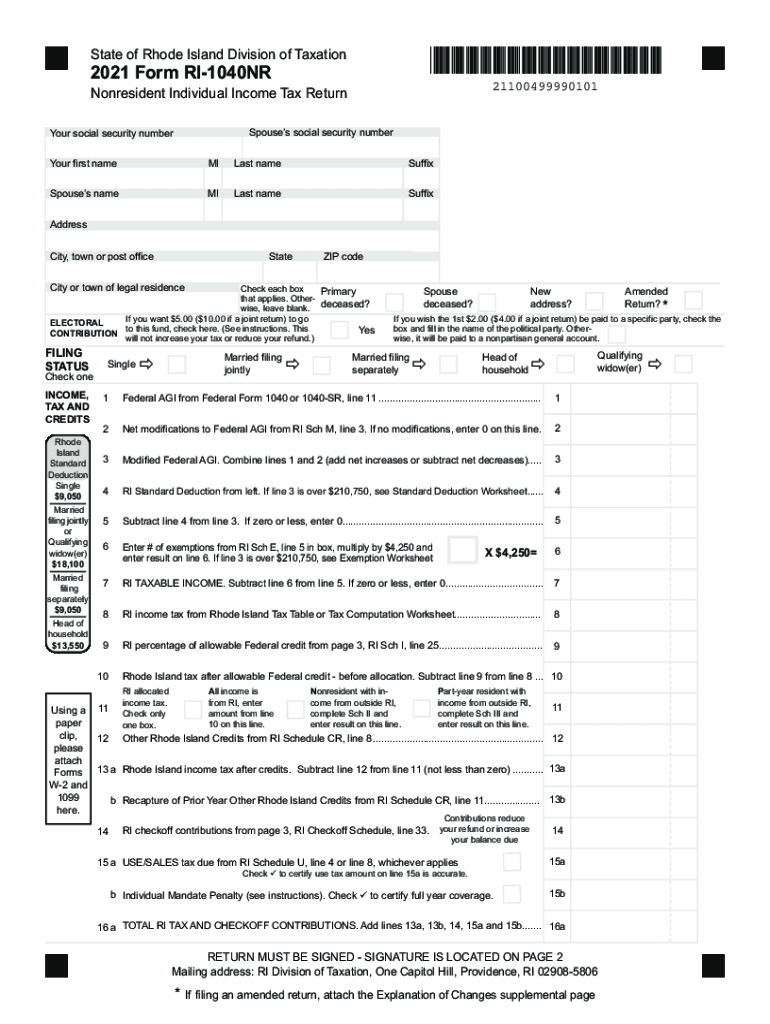

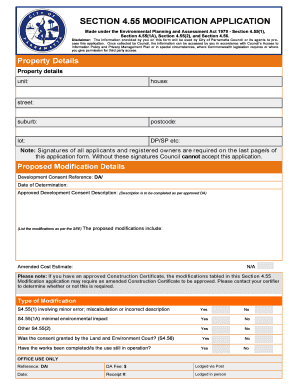

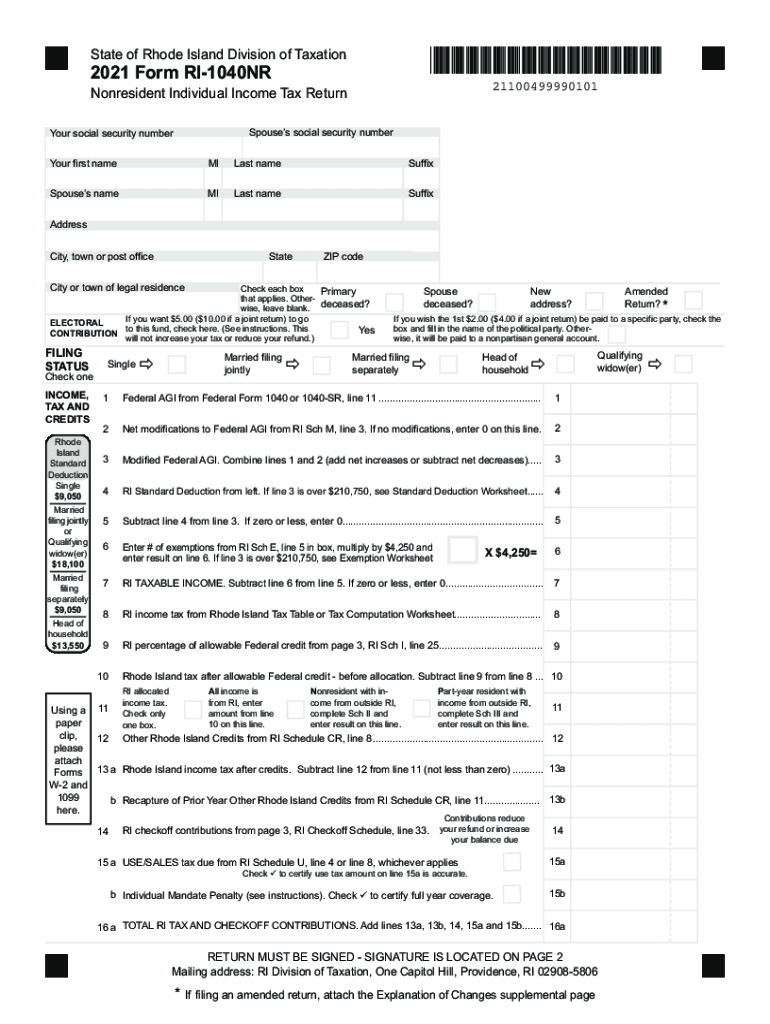

RI DoT RI-1040NR 2021 free printable template

Get, Create, Make and Sign ri

How to edit ri online

Uncompromising security for your PDF editing and eSignature needs

RI DoT RI-1040NR Form Versions

How to fill out ri

How to fill out RI DoT RI-1040NR

Who needs RI DoT RI-1040NR?

Instructions and Help about ri

Got a little energy in the room here that's great, so you ready for your week fantastic well its really great to see you were together at last, and it's my pleasure to welcome you 2018to the 2018 rotary international assembly yes you know I had an incredible moment yesterday I'm in the lobby of the hotel, and I'm seeing the district governor elects couple start arriving into the hotel, and I'm standing there with the seat with our CEO John Hugo and I turned her I said well here we go, and he said you know this reminds me of that YouTube video said YouTube video what YouTube video said you know the one where the bass player comes into a plaza with his own music by himself and starts playing beautiful music and then a cellist comes and joins in the bassoonists join them and then the strings the rest of the woodwinds they're wearing regular clothes they're ordinary people and yet you start to hear the sound of an orchestra a chorus transforming the plaza beautiful music and then and then another couple walks it in the door and I could almost hear the music begin as you're coming together to join for our year you've come from every corner of the rotary world you've come to begin our journey together which 6 I could not even imagine six months ago 71July 1st of this rotary year we you and I and all of rotary tonight thought someone else would be standing here President-elect Sam was a friend Sam was a hero to the Rotarian in Africa his brilliant smile his gentle spirit was known and loved by everyone he called himself an incorrigible optimist who believed in the goodness of the world and