RI TX-17 2016 free printable template

Show details

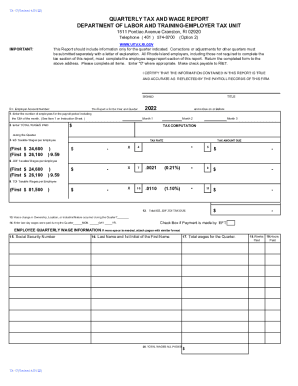

TX17(Revised 1/02/2016)QUARTERLY TAX AND WAGE REPORT DIVISION OF TAXATION EMPLOYER TAX SECTION ONE CAPITOL HILL STE 36,PROVIDENCE, Telephone (401) 574870002908 5829(Option 2)WWW.UIT AX.RI.IMPORTANT:This

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI TX-17

Edit your RI TX-17 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI TX-17 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing RI TX-17 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit RI TX-17. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI TX-17 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI TX-17

How to fill out RI TX-17

01

Obtain the RI TX-17 form from the Rhode Island Division of Taxation website or local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the RI TX-17.

04

Provide information about your income sources, including any wages, salaries, or business earnings.

05

List any deductions you are eligible for, ensuring you have the necessary documentation to support your claims.

06

Calculate your total tax owed or refund due based on the information provided.

07

Sign and date the form before submission.

Who needs RI TX-17?

01

Individuals or businesses in Rhode Island who need to report their income and calculate their tax obligations for the state.

02

Taxpayers who have earned income during the tax year and are required to file a tax return.

Fill

form

: Try Risk Free

People Also Ask about

What tax forms should I get from my employer?

When you work as an employee, your employer should send you a W-2. If you work as an independent contractor, the company will likely send you Form 1099-NEC rather than a W-2.

What is the difference between a W-2 and a w4?

What's the difference between a W2- and a W-4? A W-4 is a form the employee fills out upon hiring to let an employer know how much to withhold from their paychecks. A W-2 is a form the employer fills out each tax year to record how much an employee was paid and how much tax was withheld.

What is on form 941 the employer's quarterly federal tax return?

What is IRS Form 941? IRS Form 941 is more commonly known as the Employer's Quarterly Federal Tax Return. This is the form your business uses to report income taxes and payroll taxes that you withheld from your employees' wages. It also provides space to calculate and report Social Security and Medicare taxes.

What IRS form do I use to report wages?

File Forms W-2, Wage and Tax Statement, with Form W-3, Transmittal of Wage and Tax Statements, with the SSA to report wages paid and employment taxes withheld from these wages during the previous tax year. Forms W-2 and W-3 may be filed electronically, and certain employers can also file them on paper.

What form should I get from my employer?

Forms to Obtain Information from Payees: Form I-9, Employment Eligibility VerificationPDF. Form W-4, Employee's Withholding Certificate. Form W-4P, Withholding Certificate for Pension or Annuity Payments. Form W-9, Request for Taxpayer Identification Number and Certification.

What is form 941 and when must it be filed?

You're required to file a separate Form 941 for each quarter (first quarter - January through March, second quarter - April through June, third quarter - July through September, fourth quarter - October through December). Form 941 is generally due by the last day of the month following the end of the quarter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in RI TX-17?

The editing procedure is simple with pdfFiller. Open your RI TX-17 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit RI TX-17 in Chrome?

Install the pdfFiller Google Chrome Extension to edit RI TX-17 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I complete RI TX-17 on an Android device?

Use the pdfFiller mobile app and complete your RI TX-17 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is RI TX-17?

RI TX-17 is a tax form used in Rhode Island for reporting and paying the state's sales and use tax.

Who is required to file RI TX-17?

Businesses and individuals who collect sales tax or incur use tax liability in Rhode Island are required to file RI TX-17.

How to fill out RI TX-17?

To fill out RI TX-17, one must provide their business information, report the total sales and taxable sales, calculate the tax liability, and submit the form along with any payment due.

What is the purpose of RI TX-17?

The purpose of RI TX-17 is to allow taxpayers to report their sales and use tax obligations to the Rhode Island Division of Taxation.

What information must be reported on RI TX-17?

The information that must be reported on RI TX-17 includes the total sales, taxable sales amounts, any exemptions, and the total sales and use tax due.

Fill out your RI TX-17 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI TX-17 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.