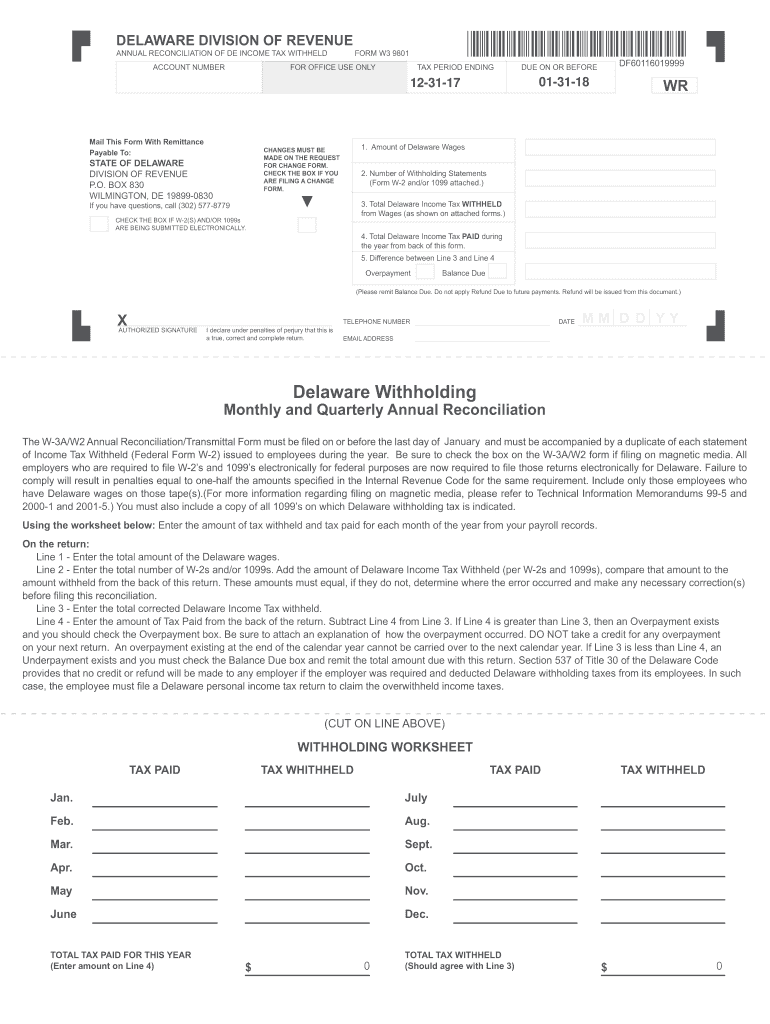

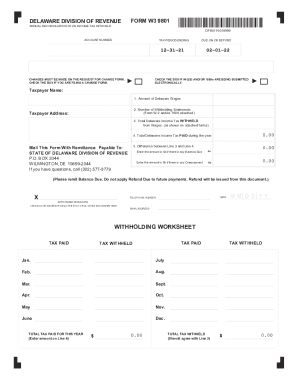

DE W-3 9801 2017 free printable template

Get, Create, Make and Sign de form w3 9801

Editing de form w3 9801 online

Uncompromising security for your PDF editing and eSignature needs

DE W-3 9801 Form Versions

How to fill out de form w3 9801

How to fill out DE W-3 9801

Who needs DE W-3 9801?

