 2013 free printable template

Instructions and Help about IRS 1099-A

How to edit IRS 1099-A

How to fill out IRS 1099-A

About IRS 1099-A 2013 previous version

What is IRS 1099-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

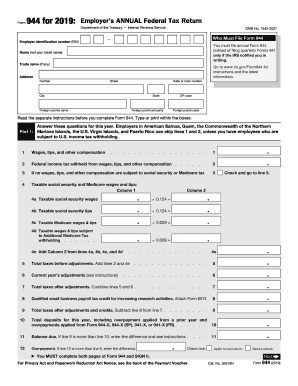

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-A

What should I do if I made a mistake on my 1099a 2013 form?

If you discover an error on your 1099a 2013 form after submission, you can submit a corrected form. Clearly mark the new form as 'Corrected' and ensure that you follow the IRS guidelines for corrections. It's important to notify the recipient of the error and provide them with the corrected version to maintain accurate records.

How can I verify the processing status of my 1099a 2013 form?

To verify the processing status of your filed 1099a 2013 form, you can contact the IRS directly or check the status on their official website. If you e-filed your form, keep track of any confirmation numbers provided, as these can help resolve issues if your form is rejected.

What are the legal considerations regarding data privacy when submitting a 1099a 2013 form?

When filing the 1099a 2013 form, it is crucial to ensure that personal and financial information is transmitted securely to protect the data privacy of all parties involved. Using encrypted methods for e-filing and understanding the record retention period mandated by the IRS are essential for compliance with data security regulations.

What should I do if I receive a notice from the IRS regarding my 1099a 2013 form?

If you receive a notice from the IRS about your 1099a 2013 form, read the notice carefully for instructions. Gather any supporting documentation, such as your original form and correspondence, and respond by the specified deadline to address any issues or discrepancies highlighted in the notice.

See what our users say