RI TX-17 2019 free printable template

Show details

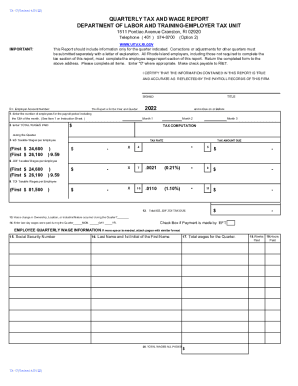

TX17(Revised 11/29/2018)QUARTERLY TAX AND WAGE REPORT DIVISION OF TAXATION EMPLOYER TAX SECTION ONE CAPITOL HILL STE 36,PROVIDENCE, Telephone (401) 574870002908 5829(Option 2)WWW.UIT AX.RI.IMPORTANT:This

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI TX-17

Edit your RI TX-17 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI TX-17 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit RI TX-17 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit RI TX-17. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI TX-17 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI TX-17

How to fill out RI TX-17

01

Begin by downloading the RI TX-17 form from the Rhode Island Division of Taxation website.

02

Enter your personal information at the top of the form, including your name, address, and social security number.

03

Fill in the section for income sources, reporting all income you received during the tax year.

04

Deduct any eligible expenses in the designated area to calculate your taxable income.

05

Review the tax rates and enter the amount of tax owed based on your taxable income.

06

Complete the payment section, stating how you intend to pay any taxes owed, whether by check or electronic payment.

07

Sign and date the form before submitting it to the Rhode Island Division of Taxation.

Who needs RI TX-17?

01

Individuals who earned income in Rhode Island and need to report their state taxes.

02

Residents of Rhode Island who have a tax liability for the year.

03

Anyone who is a business owner or self-employed individual operating within Rhode Island.

Fill

form

: Try Risk Free

People Also Ask about

What is ri tx 17?

What is RI 17? The Employer Tax Unit processes all Quarterly Tax and Wage Reports (Form TX-17) and accompanying tax payments, submitted by Rhode Island employers. These payments include all required Employment Security, Job Development Fund, Reemployment Fund and Temporary Disability Insurance taxes.

How much payroll tax is taken out of my paycheck?

Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, you'll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

What are the four 4 main payroll taxes taken out of your paycheck?

Income tax. Social security tax. 401(k) contributions. Wage garnishments.

Who pays for unemployment in RI?

Unemployment Insurance (UI) is a federal/state insurance program financed by employers through payroll taxes.

Are there local payroll taxes in Rhode Island?

Rhode Island does not have any local taxes. How do I register as an employer? Rhode Island employers need to register via the Rhode Island Division of Taxation Combined Online Registration Service for unemployment taxes, wage withholding taxes, and also temporary disability insurance payments.

Who is exempt from RI TDI?

b) Minors 14 or 15 years of age are exempt from the provisions of the TDI regulations. No deductions should be made from their salary for TDI.

Is Ri SDI the same as Ri TDI?

State Disability Insurance (SDI) is required by some states. In some states, employees pay SDI, in others, employers pay, and in some, both pay. It is also know as Temporary Disability Insurance (TDI).

What are the payroll taxes in RI?

Rhode Island State Payroll Taxes The rates range from 3.75% to 5.99%. The tax breakdown can be found on the Rhode Island Department of Revenue website.

What are the 4 types of payroll taxes?

Payroll tax rates Social Security – 6.2% Medicare – 1.45% Additional Medicare – 0.9% Unemployment – 6% (0.6% with full credit reduction)

How is TDI calculated in RI?

How much will I receive? Your weekly benefit rate will be equal to 4.62% of the wages paid to you in the highest quarter of your Base Period. Your weekly benefit rate remains the same throughout your benefit year.

What is ri tdi for 2022?

The TDI taxable wage base, which is equal to the annual earnings needed by an individual to qualify for the maximum weekly benefit rate, will be $81,500 in 2022, an increase of $7,500 from the 2021 taxable wage base of $74,000.

What is Rhode Island disability tax?

The Rhode Island Temporary Disability Insurance tax is 1.3 percent of an employee's pay.

What is Rhode Island JDF tax?

Job Development Fund Tax Employers pay an assessment of 0.21% to support the Rhode Island Governor's Workforce Board, as well as employment services and unemployment insurance activities.

What is the maximum RI TDI tax?

4.62% of total high quarter wages in base period.

What is the Form RI 941?

Form RI-941, Employer's Quarterly Tax Return and Reconciliation must be filed no later than the last day of the month following the end of the quarter. 8. Some employers are required to file Form RI-941 and make payments via electronic means. Weekly payers must file and pay via electronic means.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get RI TX-17?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific RI TX-17 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the RI TX-17 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your RI TX-17 in minutes.

How can I fill out RI TX-17 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your RI TX-17. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is RI TX-17?

RI TX-17 is a tax form used in the state of Rhode Island for reporting and paying certain taxes related to specific transactions.

Who is required to file RI TX-17?

Businesses and individuals engaged in transactions that fall under the jurisdiction of Rhode Island tax laws are required to file RI TX-17.

How to fill out RI TX-17?

To fill out RI TX-17, one must provide accurate information regarding the transaction, including details such as the nature of the transaction, amounts involved, and any applicable tax calculations.

What is the purpose of RI TX-17?

The purpose of RI TX-17 is to ensure compliance with Rhode Island tax regulations by facilitating the reporting and payment of taxes due on specific transactions.

What information must be reported on RI TX-17?

Information that must be reported on RI TX-17 includes details of the transactions, the parties involved, the tax amounts, and any exemptions or deductions that may apply.

Fill out your RI TX-17 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI TX-17 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.