RI TX-17 2018 free printable template

Show details

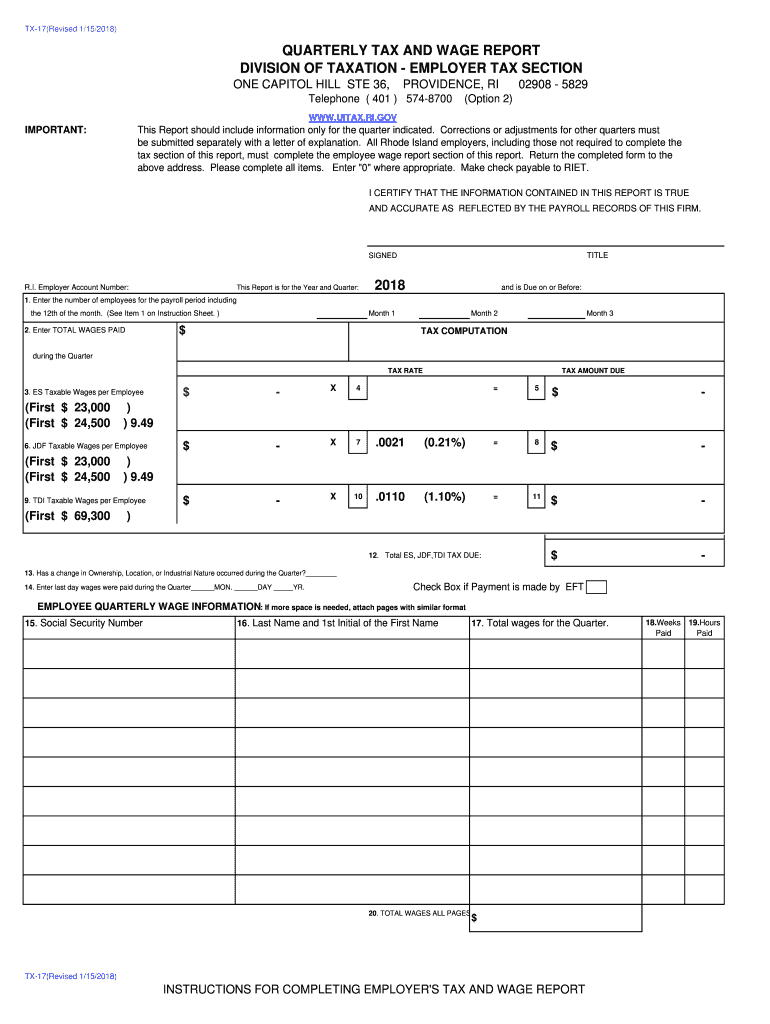

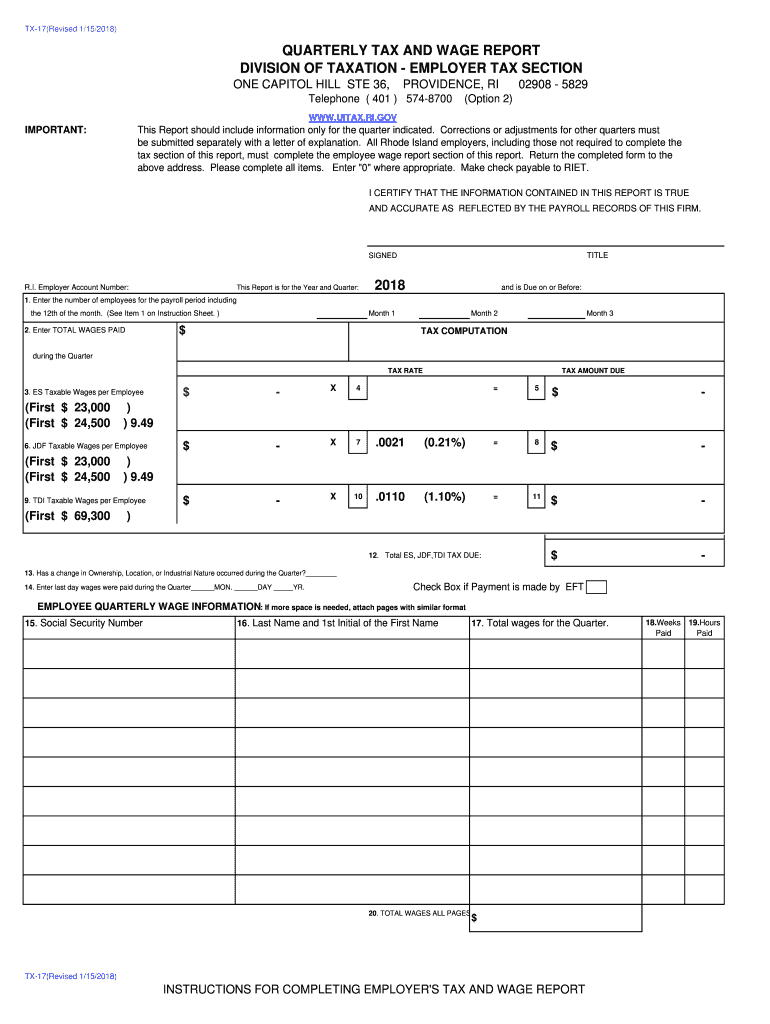

TX17(Revised 1/15/2018)QUARTERLY TAX AND WAGE REPORT DIVISION OF TAXATION EMPLOYER TAX SECTION ONE CAPITOL HILL STE 36,PROVIDENCE, Telephone (401) 574870002908 5829(Option 2)WWW.UIT AX.RI.IMPORTANT:This

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI TX-17

Edit your RI TX-17 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI TX-17 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing RI TX-17 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit RI TX-17. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI TX-17 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI TX-17

How to fill out RI TX-17

01

Obtain the RI TX-17 form from the Rhode Island Division of Taxation website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) by checking the appropriate box.

