RI DoT RI-1040NR 2023 free printable template

Show details

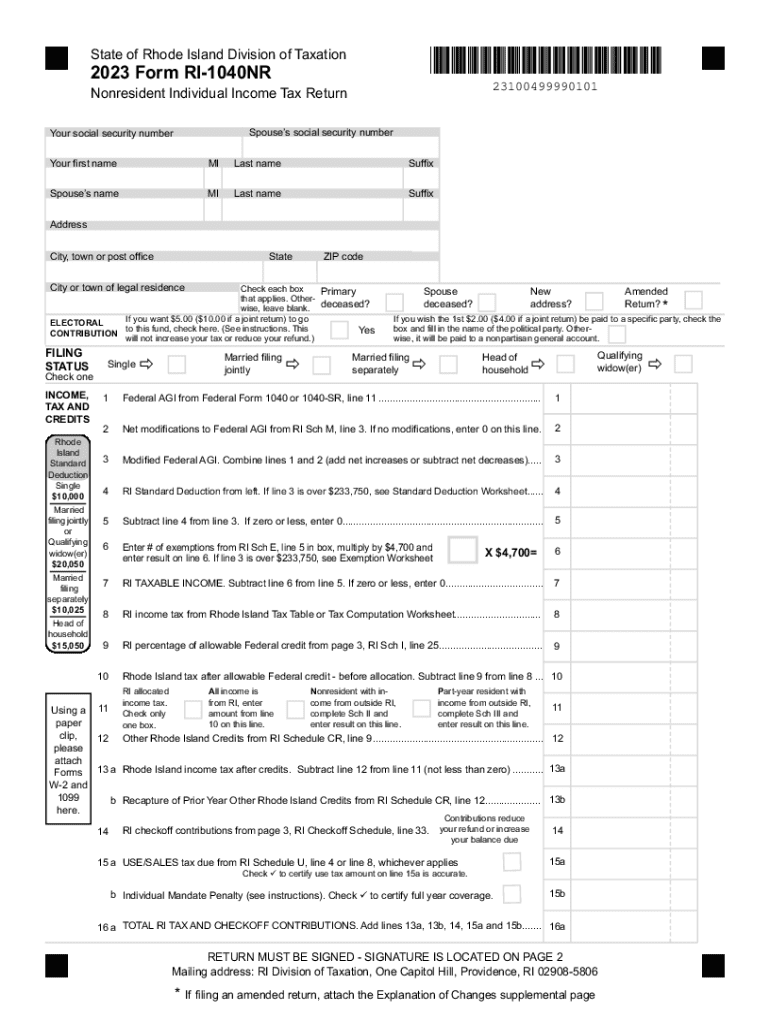

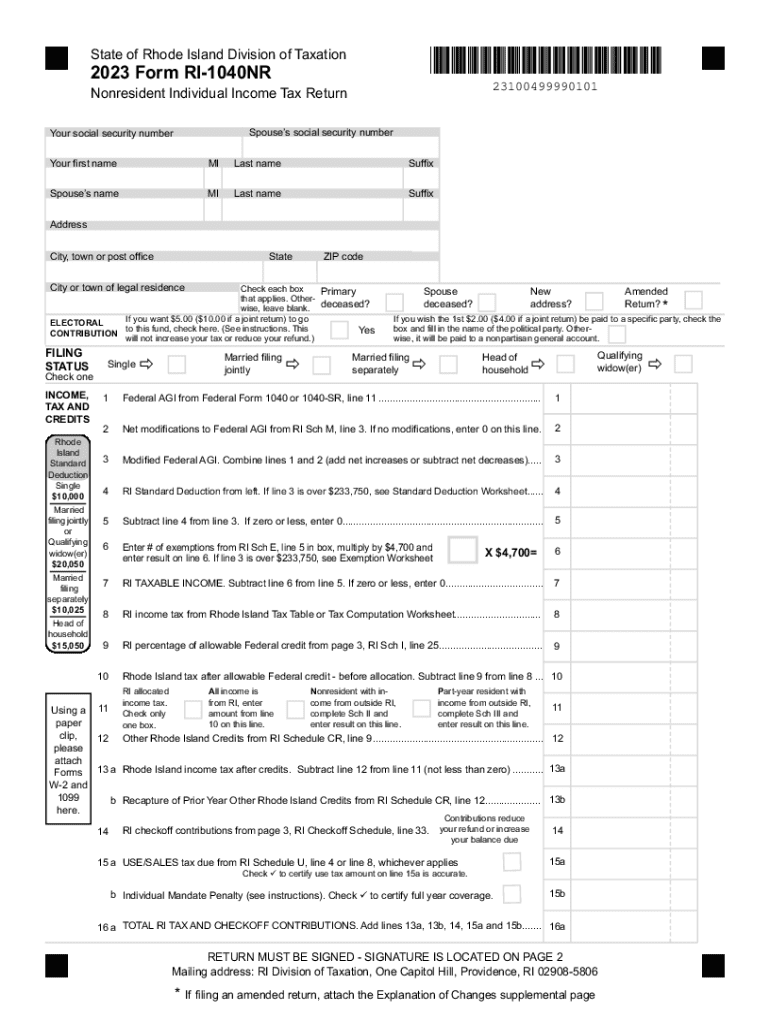

State of Rhode Island Division of Taxation2023 Form RI1040NR

23100499990101Nonresident Individual Income Tax Return

Spouses social security numberYour social security number

Your first nameMILast

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ri tax forms

Edit your rhode island income tax rates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rhode island nonresident form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form ri 1040nr online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rhode island state tax form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI DoT RI-1040NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rhode island form

How to fill out RI DoT RI-1040NR

01

Gather all necessary personal information, including your name, address, and Social Security number.

02

Collect documentation of your income earned in Rhode Island, including W-2 forms and 1099s.

03

Determine your residency status to ensure you are eligible to file the RI-1040NR.

04

Complete the top section of the form with your personal details.

05

Report your total income on the form, ensuring to include only income earned within Rhode Island.

06

Calculate your deductions and credits applicable to your situation.

07

Complete the tax calculation section to determine your tax liability.

08

Sign and date the return.

09

Submit the completed form by the tax deadline, either electronically or by mailing it to the Rhode Island Division of Taxation.

Who needs RI DoT RI-1040NR?

01

Nonresident individuals who earn income in Rhode Island and are required to file a state tax return.

02

Individuals who have specific tax obligations in Rhode Island based on their income sources.

03

People who are temporarily residing in Rhode Island but are considered residents of another state.

Fill

form ri 1040nr

: Try Risk Free

People Also Ask about ri 1040nr

Who won the election in Rhode Island 2018?

Incumbent Democratic Governor Gina Raimondo sought re-election to a second term and won, defeating Republican Allan Fung in a rematch.

Did Rhode Island lose a house seat?

It followed a primary election on September 13, 2022. In the leadup to the 2022 redistricting cycle, many analysts believed that Rhode Island would lose its 2nd district and be relegated to at-large status. However, the state managed to keep both its districts.

Who won the Congress seat in Rhode Island?

