RI DoT RI-1040NR 2011 free printable template

Show details

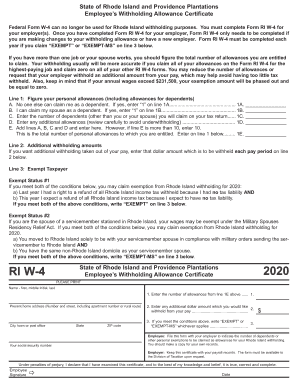

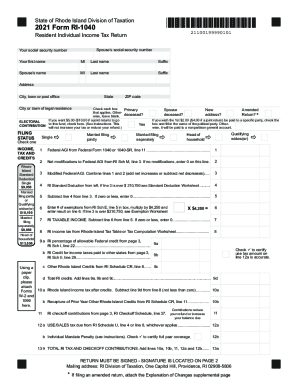

Enter here and on RI-1040NR page 1 line 14. 33. RI SCHEDULE EIC RHODE ISLAND EARNED INCOME CREDIT 35. Enter here and on RI-1040NR page 1 line 17D. 42. Under penalties of perjury I declare that I have examined this return and to the best of my knowledge and belief it is true correct and complete. Enter here and on RI-1040NR page 1 line 9. 25. RI SCHEDULES II III ALLOCATION AND MODIFICATION FOR NONRESIDENTS Schedule II should be completed by NONRESIDENTS with income from outside Rhode Island....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2011 ri form

Edit your 2011 ri form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 ri form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 ri form online

To use the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2011 ri form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI DoT RI-1040NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2011 ri form

How to fill out RI DoT RI-1040NR

01

Gather your personal information, including Social Security number and address.

02

Determine your residency status as a non-resident or part-year resident.

03

Prepare your income details from all sources, including wages, dividends, and rental income.

04

Fill in the top part of the form with your personal details.

05

Report your income on the appropriate lines, ensuring you include only income earned in Rhode Island.

06

Calculate your adjustments, credits, and deductions as applicable.

07

Complete the tax computation section to determine the amount owed or refund due.

08

Review all entries for accuracy to avoid mistakes.

09

Sign and date the form before submission.

10

Submit the form by the designated deadline to the Rhode Island Department of Taxation.

Who needs RI DoT RI-1040NR?

01

Non-residents of Rhode Island who have earned income in the state.

02

Part-year residents who need to report income earned while residing in Rhode Island.

03

Individuals who qualify for certain deductions or credits related to their income in Rhode Island.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a Rhode Island partnership tax return?

LLCs, LLPs, LPs, Partnerships and SMLLCs: Limited liability companies not treated as a corporation on the federal level, limited liability partnerships, general partnerships, and single member limited liability companies are required to file an annual tax return using Form RI-1065.

What is Form RI 2210?

State of Rhode Island Division of Taxation. 2022 Form RI-2210. Underpayment of Estimated Tax by Individuals, Estates.

What is the purpose of form 2210?

Purpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

What is the RI 706 form?

Form RI-706 is to be used by the executor(s)/administrator(s)/personal representative(s) of a. decedent to determine the Rhode Island estate tax due under R.I. Gen. Laws.

Who must file form 2210?

You may need this form if: You're self-employed or have other income that isn't subject to withholding, such as investment income. You don't make estimated tax payments or paid too little. You don't have enough taxes withheld from your paycheck.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2011 ri form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 2011 ri form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get 2011 ri form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the 2011 ri form. Open it immediately and start altering it with sophisticated capabilities.

How can I edit 2011 ri form on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 2011 ri form.

What is RI DoT RI-1040NR?

RI DoT RI-1040NR is a non-resident income tax return form used by individuals who earn income in Rhode Island but do not reside in the state.

Who is required to file RI DoT RI-1040NR?

Individuals who earn income from sources within Rhode Island while living outside the state are required to file the RI DoT RI-1040NR.

How to fill out RI DoT RI-1040NR?

To fill out RI DoT RI-1040NR, taxpayers need to provide their personal information, report their income earned in Rhode Island, calculate deductions as applicable, and determine their tax liability.

What is the purpose of RI DoT RI-1040NR?

The purpose of RI DoT RI-1040NR is to allow the state of Rhode Island to collect income taxes from individuals who earn income from Rhode Island sources but do not reside in the state.

What information must be reported on RI DoT RI-1040NR?

Taxpayers must report their name, address, social security number, types of income earned in Rhode Island, any adjustments to income, deductions, and tax credits on RI DoT RI-1040NR.

Fill out your 2011 ri form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Ri Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.