RI TX-17 2017 free printable template

Show details

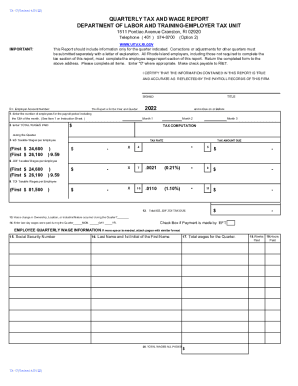

TX-17(Revised 10/04/2017) QUARTERLY TAX AND WAGE REPORT DIVISION OF TAXATION — EMPLOYER TAX SECTION ONE CAPITOL HILL STE 36, PROVIDENCE, RI Telephone (401) 574-8700 02908 – 5829 (Option 2) WWW.UIT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI TX-17

Edit your RI TX-17 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI TX-17 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit RI TX-17 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit RI TX-17. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI TX-17 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI TX-17

How to fill out RI TX-17

01

Obtain the RI TX-17 form from the Rhode Island Department of Revenue website or local office.

02

Fill in your personal information including your name, address, and Social Security number.

03

Indicate the type of return you are filing (individual, joint, etc.).

04

Provide details about your income sources and their amounts.

05

Complete any necessary schedules or additional forms that accompany the RI TX-17.

06

Calculate your total tax liability based on the information provided.

07

Sign and date the form before submission.

08

Submit the completed form by mail or electronically, as per the instructions provided.

Who needs RI TX-17?

01

Residents of Rhode Island who need to report their income and pay state taxes.

02

Individuals who have earned income from Rhode Island sources, irrespective of their residency.

03

Tax professionals assisting clients in filing state tax returns in Rhode Island.

Fill

form

: Try Risk Free

People Also Ask about

What is ri tx 17?

What is RI 17? The Employer Tax Unit processes all Quarterly Tax and Wage Reports (Form TX-17) and accompanying tax payments, submitted by Rhode Island employers. These payments include all required Employment Security, Job Development Fund, Reemployment Fund and Temporary Disability Insurance taxes.

How much payroll tax is taken out of my paycheck?

Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, you'll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

What are the four 4 main payroll taxes taken out of your paycheck?

Income tax. Social security tax. 401(k) contributions. Wage garnishments.

Who pays for unemployment in RI?

Unemployment Insurance (UI) is a federal/state insurance program financed by employers through payroll taxes.

Are there local payroll taxes in Rhode Island?

Rhode Island does not have any local taxes. How do I register as an employer? Rhode Island employers need to register via the Rhode Island Division of Taxation Combined Online Registration Service for unemployment taxes, wage withholding taxes, and also temporary disability insurance payments.

Who is exempt from RI TDI?

b) Minors 14 or 15 years of age are exempt from the provisions of the TDI regulations. No deductions should be made from their salary for TDI.

Is Ri SDI the same as Ri TDI?

State Disability Insurance (SDI) is required by some states. In some states, employees pay SDI, in others, employers pay, and in some, both pay. It is also know as Temporary Disability Insurance (TDI).

What are the payroll taxes in RI?

Rhode Island State Payroll Taxes The rates range from 3.75% to 5.99%. The tax breakdown can be found on the Rhode Island Department of Revenue website.

What are the 4 types of payroll taxes?

Payroll tax rates Social Security – 6.2% Medicare – 1.45% Additional Medicare – 0.9% Unemployment – 6% (0.6% with full credit reduction)

How is TDI calculated in RI?

How much will I receive? Your weekly benefit rate will be equal to 4.62% of the wages paid to you in the highest quarter of your Base Period. Your weekly benefit rate remains the same throughout your benefit year.

What is ri tdi for 2022?

The TDI taxable wage base, which is equal to the annual earnings needed by an individual to qualify for the maximum weekly benefit rate, will be $81,500 in 2022, an increase of $7,500 from the 2021 taxable wage base of $74,000.

What is Rhode Island disability tax?

The Rhode Island Temporary Disability Insurance tax is 1.3 percent of an employee's pay.

What is Rhode Island JDF tax?

Job Development Fund Tax Employers pay an assessment of 0.21% to support the Rhode Island Governor's Workforce Board, as well as employment services and unemployment insurance activities.

What is the maximum RI TDI tax?

4.62% of total high quarter wages in base period.

What is the Form RI 941?

Form RI-941, Employer's Quarterly Tax Return and Reconciliation must be filed no later than the last day of the month following the end of the quarter. 8. Some employers are required to file Form RI-941 and make payments via electronic means. Weekly payers must file and pay via electronic means.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my RI TX-17 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your RI TX-17 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete RI TX-17 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your RI TX-17, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete RI TX-17 on an Android device?

Use the pdfFiller mobile app and complete your RI TX-17 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is RI TX-17?

RI TX-17 is a tax form used in Rhode Island for reporting and paying various types of taxes, including but not limited to sales and use tax.

Who is required to file RI TX-17?

Businesses that engage in sales of taxable goods or services in Rhode Island are required to file RI TX-17.

How to fill out RI TX-17?

To fill out RI TX-17, you need to provide your business information, report your total sales and tax collected, and calculate your total tax due. It's important to follow the instructions provided on the form carefully.

What is the purpose of RI TX-17?

The purpose of RI TX-17 is to ensure that businesses accurately report and remit sales and use taxes to the state of Rhode Island.

What information must be reported on RI TX-17?

RI TX-17 requires reporting of gross sales, total taxable sales, total tax collected, and any deductions or exemptions applicable.

Fill out your RI TX-17 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI TX-17 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.