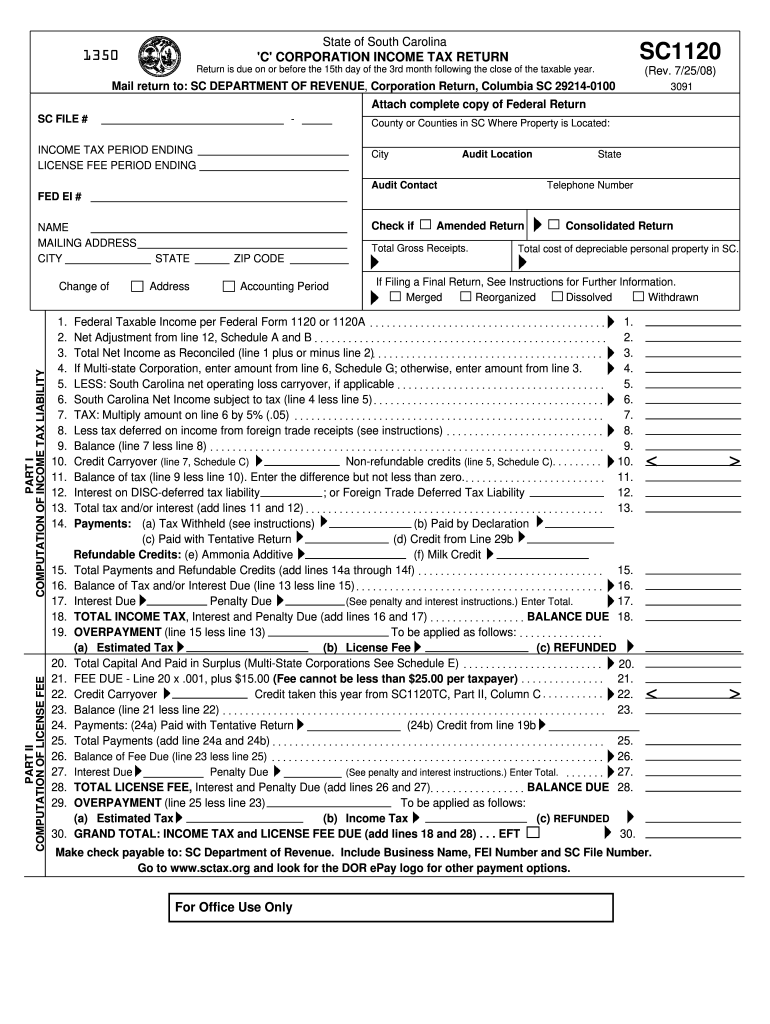

SC DoR SC1120 2008 free printable template

Show details

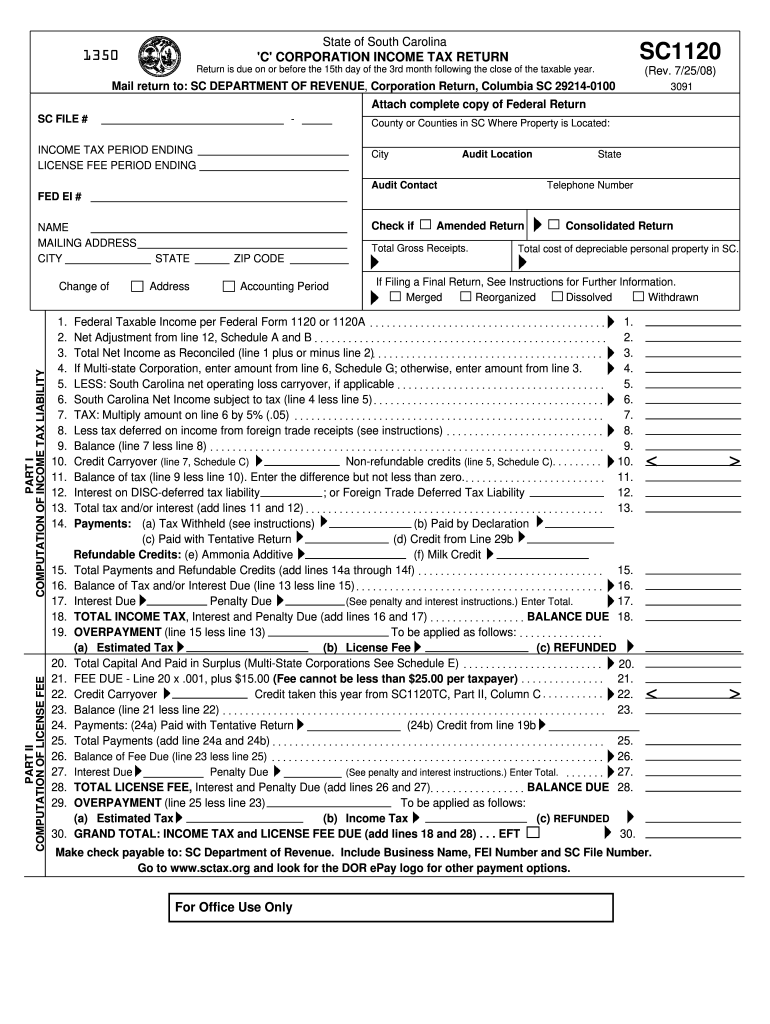

Consolidated Return Total cost of depreciable personal property in SC. ZIP CODE Accounting Period If Filing a Final Return See Instructions for Further Information. Merged Reorganized Dissolved Withdrawn Federal Taxable Income per Federal Form 1120 or 1120A. Net Adjustment from line 12 Schedule A and B. Total Net Income as Reconciled line 1 plus or minus line 2. If Multi-state Corporation