04

Report your total income from all sources on the designated line.

05

Deduct any applicable exemptions, credits, and deductions as outlined in the instructions.

06

Calculate your taxable income by subtracting deductions from total income.

07

Determine the amount of tax owed using the provided tax tables or calculators.

08

Provide any additional required information or signatures as specified.

09

Review the completed form for accuracy before submission.

10

Submit the form by the applicable due date either electronically or via mail.

Who needs RI TX-17?

01

Individuals who reside in Rhode Island and are required to report their income for state taxation.

02

Taxpayers seeking to claim refunds or seek adjustments in their state tax filings.

03

Residents who are self-employed or have income from various sources that needs to be reported to the state.

Fill

form

: Try Risk Free

People Also Ask about

What is ri tx 17?

What is RI 17? The Employer Tax Unit processes all Quarterly Tax and Wage Reports (Form TX-17) and accompanying tax payments, submitted by Rhode Island employers. These payments include all required Employment Security, Job Development Fund, Reemployment Fund and Temporary Disability Insurance taxes.

How much payroll tax is taken out of my paycheck?

Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, you'll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

What are the four 4 main payroll taxes taken out of your paycheck?

Income tax. Social security tax. 401(k) contributions. Wage garnishments.

Who pays for unemployment in RI?

Unemployment Insurance (UI) is a federal/state insurance program financed by employers through payroll taxes.

Are there local payroll taxes in Rhode Island?

Rhode Island does not have any local taxes. How do I register as an employer? Rhode Island employers need to register via the Rhode Island Division of Taxation Combined Online Registration Service for unemployment taxes, wage withholding taxes, and also temporary disability insurance payments.

Who is exempt from RI TDI?

b) Minors 14 or 15 years of age are exempt from the provisions of the TDI regulations. No deductions should be made from their salary for TDI.

Is Ri SDI the same as Ri TDI?

State Disability Insurance (SDI) is required by some states. In some states, employees pay SDI, in others, employers pay, and in some, both pay. It is also know as Temporary Disability Insurance (TDI).

What are the payroll taxes in RI?

Rhode Island State Payroll Taxes The rates range from 3.75% to 5.99%. The tax breakdown can be found on the Rhode Island Department of Revenue website.

What are the 4 types of payroll taxes?

Payroll tax rates Social Security – 6.2% Medicare – 1.45% Additional Medicare – 0.9% Unemployment – 6% (0.6% with full credit reduction)

How is TDI calculated in RI?

How much will I receive? Your weekly benefit rate will be equal to 4.62% of the wages paid to you in the highest quarter of your Base Period. Your weekly benefit rate remains the same throughout your benefit year.

What is ri tdi for 2022?

The TDI taxable wage base, which is equal to the annual earnings needed by an individual to qualify for the maximum weekly benefit rate, will be $81,500 in 2022, an increase of $7,500 from the 2021 taxable wage base of $74,000.

What is Rhode Island disability tax?

The Rhode Island Temporary Disability Insurance tax is 1.3 percent of an employee's pay.

What is Rhode Island JDF tax?

Job Development Fund Tax Employers pay an assessment of 0.21% to support the Rhode Island Governor's Workforce Board, as well as employment services and unemployment insurance activities.

What is the maximum RI TDI tax?

4.62% of total high quarter wages in base period.

What is the Form RI 941?

Form RI-941, Employer's Quarterly Tax Return and Reconciliation must be filed no later than the last day of the month following the end of the quarter. 8. Some employers are required to file Form RI-941 and make payments via electronic means. Weekly payers must file and pay via electronic means.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my RI TX-17 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your RI TX-17 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit RI TX-17 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing RI TX-17.

How do I edit RI TX-17 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign RI TX-17 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is RI TX-17?

RI TX-17 is a form used for reporting and remitting sales and use tax in the state of Rhode Island.

Who is required to file RI TX-17?

Entities and individuals who are registered to collect sales and use tax in Rhode Island are required to file RI TX-17.

How to fill out RI TX-17?

To fill out RI TX-17, gather your sales and use tax records, complete the required sections of the form accurately, and ensure all calculations are correct before submitting it to the Rhode Island Division of Taxation.

What is the purpose of RI TX-17?

The purpose of RI TX-17 is to report the taxable sales made and the use tax owed to the state of Rhode Island, enabling the state to collect necessary tax revenue.

What information must be reported on RI TX-17?

The information that must be reported on RI TX-17 includes total sales, total taxable sales, amount of tax due, and any deductions or exemptions claimed.

Fill out your RI TX-17 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI TX-17 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.