the power of rotary to make it great were here to carry forward Sam's work the work of rotary to carry forward the lessons that we've learned over the last few months the lesson that the work of rotary doesn't begin or end with any one of us we've been given the responsibility to build from those who went before us to build a solid foundation for those who will come in the future by serving effectively by serving efficiently keeping accountability keeping our transparency and changing lives in as many ways as possible in significant and lasting ways our job is to ensure that rotary continues to provide the best experience to our members we must continue to make sure our organization is growing we must continue to be sure that we are being useful to the world not only this year and next but beyond our time and rotary and beyond our time on earth we've been entrusted with these tasks indeed it's these ideas that have inspired our new vision statement that describe the rotary that we want to be together we see a world where people unite to take action to create lasting change across the globe in our communities and in ourselves we unite because we know that together we can do so much more than we can by ourselves we take action because were not just dreamers but where doers were people of action we create lasting change for the good of the world that will endure long...

People Also Ask about

Who won the election in Rhode Island 2018?

Did Rhode Island lose a house seat?

Who won the Congress seat in Rhode Island?

Who won the midterm election in 2018?

Who was the former governor of RI?

Is Rhode Island a swing state?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ri in Gmail?

How do I edit ri in Chrome?

Can I create an electronic signature for the ri in Chrome?

What is RI DoT RI-1040NR?

Who is required to file RI DoT RI-1040NR?

How to fill out RI DoT RI-1040NR?

What is the purpose of RI DoT RI-1040NR?

What information must be reported on RI DoT RI-1040NR?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.