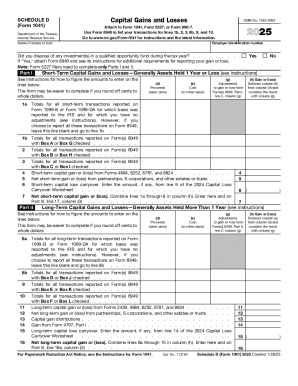

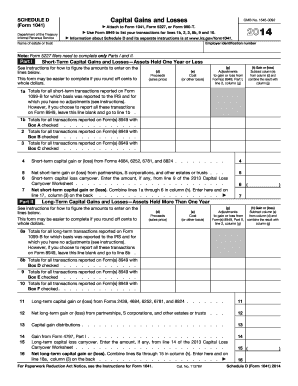

IRS 1041 - Schedule D 2017 free printable template

Instructions and Help about IRS 1041 - Schedule D

How to edit IRS 1041 - Schedule D

How to fill out IRS 1041 - Schedule D

About IRS 1041 - Schedule D 2017 previous version

What is IRS 1041 - Schedule D?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1041 - Schedule D

What should you do if you realize you made a mistake on your IRS Form 1041 2017 after filing?

If you discover an error on your IRS Form 1041 2017, you should file an amended return using Form 1041-X, which corrects your initial submission. Ensure you explain the changes clearly and provide any necessary supporting documentation. Amending your form promptly helps avoid potential penalties and interest from the IRS.

How can you confirm the IRS received your Form 1041 2017?

To verify the receipt of your IRS Form 1041 2017, you can check your status on the IRS website or contact the IRS directly via phone. If you filed electronically, you should receive an acknowledgment of receipt, allowing you to confirm processing or any rejections due to errors.

What steps can you take if your IRS Form 1041 2017 is rejected during e-filing?

In case your IRS Form 1041 2017 is rejected, review the rejection code provided, as it often indicates the reason for the failure. Correct any identified issues and then re-submit your amended form. Ensure to keep track of the filings to prevent further complications.

What are some common mistakes to avoid when filing IRS Form 1041 2017?

Common mistakes when filing IRS Form 1041 2017 include incorrectly entering income figures, misreporting deductions, and failing to sign the form. Review your entries carefully and consider using tax software that provides guidance to minimize errors.

What should you do if you receive an IRS notice after filing Form 1041 2017?

If you receive an IRS notice after submitting your IRS Form 1041 2017, read it carefully to understand the required action. Gather the necessary documentation to support your response and reply promptly to resolve any issues or discrepancies highlighted in the notice.

See what our users say