enter amount from line 6 Schedule G otherwise enter amount from line 3. LESS South Carolina net operating...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR SC1120

Edit your SC DoR SC1120 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

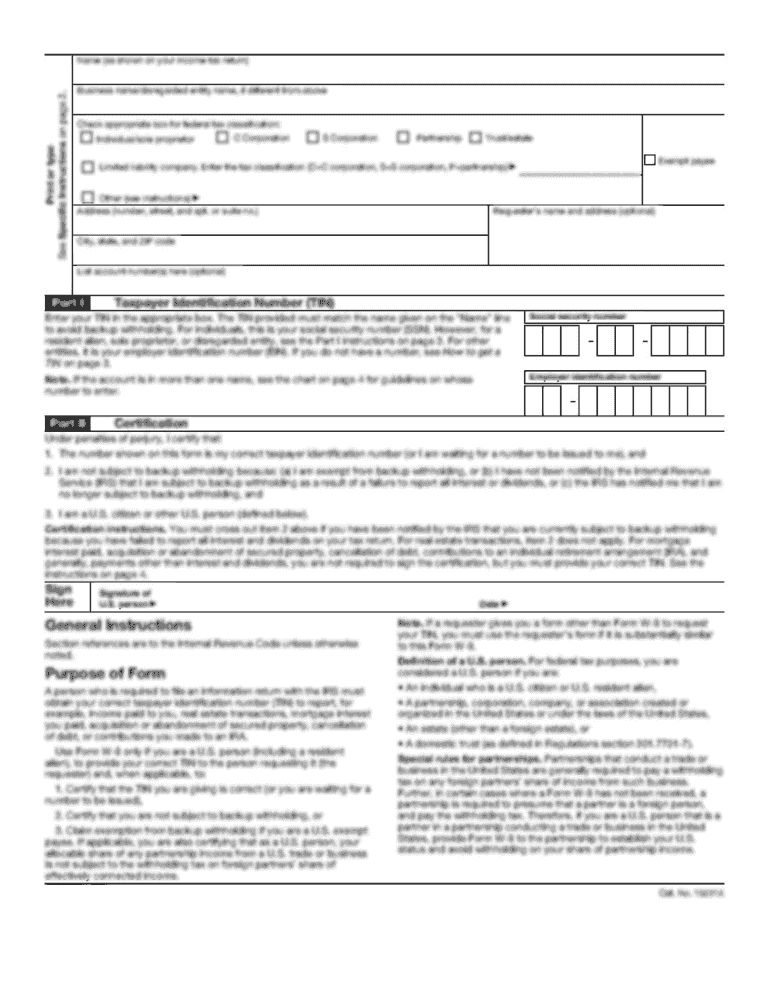

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC1120 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR SC1120 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC DoR SC1120. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