Instructions and Help about de form w3 9801

Hey folks, Matt Horowitz, LLCUniversity.com. Six reasons why you should not form an LLC in Delaware. I just got finished writing this and figured it would be an excellent piece to make a video on, and we get so many phone calls. This is such a pain point for so many people, and they make a lot of mistakes here. Note if you live in Delaware or you do business in Delaware, this information does not apply to you, you should form an LLC in Delaware. If you don't live in Delaware, and you're done×39’t do business in Delaware, and you×3heartbeatthat stat you should form an LLC in this magical state, let me save you a lot of money and headaches. Don't form an LLC in Delaware. The disadvantages of forming an LLC in Delaware far outweigh the perceived advantages. Let's look at an example. Nathan is from Connecticut. He reads online that Delaware is the best state to form an LLC in, so he forms an LLC in Delaware. He's a resident of Connecticut, he already pays taxes in Connecticut, and his home officers based in Connecticut. Most people arena×39’t aware of, but there's a lot of issues with this setup, illegally transacting business without authority. Nathan's Delaware LLC is doing business illegally in Connecticut. The Connecticut Secretary of State is going to enforce it×39’s laws and will soon be sending Nathan a citation in the mail with a fine, so he needs to register as a Foreign LLC. To remedy the citation and because it's the law, Nathan must now- It×39’s harreadoutur own writing. Nathan must now register his Delaware LLC as a Foreign LLC in Connecticut. He needs to file a Connecticut Foreign LLC registration, pay the state filing fee, chichis $120 in Connecticut, it's a lot more expensive in other states. Then he must keep this Foreign LLC in compliance with Connecticut law. That means filing an annual report every year and paying that fee, as well as paying a Connecticut business entity tax of $250 every other year. Remember, this is already on top of him paying the $90 registration fee in Delaware, the×300 required annual franchise tax in Delaware, and $125 every year for his Delaware registered agent. In short, Nathan now needs to maintain two LCS. He has a Domestic LLC in Delaware and a Foreign LLC in Connecticut, and it gets worse. Nathan was deceived into forming a Delaware LLC because he read it was a tax friendly state, and while this is true, it really only applies to large, multi-million dollar companies and not small business LCS. Look, don't just take our word for it. Read what the Delaware Secretary of State has to say about the hype ... I guess toucans×39’t click the link, but the link is below the video. Most people are unaware of this simple fact, taxes are paid where the money is made, nowhere your LLC is set up. That means Nathan still owes Connecticut taxes, which could include but arena×39’t limiteRosaleses and use tax, business entity tax, withholding tax, corporate business tax, net income tax, franchise tax, property tax,...

People Also Ask about

How does the Delaware tax haven work?

Does a Delaware corporation need to file a tax return?

Where to get Delaware tax forms?

Who must file a Delaware nonresident tax return?

What makes Delaware a tax haven?

How does Delaware survive without taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send de form w3 9801 to be eSigned by others?

How can I get de form w3 9801?

Can I create an eSignature for the de form w3 9801 in Gmail?

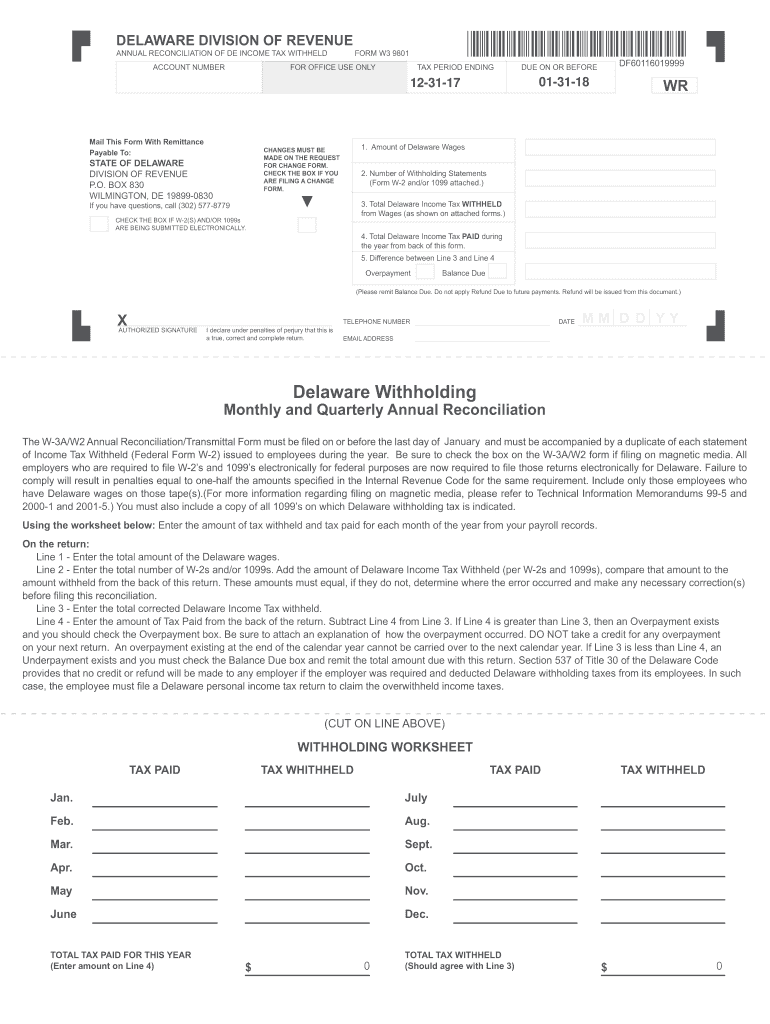

What is DE W-3 9801?

Who is required to file DE W-3 9801?

How to fill out DE W-3 9801?

What is the purpose of DE W-3 9801?

What information must be reported on DE W-3 9801?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.