Elected U.S. Representative Before redistricting, the 1st district encompassed parts of Providence, as well as eastern Rhode Island, including Aquidneck Island and Pawtucket. The incumbent is Democrat David Cicilline, who was re-elected with 70.8% of the vote in 2020.

Who won the midterm election in 2018?

The 2018 elections were the third midterm elections since 2006 in which the President's party lost control of the House of Representatives. Democrats defeated 29 Republican incumbents and picked up 14 open seats.

Who was the former governor of RI?

Former Governors - Rhode Island Governor's NameStateTime in OfficeGov. Gina RaimondoRhode Island2019 - 2021 2015 - 2018Gov. Lincoln ChafeeRhode Island2011 - 2015Gov. Don CarcieriRhode Island2003 - 2011Gov. Lincoln AlmondRhode Island1995 - 200367 more rows

Is Rhode Island a swing state?

Democrats usually take the Mid-Atlantic states, including New York, New Jersey, Maryland, Virginia, and Delaware, New England, particularly Vermont, Massachusetts, Rhode Island, and Connecticut, the West Coast states of California, Oregon, Washington, Hawaii, and the Southwestern states of Colorado and New Mexico, as

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ri 1040nr printable?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ri pdf and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the ri in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ri tax forms in seconds.

How do I fill out ri tax forms pdf on an Android device?

Use the pdfFiller app for Android to finish your ri pdf. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is RI DoT RI-1040NR?

RI DoT RI-1040NR is a state tax form used by non-residents who earned income in Rhode Island to report their income for state tax purposes.

Who is required to file RI DoT RI-1040NR?

Non-residents who earned income sourced in Rhode Island are required to file the RI DoT RI-1040NR.

How to fill out RI DoT RI-1040NR?

To fill out the RI DoT RI-1040NR, you must provide personal information, report your income, calculate your tax liability, and provide any deductions or credits applicable.

What is the purpose of RI DoT RI-1040NR?

The purpose of the RI DoT RI-1040NR is to collect state income tax from individuals who do not reside in Rhode Island but have earned income within the state.

What information must be reported on RI DoT RI-1040NR?

Information that must be reported on RI DoT RI-1040NR includes your name, address, Social Security number, income types, deductions, credits, and the total tax computed.

Fill out your form ri 1040nr 2023 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ri Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to ri income

Related to ri tax table

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.