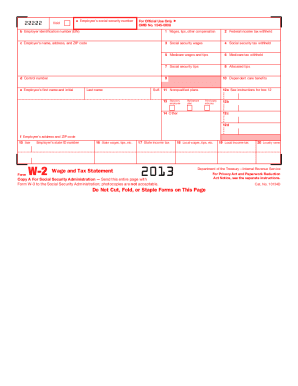

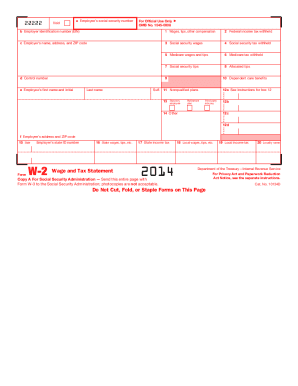

SC DoR SC1120 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR SC1120

How to fill out SC DoR SC1120

01

Gather all necessary personal and financial information.

02

Start with Section A: Provide your name and contact details.

03

Move to Section B: Indicate your income sources for the year.

04

Complete Section C: Detail your deductions and credits.

05

Fill in Section D: Report your total tax liability.

06

Review all information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed SC DoR SC1120 to the appropriate tax authority.

Who needs SC DoR SC1120?

01

Businesses operating in South Carolina that need to file corporate income tax.

02

Corporations registered in South Carolina.

03

Any entity subject to South Carolina corporate tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What are the tax breaks for seniors in SC?

2022 Senior Citizen Standard Income Tax Deduction For those 65 years of age or legally blind, the standard deduction was increased in 2022 to $1,750 for Single filers or Head of Household, and $1,400 (per person) for married filing jointly, married filing separately, and Surviving Spouses.

What is SC 1120 form?

SC 1120. Includes Disregarded LLCs. Check if: Total cost of depreciable personal property in SC. Check if you filed a federal or state extension.

What is a 1120 tax form used for?

Purpose of Form Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

Who must file a SC corporate tax return?

Summary. Corporations transacting or conducting business within South Carolina are required to file a corporate tax return. Domestic corporations must submit the "Articles of Incorporation" and related documents to the Secretary of State.

At what age do you stop paying state taxes in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return in most cases. If your gross income is less than the federal gross income filing requirement, you shouldn't be required to file a SC state return. In addition, Social Security benefits are not taxed by the state of South Carolina.

At what age do you stop paying property taxes in South Carolina?

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit SC DoR SC1120 online?

The editing procedure is simple with pdfFiller. Open your SC DoR SC1120 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the SC DoR SC1120 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your SC DoR SC1120 in seconds.

Can I create an eSignature for the SC DoR SC1120 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your SC DoR SC1120 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is SC DoR SC1120?

SC DoR SC1120 is a state-specific tax form used in South Carolina for reporting income by certain business entities, including corporations and LLCs.

Who is required to file SC DoR SC1120?

Corporations and limited liability companies (LLCs) doing business in South Carolina or having income sourced from South Carolina are required to file SC DoR SC1120.

How to fill out SC DoR SC1120?

To fill out SC DoR SC1120, gather financial records, complete the form with accurate income and deductions, and ensure all required schedules and attachments are included before submitting it to the South Carolina Department of Revenue.

What is the purpose of SC DoR SC1120?

The purpose of SC DoR SC1120 is to assess the state income tax liability for eligible business entities operating in South Carolina.

What information must be reported on SC DoR SC1120?

SC DoR SC1120 requires reporting of total income, federal taxable income, state modifications, deductions, and the resulting state tax liability, along with any additional information required by the state.

Fill out your SC DoR SC1120 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc1120 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.